Bitcoin price surged 77% since October 10th, reaching a new high of $106,533.

The number of wallets holding 100+ BTC increased by nearly 10% in just nine weeks.

Retail investors hold over 88% of Bitcoin's circulating supply, ensuring decentralization and minimal manipulation risk.

Bitcoin is reaching new heights this month, with its price jumping to $106,533 today. This marks a 77% increase since the bull run started on October 10. As Bitcoin’s price rises, the number of Bitcoin wallets is also growing.

Here’s an interesting fact: in just nine weeks, the number of wallets holding at least 100 BTC has grown sharply. Data from Santiment shows that these large wallets increased from 16,072 to 17,644 — almost a 10% rise.

Who Are the Major Bitcoin Holders?

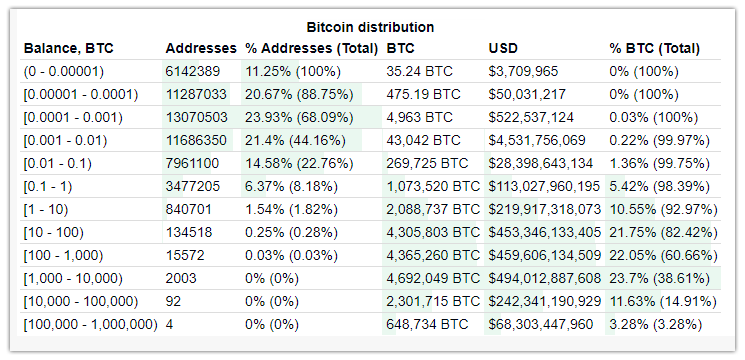

But not all large holders are the same. Four addresses hold between 100,000 and 1 million Bitcoins. The most famous is Satoshi Nakamoto, the mysterious creator of Bitcoin, who is thought to own around 1.1 million coins. Another big holder is MicroStrategy, a public company that owns 423,650 BTC.

The third known whale is Roger Ver, known as “Bitcoin Jesus,” who holds 131,000 BTC. Ver made headlines earlier this year when he was arrested for U.S. tax evasion.

A total of 17,671 wallet addresses hold more than 100 BTC. While this sounds like a lot, it’s a small number compared to the 85 million addresses holding between $1 and $1,000 worth of Bitcoin. In total, there are about 460 million Bitcoin addresses.

Over 88% of Bitcoin’s circulating supply is controlled by retail investors. This ensures Bitcoin stays decentralized and isn’t dominated by a few wealthy players. It also reduces the risk of market manipulation, helping to build trust in the currency.

- Also Read :

- Crypto Market Today (Dec 16, 2024): Bitcoin Hits New ATH Above $106k | Market Goes “Extreme Greed”

- ,

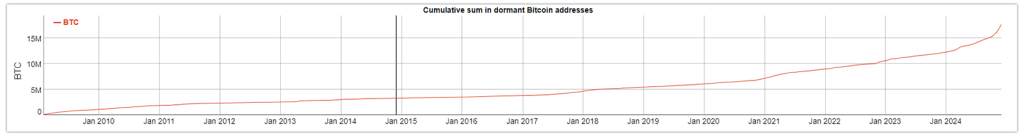

Dormant Wallets Come to Life

Another exciting development is the reactivation of dormant wallets. Some of these accounts have been inactive since 2009, but they’re suddenly being used again. Many of these wallets hold large amounts of Bitcoin, like 10,000 BTC or more.

Typically, only exchanges manage such large balances, but seeing individual investors hold this much Bitcoin shows that long-term holders still believe in Bitcoin’s potential.

What Does This Mean for Bitcoin?

The rise in large wallet holders and the return of dormant wallets show increasing confidence in Bitcoin’s future value. Retail investors still control the majority of Bitcoin, which keeps the asset decentralized and protected from manipulation.

The market is buzzing, the whales are active, and the momentum is undeniable—Bitcoin’s future is looking more promising by the day.

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

FAQs

Satoshi Nakamoto reportedly holds the largest wallet with around 1.1M BTC.

Decentralization ensures no single entity controls the market, promoting fairness and reducing the risk of price manipulation.