Bitwise launches its spot XRP ETF on the NYSE with ticker “XRP,” sparking expectations of a supply shock and rising institutional demand.

XRP eyes a rebound after a Wave 4 dip, as new ETFs and potential inflows this week could fuel a broader demand cycle into December.

Bitwise has officially announced that its spot XRP ETF goes live today on the New York Stock Exchange. The company called it a major step forward for XRP, now the world’s third-largest crypto asset by market cap. A listing page for the fund has already appeared on Bloomberg, and the ticker will simply be XRP, a rarity and a highly sought-after symbol.

Bitwise also purchased the domain BitXRPetf.com, signaling a strong marketing push behind the product. The fund has a 0.34 percent management fee, but Bitwise is waiving that fee for the first month on the first $500 million in assets.

What About XRP’s Price Today?

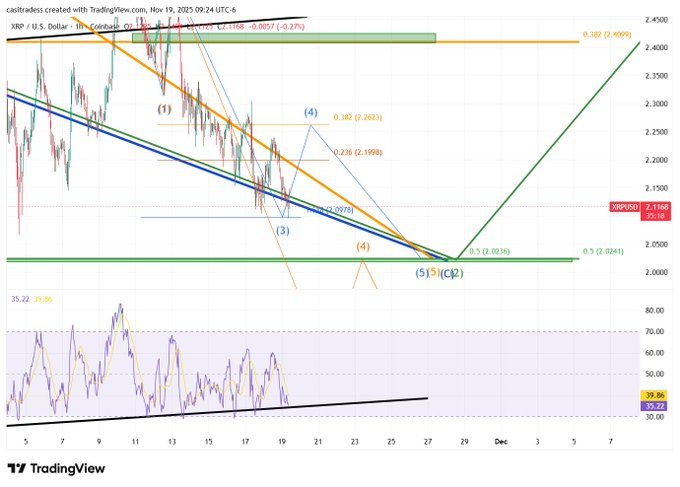

XRP recently dropped toward $2.10, but analysts say the move looks normal for a Wave 4 correction. XRP also touched its RSI support trendline, hinting at a possible bounce.

A push back to $2.26 is still possible in the short term, while the $2.03 macro Fib level remains the most important support zone of this entire correction phase.

Why This ETF Matters for XRP

Analysts say this ETF could cause a “supply shock,” because authorized participants must buy XRP to seed and support the fund.

They also expect demand to rise due to global macro shifts, including what analyst Jake Claver calls the “reverse carry trade”—a situation where rising rates in Japan could trigger huge financial flows into other assets, including crypto.

Claver says this domino effect could push XRP into a major long-term demand cycle, especially if institutions begin treating it as real payment infrastructure.

There is also speculation that BlackRock could launch its own XRP ETF in 2025, adding even more pressure to secure XRP supply.

- Also Read :

- Grayscale and Franklin XRP ETF To Go Live on Nov 24

- ,

Will the Bitwise ETF Trigger a Rally?

The launch could bring fresh inflows today, but analysts warn that XRP may still show “choppy” or sideways behavior early on, just like Bitcoin and Ethereum did when their ETFs first launched.

However, the main question is not whether XRP jumps today, but whether:

- inflows continue this week

- new ETFs launching on November 20–22 add more buying pressure

- institutions accumulate XRP throughout December

With more ETFs coming and growing interest from large financial players, today’s debut could be the start of a longer buildup in demand.

If inflows remain strong, XRP may attempt another rally once the wider correction settles.

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

FAQs

Yes, the Bitwise spot XRP ETF started trading today on the New York Stock Exchange under the highly coveted single ticker XRP – a rare approval that confirms strong regulatory confidence.

The ETF trades under the simple ticker XRP. It has a 0.34% annual management fee, but Bitwise is completely waiving the fee for the first month on the first $500 million in assets.

You can buy it like any stock through any regular brokerage account (Fidelity, Schwab, Robinhood, etc.) using the ticker XRP – no crypto exchange or wallet needed.

History with Bitcoin and Ethereum ETFs shows the first day is often quiet or even choppy. The real impact usually comes from sustained inflows over the following weeks and months as institutions build positions.

A spot ETF creates real buying pressure because authorized participants have to purchase actual XRP tokens to create new shares. Strong, consistent inflows can trigger a supply shock, especially with more XRP ETFs expected soon.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author's own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.

![Why Is the Crypto Market Going up Today [Live] Updates on March 3, 2026](https://image.coinpedia.org/wp-content/uploads/2026/03/03170220/Why-Is-the-Crypto-Market-Going-up-Today-Live-Updates-on-March-3-2026-2-390x220.webp)