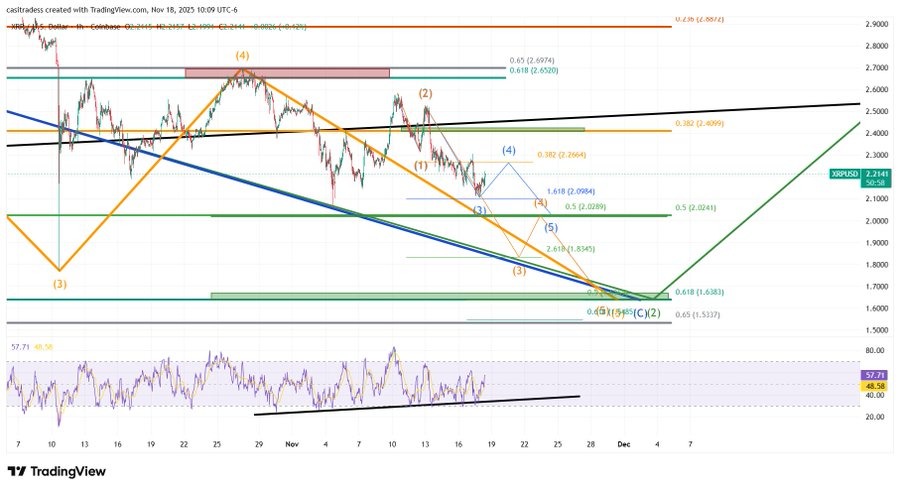

XRP price may fall toward $2.03 before starting a stronger bullish rally upward soon.

Trader CasiTrades warns XRP remains weak unless it breaks above the crucial $2.41 resistance.

A deeper move toward $1.65 is possible and viewed as a strong buying opportunity.

Following the launch of the spot XRP ETF, many people thought the XRP price would break its ATH. But that didn’t happen. Instead, the price has been dropping drastically, now trading around $2.10.

Making traders confused about what is coming next for XRP?

However, veteran trader CasiTrades says the market is actually giving a clear message, and it’s pointing to a very crucial level, i.e, $2.03.

Let’s see what it is.

Why XRP’s $2.03 Level Matters the Most?

According to CasiTrades analysis, XRP is still following a large structure that has been building for months. In this structure, the price is slowly moving down toward a key support level at $2.03.

Meanwhile, Casi believes this level is very important because it matches the 0.5 Fibonacci support area, a zone where prices often bounce strongly in healthy markets.

She also says the move down will not be a straight fall. Instead, the price will move in a zig-zag pattern, with ups and downs along the way. According to her, this is normal behavior for this stage of the market.

For now, CasiTrades says the only way this idea becomes invalid is if XRP breaks above $2.41. If XRP stays below $2.41, then the chart still points toward a final drop to $2.03.

What If XRP Falls Even Lower? The $1.65 Surprise

Many traders fear that XRP might drop even more, but CasiTrades says there is nothing to fear about the next key level, $1.65. This level is the 0.618 Fibonacci, which he says is actually common for this kind of market move.

According to her, a dip to $1.65 is not bearish, it’s an opportunity. She says this entire price range is a chance for smart traders to quietly accumulate.

Many people wait for big breakouts, but she reminds everyone that the best buying moments usually appear before the big move happens, not after it.

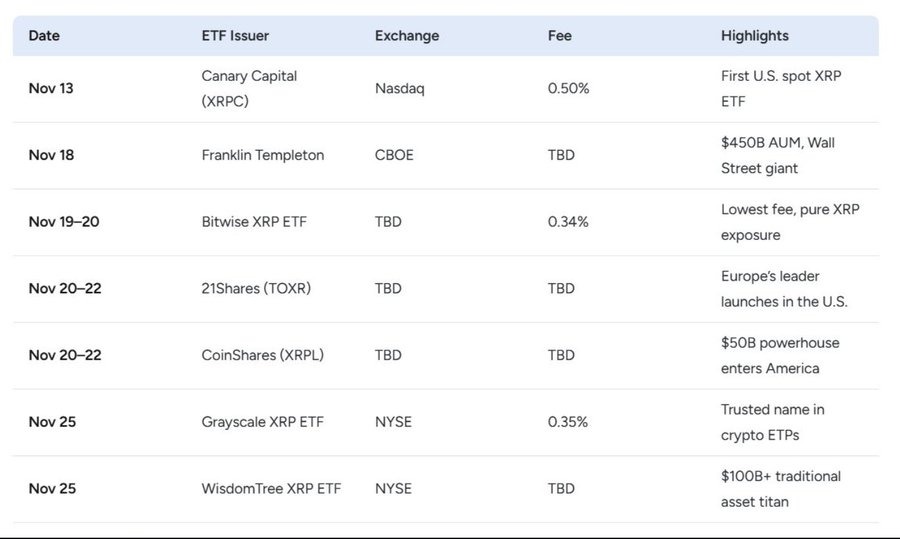

5 more XRP ETFs to go live

After Canary Capital and Franklin Templeton launched their XRP ETFs, another five ETFs are now lined up for approval in November. Many market watchers believe these new funds will bring fresh buyers, increase demand, and help push XRP’s price upward.

Experts say that if demand continues to rise, XRP could move closer to its all-time high of $3.80, and possibly even break above it to form a new record.

As of now, XRP is trading near $2.10, showing a small dip in the past 24 hours. Its market cap is holding around $129 billion.

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

FAQs

Analysts and AI forecasts project XRP could reach $5.05 by the end of 2025, driven by ETF approvals, partnerships, and regulatory clarity.

Based on compounding growth and adoption, projections estimate XRP could trade around $26.50 by 2030, with averages near $19.75.

Hypothetically, yes—if XRP reaches $500+ and an investor holds a significant amount (e.g., 2,000 XRP). However, this is speculative and depends on extreme long-term growth.

XRP is considered a strong investment due to its institutional adoption, regulatory progress, and role in cross-border payments. However, it carries volatility risks like all cryptocurrencies.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author's own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.