Wintermute’s data shows that as macro uncertainty returned and altcoin momentum faded, positioning steadily rotated back toward Bitcoin and Ethereum.

Institutional investors made the move first. From the second quarter of 2025 onward, they remained consistently overweight in major tokens, using them as a defensive anchor while smaller tokens struggled to sustain rallies.

Retail traders followed later. Many initially rotated back into altcoins during the second and third quarters, hoping for a delayed “alt season.” That optimism faded quickly after the sharp October 10 deleveraging event, triggering a broad return to majors by year-end.

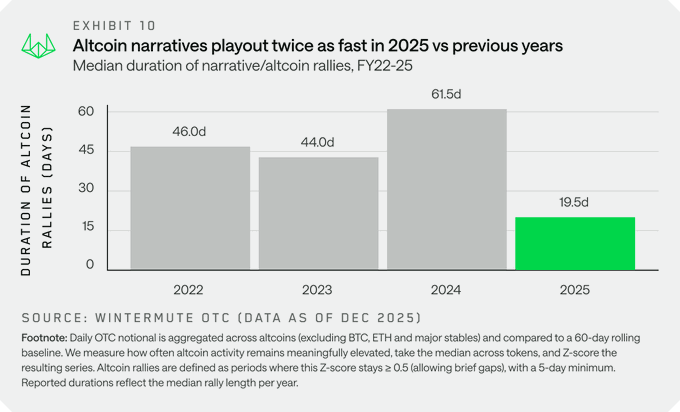

Altcoin Rallies Got Shorter and Weaker

The report highlights a clear slowdown in altcoin momentum.

In 2024, the average altcoin narrative rally lasted more than two months. In 2025, that figure collapsed to around 20 days, a sign of growing market exhaustion. “Altcoin rallies lasted ~20 days on average in 2025, down from ~60 days in 2024,” Wintermute said.

While individual themes like memecoins, perpetual DEXs, and new trading narratives briefly caught attention, none translated into sustained, market-wide participation. Rallies were tested repeatedly but faded fast as conviction failed to build.

Wintermute says this was not due to a lack of ideas, but a lack of persistence.

Market Fatigue Replaces Conviction

Rather than strong trend-following, 2025 became a year of tactical trading. Altcoin moves increasingly looked like short-term bets instead of long-term themes.

According to the report, this shift reflected:

- Choppy macro conditions

- Lingering fatigue after last year’s overshoot

- Insufficient liquidity to support prolonged altcoin rallies

As a result, investors treated most altcoin moves as temporary opportunities, not conviction trades.

Retail Flows Look Structural, Not Tactical

One takeaway from Wintermute’s analysis is that retail behavior changed meaningfully after October.

Retail flows back into Bitcoin and Ethereum now appear more structural than opportunistic. In other words, traders are not simply waiting for the next altcoin breakout. Many now believe majors must lead first before risk appetite returns to smaller tokens.

This view, once mostly held by institutions, is increasingly shared by retail participants.

Memecoins Lose Momentum

Memecoins, once the most active corner of the market, peaked early in the year and never fully recovered.

Wintermute said that trading became fragmented and narrowed, with fewer tokens attracting meaningful liquidity. Activity persisted, but within a much smaller range, offering fewer opportunities for broad participation.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author's own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.