BlackRock CEO Larry Fink warns the US is likely in a recession, predicting a potential 20% stock market decline due to tariff-related fears.

Bitcoin's "death cross" signal, coupled with recent price drops, indicates bearish momentum, mirroring concerns in the US stock market.

Despite market turbulence, both Fink and crypto enthusiasts see potential long-term buying opportunities amidst volatility.

BlackRock CEO Larry Fink has issued a serious warning: the U.S. might already be in a recession. Since April began, the S&P 500 has dropped by 10.11%, now sitting at $5,062.24—and Fink believes it could fall another 20%. At the same time, Bitcoin is flashing a bearish signal with a rare death cross pattern. Markets are shaky, headlines are heating up, and fear is spreading fast.

So, what’s really going on – and what does it mean for crypto and stocks alike? Let’s break it down.

Bitcoin Forms a Death Cross – What It Means

On April 6, Bitcoin’s 50-day Simple Moving Average (SMA) dropped below its 200-day SMA. This crossover is called a “Death Cross” and is considered a bearish signal, often indicating a potential downtrend.

Since the beginning of April, Bitcoin has fallen by over 4.13%. The biggest drop came just before the death cross formed, with prices sliding nearly 6.10% in one day. A brief rally sparked by a false news report—claiming President Trump would pause tariffs on China for 90 days—did little to stop the decline. Currently, Bitcoin is priced at $79,060.

Crypto Market Follows U.S. Economic Trends

Experts say the crypto market is moving in line with the broader U.S. economy, especially the tech sector. The U.S. stock market is under heavy pressure, partly due to President Donald Trump’s aggressive tariff policies. These have caused major disruption in both global and U.S. markets.

Since the beginning of this month alone, the S&P 500 has dropped about 9.56%.

Larry Fink: “We’re Probably in a Recession Already”

Speaking in a recent interview, Larry Fink said he believes the U.S. is already in a recession. He warned that markets could fall another 20% due to fear sparked by rising tariffs. Fink also said these tariffs could lead to higher prices and increase inflation.

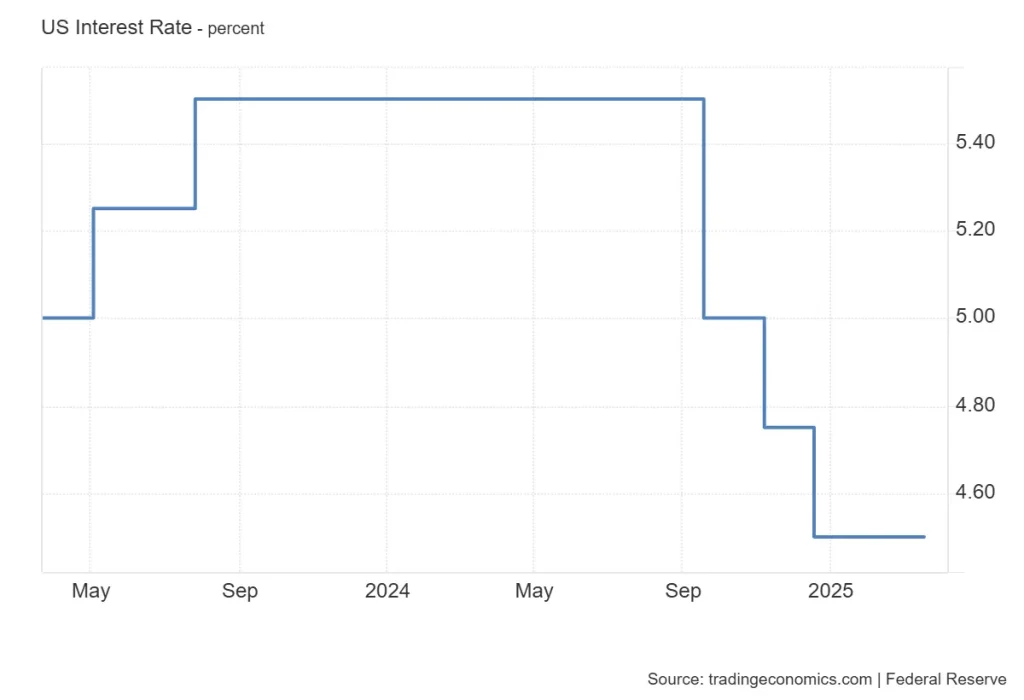

In March 2025, the Federal Reserve kept interest rates steady at 4.25% to 4.5%. There were rumors that rate cuts might return this year, as the Fed had already cut rates at least three times in 2024. However, Fink dismissed talk of four to five cuts this year, calling it unlikely.

