The crypto market experienced a significant downturn on October 10, 2025, when a sudden geopolitical event triggered a flash crash, leading to over $19B in liquidations and causing major coins to plummet. However, as of October 21, 2025, the market has shown signs of recovery, with several cryptocurrencies leading the charge.

Among them, Digitap ($TAP), Solana (SOL), Polkadot (DOT), Bittensor (TAO), and Chainlink (LINK) have demonstrated impressive resilience and growth potential. Of these, Digitap leads the charge as the best crypto to invest in right now.

Here are the best cryptos to buy now, leading the recovery after the flash crash:

1. Digitap ($TAP): The world’s first omni-bank.

2. Solana (SOL): Crypto’s fastest layer 1.

3. Polkadot (DOT): The leading interoperability solution.

4. Bittensor (TAO): The decentralized machine learning protocol.

5. Chainlink (LINK): Crypto’s leading oracle service provider.

1. Digitap ($TAP): A Fintech Gem with Real-World Utility

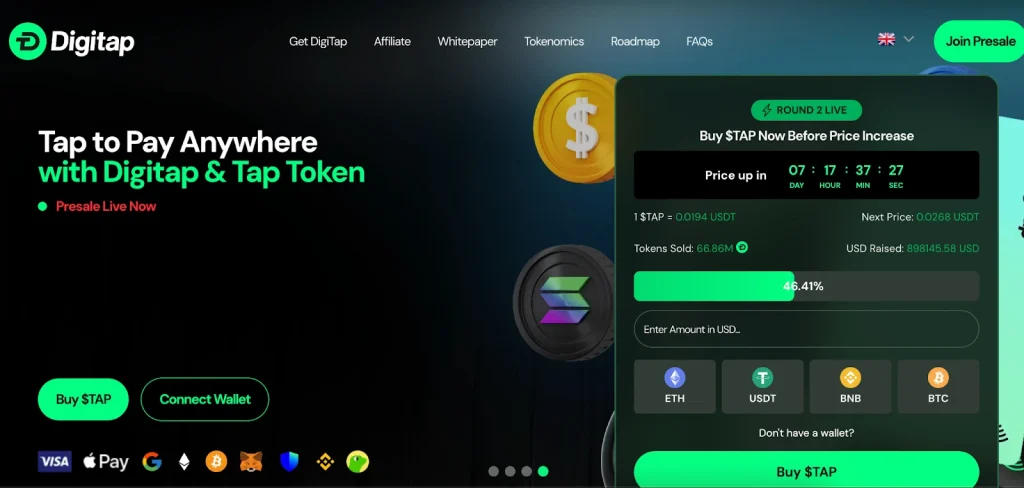

Digitap has emerged as a standout performer in the aftermath of the flash crash. The presale price will see a roughly 40% surge, rising from $0.0194 to $0.0268 in the next round, capturing the attention of both retail and whale investors.

Analysts are particularly bullish on Digitap due to the convergence of real-world utility, strong whale accumulation, and an active user base. With over 60M tokens sold and a presale nearing $1M, Digitap is poised for explosive growth.

Unlike many presale tokens, Digitap offers a live working app available on the Apple Store and Google Play Store. Users can manage both fiat and crypto, make transactions seamlessly, and interact with a multi-currency omni bank ecosystem. This has major appeal for digital nomads who want private payment mechanisms for global transfer.

Another key driver of Digitap’s growth is its deflationary tokenomics. 50% of platform profits are allocated to burning $TAP and rewarding stakers, creating long-term value for holders as adoption increases. Zero-KYC onboarding in eligible jurisdictions also lowers barriers for the 1.4 billion unbanked globally, democratizing market access.

2. Solana (SOL): Recovering on Scalability and Speed

Solana, known for its high-speed blockchain and extremely low transaction fees, was heavily impacted during the October flash crash. Some exchanges reported losses of up to 70% in SOL holdings, reflecting broader market fear. However, the network’s focus on scalability and developer-friendly infrastructure has allowed it to bounce back quickly, now trading at around $186.

