XRP retests the reliable $2 support as whales accumulate and ETF inflows strengthen demand.

Rising trading volume jumps 77.5% signaling strong buyer interest despite market weakness.

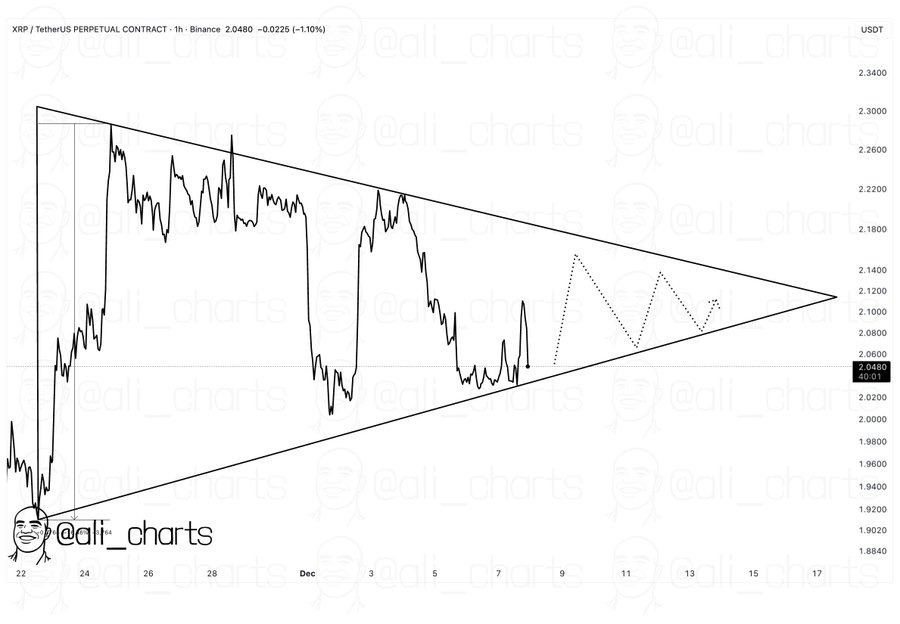

Ali Martinez predicts a sharp 16% breakout towards $2.40 as XRP compresses inside a tightening triangle.

XRP price today is again testing the $2 support level, a zone that has held firm several times this year. Each time XRP slips to this range, buyers step in, and the same behavior is unfolding now.

XRP whales are buying more, ETF inflows are increasing, and the price is moving in a tight range. Top analyst Ali Martinez thinks this could lead to a 16% price jump.

XRP Price Rebounds From $2 Support

XRP price dropped toward $2.00 before bouncing back above $2.08, showing early signs of strength. While the price rise itself was small, something notable happened in the background as the trading volume jumped by 77.5%.

This stood out because Bitcoin, Ethereum, and Solana all saw declines in both price and volume at the same time.

Analysts say this kind of split behavior often shows quiet buying during dips, especially by whales looking to build positions before a bigger move.

Institutional & Whale Activity Tightening Supply

Bitnomial’s CFTC approval to offer an XRP/USD spot contract has increased interest from regulated U.S. investors.

At the same time, spot XRP ETFs have already attracted close to $900 million in inflows since launching, pointing to steady demand.

Ripple also drew attention after moving 250 million XRP into an unknown wallet. Shortly after, exchange balances dropped by 2.51%, meaning fewer tokens are sitting on trading platforms. When available supply shrinks like this, it often signals that major players are positioning for a move rather than selling.

XRP Price 16% Breakout Coming

Looking at the chart, Ali Martinez notes that XRP is moving inside a tightening symmetrical triangle, a pattern that often leads to sharp breakouts.

Over the past week, XRP has been squeezed between $2.03 and $2.18, signaling that volatility is compressing. He suggests that when such a squeeze occurs, volatility is compressed, and when it releases, it usually does so quickly.

Therefore, Martinez expects a 16% breakout once XRP escapes the triangle, which would place XRP near $2.40–$2.45 if it breaks the upper trendline.

But if XRP slips below $2.02, traders warn of a possible drop toward $1.85–$1.90.

With whales buying, supply tightening, ETFs pulling fresh inflows, and the chart reaching its final squeeze point, XRP sits at a crossroads.

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

FAQs

Analysts predict XRP could reach $5.05 by December 2025 if bullish momentum continues and key resistance levels are broken.

XRP price is influenced by ETF approvals, on-chain activity, investor sentiment, legal developments, and broader crypto market trends.

XRP shows bullish signs with strong on-chain activity and ETF interest, but investors should watch key support and resistance levels carefully.

XRP could reach an average of $26.50 by 2030, driven by growing adoption, institutional interest, and market expansion.

XRP’s price could range from $97.50 to $179 by 2040, reflecting potential long-term adoption as a global payment solution.

XRP might reach between $219 and $526 by 2050 if it becomes a dominant digital asset with widespread global usage.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author's own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.