XRP outperforms Bitcoin and Ethereum in 2026 as investors rotate into less crowded trades.

CNBC highlights XRP ETF inflows reaching $1.62 billion, signaling growing institutional confidence worldwide today.

Ripple confirms no IPO plans for 2026 after raising $500 million privately last year.

XRP has emerged as one of the hottest crypto trades of the year, even outperforming giant Bitcoin & Ethereum in performance and becoming the 3rd-largest cryptocurrency by market cap.

Since the start of the year, XRP has climbed more than 20%, briefly trading near $2.40. What stands out is not just the price move, but the reason behind it.

XRP as a “Less Crowded Trade”

Speaking on CNBC, journalist Mackenzie Sagalos explained that XRP benefited from a shift in investor mindset during late 2025. She noted that many traders treated XRP as a “buy-the-dip” opportunity rather than a momentum trade.

With Bitcoin becoming more stable and crowded, traders were clearly hunting for assets with higher upside potential, and XRP fit that profile well.

This strategy paid off quickly. In early January, XRP jumped as new buyers entered, while selling stayed low. Institutional interest also played a key role, with steady money flowing into XRP ETFs during a quiet period.

Since the launch of the XRP ETF, total inflows have reached around $1.62 billion, showing sustained confidence from large investors.

She further added that, beyond trading dynamics, XRP continues to gain attention for its role in cross-border payments.

No IPO For Ripple In 2026

Despite XRP’s strong market performance, Ripple has confirmed it has no plans to go public. In a recent interview, President Monica Long said the “Currently, we still plan to remain private. The company is financially strong and prefers to grow privately through acquisitions and products.

Long said that Ripple had raised $500 million in late 2025 at a $40 billion valuation, giving it enough capital without needing an IPO.

- Also Read :

- Was XRP’s Price Engineered to Hit $12,000? Analyst Alleges Long-Term Plan Behind SEC Lawsuits

- ,

XRP Price Analysis

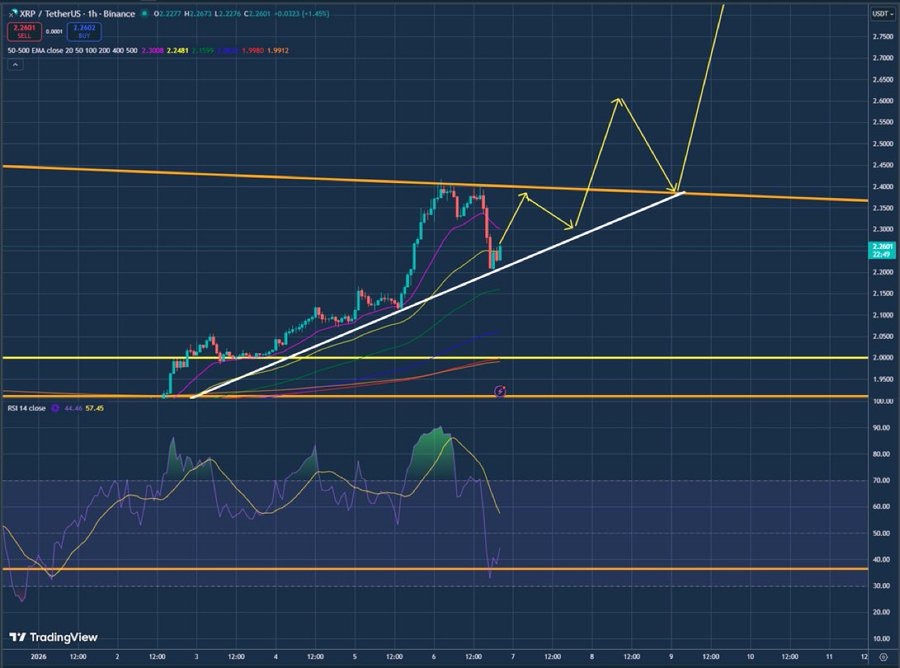

On the technical side, XRP is holding above a rising support trendline even after pulling back from recent highs near $2.41. The price briefly slipped below $2.32 and dipped toward $2.25, but buyers quickly stepped in.

Since early January, XRP has been forming higher lows, showing that buyers are entering earlier on each dip. As long as the price stays above the $2.20 zone, the structure remains stable, with room for a move back toward $2.60 – $3 if momentum returns.

Meanwhile, the RSI has cooled to 45, which often acts as a healthy reset during ongoing uptrends.

Will XRP Hit $5 by the End of 2026?

With steady ETF inflows and supportive fundamentals, XRP has the potential to extend its current rally toward the $5 level later this year.

Although short-term volatility is expected, the recent pullback appears to be a healthy pause within a broader uptrend, not a full trend reversal.

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

FAQs

XRP’s rally is fueled by ETF inflows, investor interest in “less crowded” trades, and its role in cross-border payments.

With steady ETF inflows and supportive fundamentals, XRP has potential to climb toward $5, though short-term volatility is expected.

Major risks include regulatory setbacks, weak market liquidity, competition from other payment-focused blockchains, and prolonged bearish market cycles.

Triple-digit targets assume massive global adoption and long-term dominance in payments, making them highly speculative rather than guaranteed outcomes.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author's own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.