Why Chainlink And ASTER Are No Match For The 50,000% Payday (PDP) Rally In October 2025

If you thought the crypto bull run of 2021 was wild, wait until you see what’s brewing in 2025. While top players like Chainlink (LINK) and ASTER continue to dominate headlines, a new contender — Paydax (PDP) — is quietly gearing up for a potential 50,000% rally this October.

In a market flooded with overhyped tokens and short-lived trends, Paydax (PDP) is rapidly emerging as the “People’s DeFi Bank.” Combining real-world asset lending, staking, and peer-to-peer insurance, it is positioning itself as the next big breakout rally of 2025.

DeFi Just Got An Upgrade — And Its Name Is Paydax (PDP)

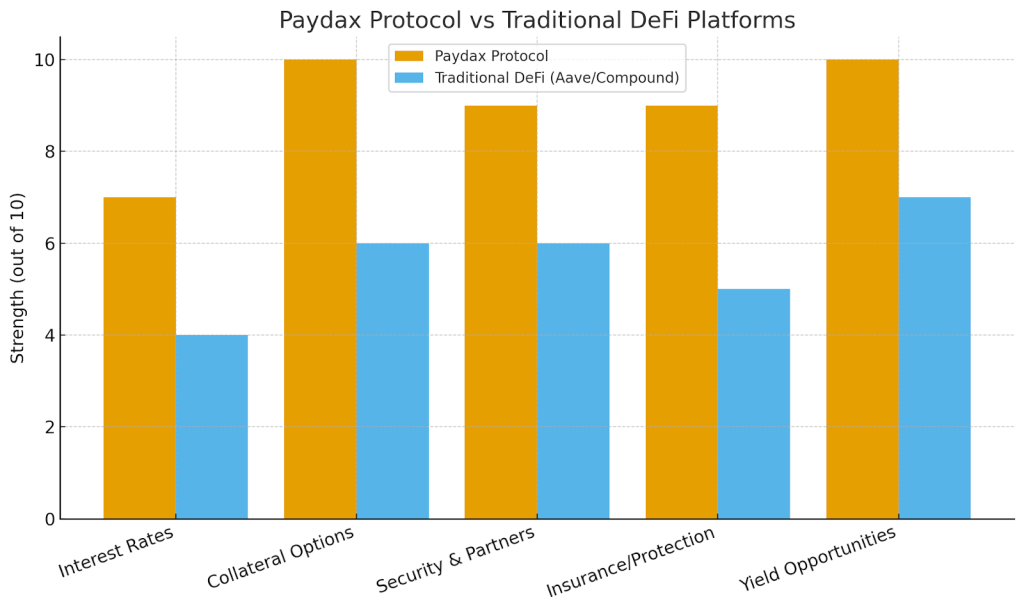

Unlike Chainlink (LINK), which remains locked into its oracle infrastructure role, or ASTER, which focuses narrowly on perpetual trading, Paydax (PDP) is rewriting the rules of capital efficiency in DeFi. What truly sets it apart is a multi-layered utility. Through the PDP token, users can borrow against crypto and real-world assets, stake stablecoins for passive yields, lend for double-digit APYs, and even underwrite loans through a Redemption Pool for up to 20% APY.

Add in leveraged yield farming with returns as high as 41% APY, and you have a platform that outpaces both Chainlink’s (LINK) infrastructure role and ASTER’s trading focus. In short, Paydax (PDP) doesn’t just participate in DeFi — it redefines it, and that’s why it could leave Chainlink (LINK) and ASTER in the dust come October 2025.

Where Billion-Dollar Security Fuels A 50,000% Rally

Unlike many early-stage projects that rush to market, Paydax (PDP) has built its foundation on institutional-grade security. The platform uses multi-sig wallets, rigorous stress testing, and bug bounty safeguards to ensure stability and security — a system built not just for a rally, but for long-term resilience.

This level of foresight is what separates it from competitors like Chainlink (LINK) and ASTER, which, while innovative, don’t offer the same end-to-end safety net for everyday investors. But Paydax’s approach to security goes far beyond code. It partners with world-class institutions to ensure every asset, transaction, and user is fully protected:

- Brinks Custody – Secures Paydax’s real-world collateral with the same protection used for billions in cash and gold.

- Sotheby’s – Verifies luxury assets before tokenization, ensuring all collateral is authentic.

- Onfido – Conducts borrower ID checks and KYC to block fraud and keep the platform compliant.

Every loan is locked into immutable smart contracts, meaning not even Paydax itself can alter the terms — a level of fairness traditional banks can’t match. To top it off, the platform has been audited by Assure DeFi, giving investors confidence that Paydax’s code is as solid as its vision.

Decentralization Isn’t Dead — Paydax (PDP) Is Proving It

Chainlink’s (LINK) recent appearance at the Federal Reserve’s Payments Innovation Conference confirms its growing role in institutional finance. Impressive, yes—but it also marks a shift toward centralized adoption that leaves everyday investors on the sidelines. Paydax (PDP), on the other hand, is charting a different course.

In other words, while Chainlink (LINK) is busy becoming the “Oracle for Wall Street,” Paydax (PDP) is creating the bank of the people — decentralized, transparent, and still early enough to deliver a 50,000% rally. And in a world where decentralization is the original crypto dream, Paydax might just be closer to that vision than any institution-backed protocol.

Why Paydax (PDP) Is What “Smart Money” Really Looks Like

An analyst report on ASTER describes its recent dip as a setup for a “giga reversal” — the classic cycle where retail panics while smart money quietly positions for the next leg up. It’s an appealing narrative for short-term traders chasing momentum and quick rebounds.

Paydax (PDP), however, isn’t built on chart patterns or whale-driven cycles. Priced at just $0.015 in its first presale stage, its upside is grounded in fundamentals, adoption, and innovation. Where ASTER traders are betting on timing, Paydax investors are betting on a design built to sustain a 50,000% rally through real utility and early positioning. In 2025’s volatile market, smart money won’t chase the next pump; it will back the next protocol built to last.

Don’t Watch The Rally — Be Part Of It

With over $1 million raised and more than 67 million PDP tokens sold, Paydax (PDP) is already proving that investors see the potential before the market catches on. At just $0.015, early adopters have a rare chance to enter early and position for a potential 50,000% rally when Paydax launches. And with a 25% presale bonus available through the code PD25BONUS, the timing couldn’t be better.

While Chainlink (LINK) and ASTER may deliver steady gains, Paydax is positioned for an explosive rally because it’s entering the market at the ground floor with a disruptive model. This isn’t just another token; it’s the blueprint for DeFi’s next era. The question isn’t whether Paydax will take off — it’s whether you’ll be part of the story when it does.

How To Join The Paydax Protocol (PDP) Presale Today:

- Website: https://pdprotocol.com/

- Telegram: https://t.me/PaydaxCommunity

- X (Twitter): https://x.com/Paydaxofficial

- Whitepaper: https://paydax.gitbook.io/paydax-whitepaper

Disclaimer and Risk Warning

The content featured on Coinpedia's press release page is provided for informational purposes only. Coinpedia does not endorse, verify, or take responsibility for the accuracy, completeness, or reliability of any press releases or associated materials. Any views, opinions, or statements expressed in these press releases are those of the respective issuers and do not reflect the opinions or positions of Coinpedia. Coinpedia is not liable for any content, products, services, or actions mentioned in the press releases. Readers should independently verify the information before taking any actions related to the subject matter of the releases.