The recovery has been fueled by renewed interest in Solana’s DeFi and NFT ecosystems. Developers are increasingly building on the network thanks to its ability to handle high transaction volumes at minimal costs. At the same time, traders and liquidity providers return to take advantage of growing activity.

Solana’s resilience also comes from strong community engagement and validator participation. This has created confidence among investors that the network can withstand volatility better than many competitors. Analysts suggest that Solana could continue gaining momentum as it launches additional staking and incentive programs for users, positioning it as a key altcoin recovery leader.

3. Polkadot (DOT): Interoperability Driving Market Confidence

Polkadot’s multi-chain framework allows interoperability between various blockchains, making it a critical piece of the DeFi infrastructure. Following the flash crash, DOT initially fell to around $2.78, but it has now rebounded to approximately $3.0.

The resurgence is driven by the growing demand for cross-chain solutions, which enable users and developers to interact seamlessly across different networks. Polkadot’s parachain auctions and ecosystem growth have attracted both developers and investors, creating a surge in platform activity.

Additionally, DOT’s governance model, which allows stakeholders to participate in decision-making, provides a level of security and long-term planning that is appealing during volatile markets. With several high-profile projects set to deploy on Polkadot this quarter, the token’s recovery signals renewed investor confidence in multi-chain interoperability.

4. Bittensor (TAO): AI-Driven Blockchain Innovation

Bittensor (TAO) has demonstrated remarkable resilience following the flash crash. The token has fully recovered and is currently trading above its pre-crash levels, reaching over $400. This recovery is attributed to Bittensor’s unique position at the intersection of artificial intelligence and blockchain technology.

The project’s focus on decentralized machine learning and its ability to incentivize participants in the AI ecosystem have attracted significant attention. With backing from major entities like Digital Currency Group, Bittensor is poised to play a pivotal role in the future of decentralized AI.

Investors are increasingly viewing Bittensor as a promising long-term investment, given its innovative approach and the growing demand for AI solutions. The token’s performance post-crash reflects the market’s recognition of its potential and the strength of its underlying technology.

5. Chainlink (LINK): Enhancing Smart Contract Connectivity

Chainlink (LINK) has shown significant resilience in the wake of the October flash crash. After experiencing a sharp decline, LINK has rebounded, trading around $18.10. This recovery is attributed to its critical role in the blockchain ecosystem as a decentralized oracle network.

Chainlink’s technology enables smart contracts to securely interact with real-world data, APIs, and payment systems, making it indispensable for DeFi applications. The increasing adoption of DeFi protocols has driven demand for Chainlink’s services, contributing to its price recovery.

Moreover, Chainlink’s continuous development and partnerships with major blockchain projects have strengthened its position in the market. As the DeFi sector continues to expand, Chainlink is well-positioned to benefit from the growing need for reliable and secure data feeds.

Altcoins Leading the Recovery

The swift recovery of these coins following the October flash crash highlights the underlying resilience of the digital asset market. While the crash served as a stark reminder of the inherent volatility in the crypto space, the rebound demonstrates the market’s capacity to recover.

Of these recovery coins, Digtap is the one capturing interest from whale investors. This is partly due to its intention to disrupt the trillion-dollar payments industry by providing a working solution for both remote workers and the global unbanked population.

Combined with structured presale price increases, a 50% token burn, zero-KYC, and a live app, it could do far more than merely lead the recovery. It might be the best crypto to invest in right now, with explosive upside potential.

Discover the future of crypto cards with Digitap by checking out their live Visa card project here:

Presale https://presale.digitap.app

Website: https://digitap.app

Social: https://linktr.ee/digitap.app

Disclaimer and Risk Warning

The content featured on Coinpedia's press release page is provided for informational purposes only. Coinpedia does not endorse, verify, or take responsibility for the accuracy, completeness, or reliability of any press releases or associated materials. Any views, opinions, or statements expressed in these press releases are those of the respective issuers and do not reflect the opinions or positions of Coinpedia. Coinpedia is not liable for any content, products, services, or actions mentioned in the press releases. Readers should independently verify the information before taking any actions related to the subject matter of the releases.