Fink said the U.S. government should focus more on pro-growth strategies and easing regulations. Despite the recent market drop, he believes this could be a good long-term buying opportunity for investors.

Long-Term Outlook for BTC is Strong

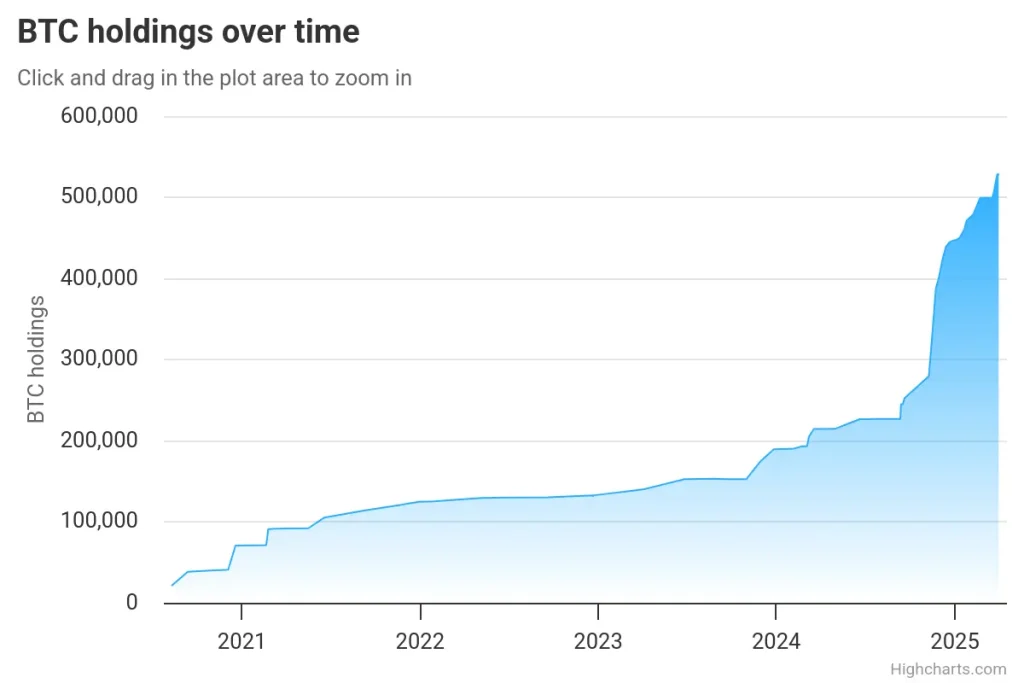

Fink’s view is shared by well-known crypto advocate Michael Saylor. He has long argued that volatility pushes out short-term traders and creates strong opportunities for long-term investors.

Saylor’s company, Strategy, holds at least 528,185 BTC—currently valued at around $41.79 billion—making it the largest public holder of Bitcoin.

BlackRock’s iShares Bitcoin Trust ETF is the largest BTC spot ETF by market cap. It has a total market value of $44.82 billion, a turnover rate of 10.647%, and is currently priced at $44.27.

It’s not just charts flashing red—sentiment is shifting, and the road ahead looks anything but smooth.

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

FAQs

Yes, BlackRock CEO Larry Fink believes the U.S. is likely already in a recession due to tariffs and market instability.

Crypto often faces volatility in a recession as investors move to safer assets, but long-term holders may see opportunity.

Crypto usually drops too, as market panic leads to liquidity selling across stocks and digital assets alike.