XRP fails to break $3.10, signaling potential short-term correction toward $2.90 support level.

On-chain activity remains strong, but trading volume and DEX activity show declining market participation.

Meanwhile, Immediate support at $2.98 critical; bulls must defend to attempt recovery toward $3.25 resistance.

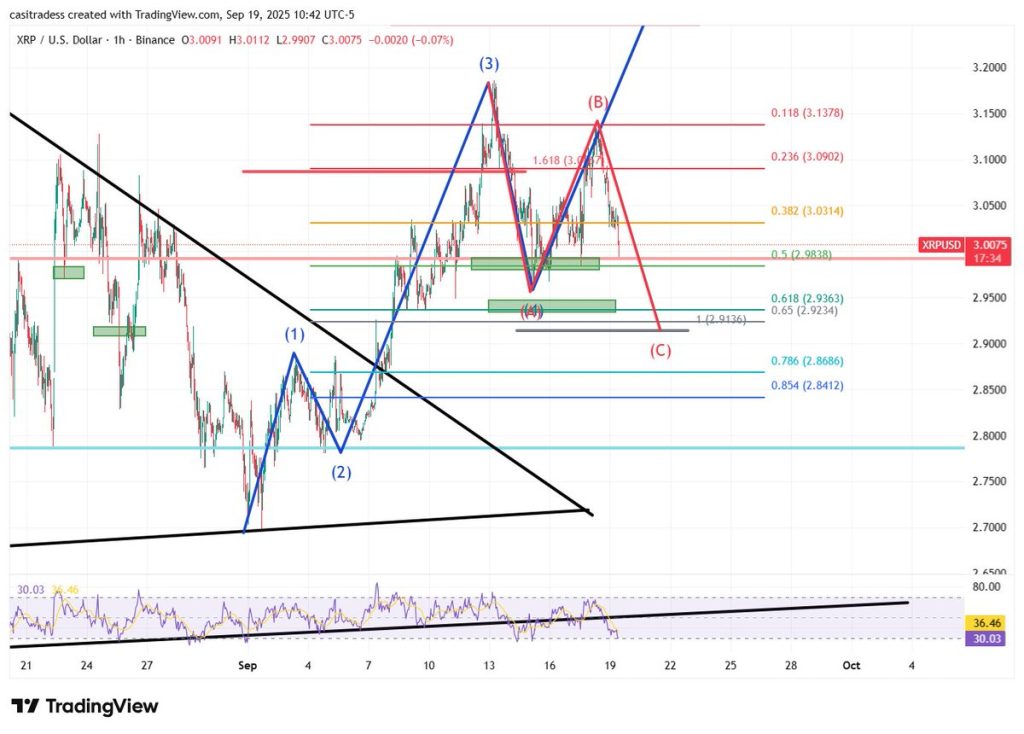

XRP price is once again under immense pressure after failing to push higher $3.10 for the third time this week. Veteran trader CasiTrades now warns the token could be entering a “deeper correction,” with market patterns hinting at a possible dip toward the $2.90 level.

XRP Price Could Drop $2.90, IF!

Over the past week, XRP has tried multiple times to break higher, but each attempt above $3.10 was met with selling pressure. This repeated failure to set a new local high has now opened the door for a corrective pattern.

According to CasiTrades, the chart is forming an ABC wave structure, with the next leg the C-wave potentially sending XRP down to the $2.90–$2.92 range. These levels also align with key Fibonacci retracement zones, making them important areas for buyers to step in.

Looking at the Relative Strength Index (RSI) on both the 1-hour and 4-hour charts, momentum is fading and no strong bullish divergence has formed. That suggests sellers may still have control in the short term.

On-chain data Suggest Weakness

At the moment, XRP price is holding near $2.98, but signs show the market is a bit weak. XRP’s network has processed over 1.1 million transactions daily, but trading volumes have dropped by 31% trading around $4.21 billion.

Adding more pressure is the decentralized exchange (DEX) volume on XRP Ledger also reached a multi-month low of $2.3 million, indicating reduced retail participation and softer demand.

What Comes Next for XRP?

Looking ahead, the $2.98 level will decide XRP’s immediate path. If bulls defend this area successfully, the price could stabilize and attempt another push toward resistance near $3.25 and $3.44.

As of now, XRP price is trading around $3 reflecting a drop of 0.7% seen in the last 24 hours with a market cap hitting $180 billion.

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

FAQs

XRP price is facing selling pressure after failing to break above the $3.10 resistance level multiple times, leading to a potential short-term corrective pattern.

Analysts suggest XRP could see a deeper correction toward the $2.90 support level if it fails to hold above its current price near $2.98.

If XRP holds key support at $2.90, it could present a buying opportunity for a rebound toward resistance levels at $3.25. Always assess market conditions and risk.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author's own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.