Institutional accumulation is accelerating as XRP exchange supply drops 45%, signalling a liquidity shift toward long-term holdings and potential volatility.

XRP price nears a breakout as supply dries up and a triangle pattern tightens—crossing $2.12 could spark a rally, while a dip below $2 may bring short-term weakness.

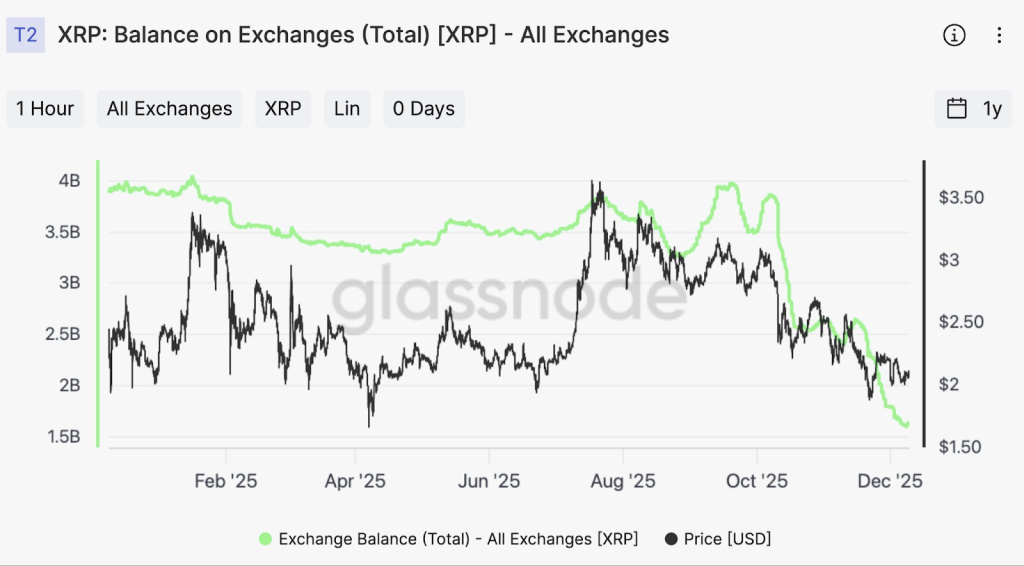

XRP is undergoing a major shift as over 1 billion tokens have moved off exchanges in just three weeks, according to Glassnode. Despite this large supply drop, the XRP price has stayed mostly flat, showing a clear gap between what’s happening with available supply and how the market is pricing XRP.

XRP’s total balance on exchanges has dropped sharply, falling from 3.95 billion tokens to around 1.6 billion. This represents a 45% decline in less than 60 days, with roughly 1.35 billion XRP removed from public exchange order books.

Historically, exchange balances show how much traders are buying and selling in the short term. When tokens leave exchanges in large amounts, it usually means they are being moved for long-term holding or private custody.

This kind of activity is rarely driven by retail traders and instead suggests liquidity is shifting away from public exchanges toward OTC desks, custody platforms, and institutional systems.

Institutional Adoption Reduces XRP Exchange Supply

Several recent developments back this view. In a short period, XRP has been included in multiple institutional filings and investment products. Crypto index funds now carry meaningful XRP weightings, and new ETF-related filings explicitly mention the token.

At the same time, regulators have relaxed rules for banks engaging in crypto, while payment platforms have added easier ways to buy XRP. Together, these steps point to growing institutional integration, not short-term price speculation.

- Also Read :

- How High Can Bitcoin Price Go After FOMC Meeting Today?

- ,

This kind of setup can change how prices move. When there is less XRP available on exchanges, even small buying pressure can push prices higher. With limited supply for sale, price moves tend to be quicker and more volatile once demand picks up.

XRP Price Predictions For Next 3 Weeks

XRP price is currently trading near $2.05, consolidating within a symmetrical triangle pattern. According to Alicharts, this formation reflects a tightening range, with buyers stepping in at higher levels and sellers capping price advances at lower highs.

These patterns usually lead to a strong move once the price breaks out. If XRP rises above $2.12–$2.15, it could trigger an upward rally, while a drop below $2.00 may cause short-term weakness.

For now, XRP is still moving sideways. However, with exchange liquidity falling, institutional activity increasing, and price tightening into a narrow range, the data suggests a major move is coming. The direction will depend on which side the price breaks out next.

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

FAQs

Large XRP outflows suggest institutional custody moves, not retail trading, as long-term holders shift tokens off public exchanges.

Lower exchange supply can create sharper price moves because even small bursts of demand face reduced liquidity.

With shrinking supply and rising institutional activity, XRP is primed for a strong move once the current range breaks.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author's own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.