Gold surges to a record high, driven by geopolitical instability, while Bitcoin declines, mirroring US tech stock performance.

Gold's 15.51% year-to-date growth reinforces its status as a reliable store of value, contrasting with Bitcoin's recent 14.4% monthly drop.

Bitcoin's current behavior raises questions about its "digital gold" label.

Gold prices have just hit a new all-time high of $3,047, continuing a strong rally that has seen the market grow by 15.51% since the start of 2025. Meanwhile, the U.S. stock market is struggling, making gold an even more attractive safe-haven asset.

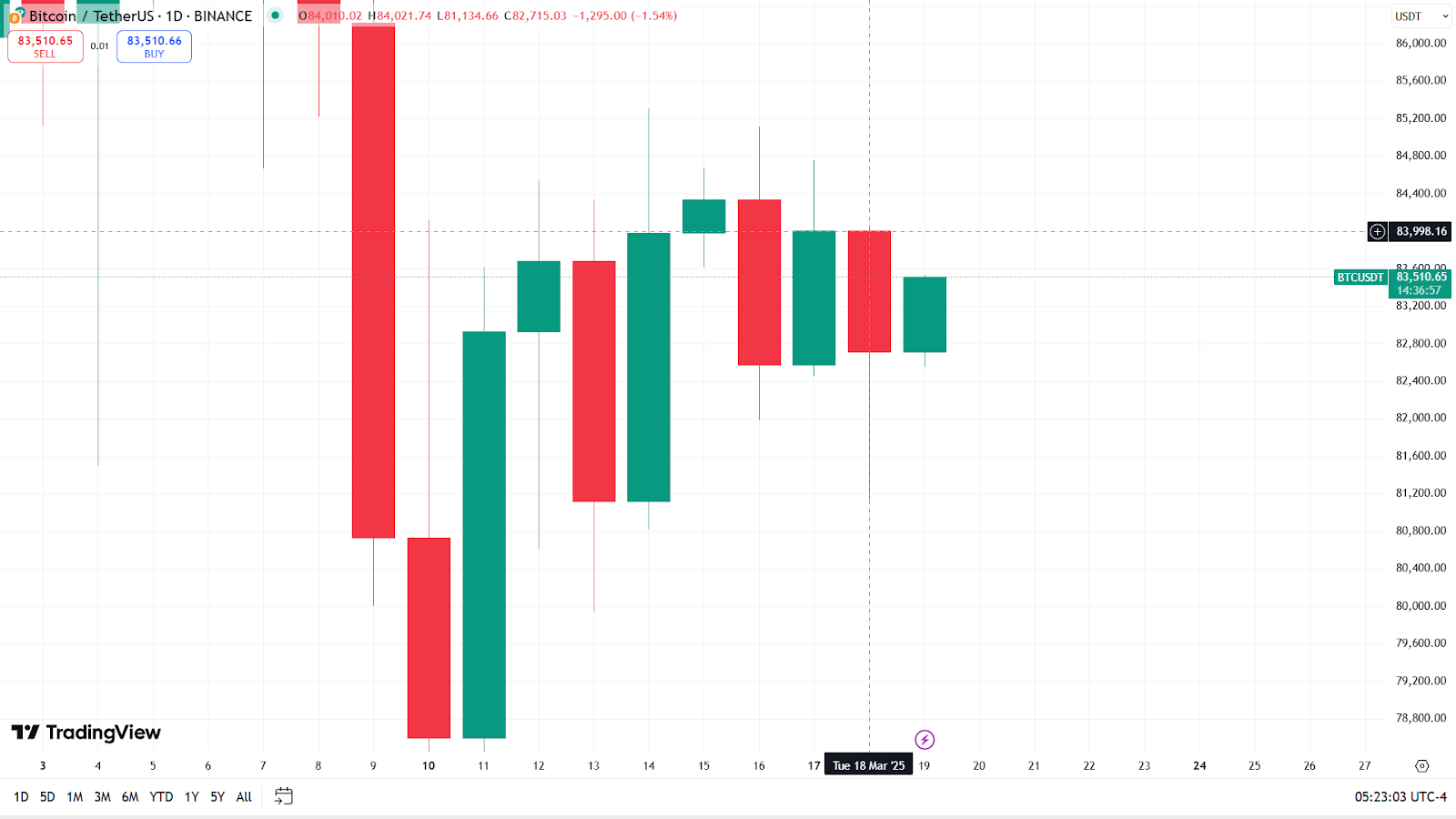

But while gold is soaring, Bitcoin—often called “digital gold”—is telling a very different story. Over the past month, BTC has dropped by 14.4%, moving in the same downward direction as tech stocks rather than holding strong like gold. This has raised a big question: Is Bitcoin really the safe asset its supporters claim it to be?

Let’s dive into what’s driving these dramatic moves.

Markets React to Rising Geopolitical Tensions

Recent global tensions have added to market uncertainty. Israel has resumed attacks in Gaza, breaking a ceasefire agreement.

The U.S. stock market reacted immediately. Yesterday, the Nasdaq Composite dropped from $17,659.06 to $17,504.12, while the Nasdaq 100 fell from $19,654.99 to $19,483.36. The S&P 500 also declined from $5,654.65 to $5,614.65.

Bitcoin followed the same trend, falling from $83,999.56 to $82,715.85.

Unlike stocks and Bitcoin, gold moved in the opposite direction. Spot prices rose from $3,000.268 to $3,033.446, reaching a peak of $3,047 today.

This trend reinforces gold’s reputation as a dependable asset during uncertain times.

Bitcoin’s Behavior Is Shifting

During the 2023 banking crisis, Bitcoin mirrored gold’s movements, acting as a strong store of value. However, that pattern has changed. Now, Bitcoin seems to follow tech stocks more closely than gold, making it less predictable as a safe-haven asset.

ETF analyst Eric Balchunas points out that Bitcoin is still young and needs time to mature before it can compete with gold as a reliable investment. He also acknowledges that, for now, Bitcoin behaves more like a tech stock than a commodity.

Trump’s Crypto Policies: Support or Setback?

U.S. President Donald Trump

- Creating a special crypto task force under the U.S. SEC to establish clear regulations.

- Issuing an executive order to develop a strategic cryptocurrency reserve.

However, Trump’s aggressive tariff policies have negatively impacted the U.S. economy, and the crypto market, including Bitcoin, has felt the effects.

Gold and Bitcoin are currently moving in opposite directions. Gold continues to rise as a safe-haven asset, while Bitcoin struggles like tech stocks.

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

FAQs

Gold prices surged due to geopolitical tensions, economic uncertainty, and expectations of Fed rate cuts, making it a strong store of value

Bitcoin once correlated with gold but now follows tech stocks. Analysts say it needs time to prove itself as a reliable store of value

Bitcoin has higher growth potential but is volatile. Gold remains stable amid crises. Experts predict both will have strong but different roles