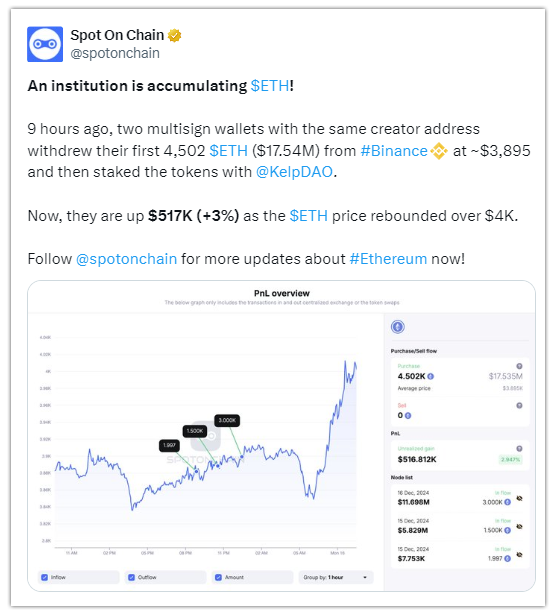

Two newly created multisig wallets, linked to a common creator address, withdrew a significant amount of ETH.

The timing and scale of these transactions suggest potential institutional involvement in Ethereum.

The price surge following the multisig wallet activity highlights the market's sensitivity to significant transactions.

Ethereum’s price surged to $4,000 in a dramatic recovery, and the timing raises intriguing questions. Just six hours before this rally, two mysterious multisignature wallets made their first-ever Ethereum withdrawals and staked the tokens.

Was this just a coincidence that perfectly aligned with the market’s recovery? Hmm, maybe not.

The transactions sparked speculation, with the wallets pocketing over $500,000 in unrealized profit at the peak. But what’s even more fascinating is the lack of history tied to these wallets, leaving the crypto community wondering: who’s behind these moves, and what does it mean for Ethereum’s future?

Two Wallets, One Creator

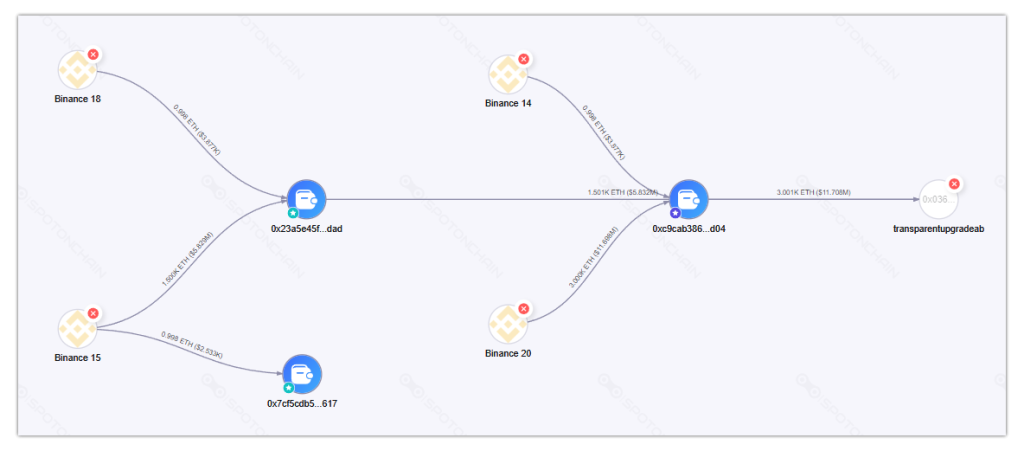

Two multisign wallets, 0x23a…dad and 0xc9c…d04, withdrew a combined 4,502 ETH worth $17.54 million from Binance. This marked the first withdrawal for both wallets, which share a common creator address, 0x7cf…617. The transactions occurred as Ethereum traded between $3,880 and $3,900, and the withdrawn ETH was staked into KelpDAO shortly afterward.

The scale and timing of these transactions suggest that a major entity could be involved. Just six hours later, Ethereum’s price rose to $4,022, boosting the value of the staked ETH by 3% and generating an unrealized profit of over $500,000.

Multisignature wallets are commonly used by institutions, adding to the speculation.

Who Could Be Behind These Wallets?

The lack of transaction history for these wallets makes it difficult to identify the owner. Several possibilities exist:

- A new institutional investor.

- A decentralized autonomous organization (DAO).

- A major individual investor testing the waters.

One wallet is just four days old, and the other was created only 15 hours before the transactions. Even the creator wallet is relatively new, having been established just 51 days ago.

Did These Transactions Drive the Price Surge?

The timing of these transactions is striking. Did they occur in anticipation of Ethereum’s recovery to $4,000, or did they instill confidence in the market, pushing the price up? While it’s unclear whether the price action was a coincidence or a direct result of these moves, it highlights how sensitive the market is to large transactions.

Ethereum Price Update

At the time of writing, Ethereum is trading at $3,930, down 0.28% in the past 24 hours. Before this dip, the token rose by 2.06%, reaching $4,022. The price is currently facing resistance at higher levels, with the moving average offering support near $3,940. The RSI has dropped to 53.19 but remains stable. Meanwhile, an 11.26% increase in trading volume shows that traders are still actively engaging with the market.

Institutions Betting on Ethereum?

Whether these wallets belong to an institution, a DAO, or an individual, one thing is clear: Ethereum is becoming as attractive to big players as Bitcoin. Staking ETH at this price level demonstrates strong confidence in the cryptocurrency.

The mystery remains—are these transactions the work of a new fund, an institutional investor, or a major DAO? We’ll have to wait for more information to uncover the truth.