World Liberty Financial WLFI price surged 20% despite overall crypto market showing weakness today.

Major Mar-a-Lago event sparked investor optimism and boosted WLFI token demand significantly worldwide.

WLFI trading volume jumped 120%, reflecting strong market interest and rising investor confidence globally.

The Donald Trump family-backed project, World Liberty Financial, has seen its WLFI token price surge nearly 20% today. As of now, the $WLFI price is hovering around $0.1175, giving it a market cap of about $3.13 billion.

While most major coins trade in the red, this sharp rise raises questions among investors: why is the World Liberty Financial WLFI token price up today?

Why WLFI token price up today?

WLFI Event at Mar-a-Lago

One of the biggest reasons behind the World Liberty Financial WLFI price rally is a high-profile event taking place at Mar-a-Lago, Donald Trump’s Florida resort, on 18th February.

As per the WLFI announcement, the event will host CEOs from major financial and crypto firms, including Coinbase, BitGo, Nasdaq, Franklin Templeton, and Goldman Sachs. Other well-known figures include rapper Nicki Minaj, investor Kevin O’Leary, and the president of FIFA and the NYSE.

Around 300 global leaders will attend the event. Several experts expect World Liberty Financial (WLFI) to make major announcements today.

WLFI Whale Buying Activity Boosts Investor Confidence

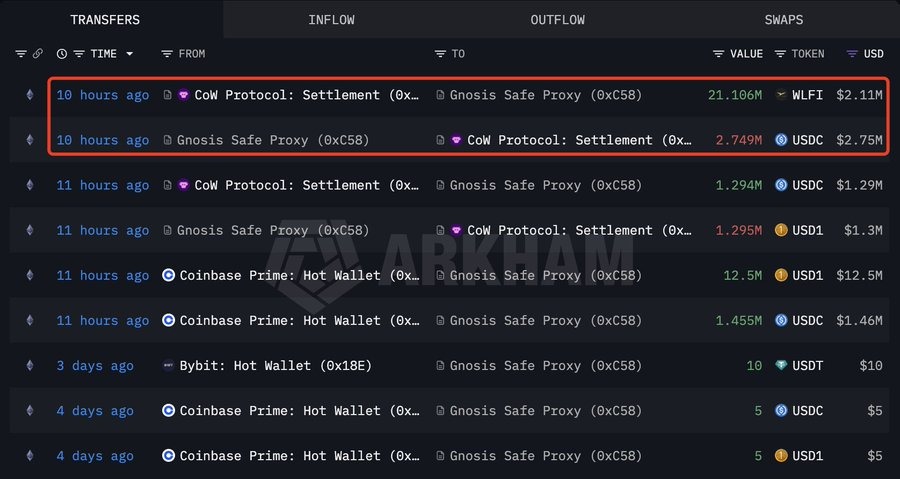

Another key factor supporting the WLFI price surge is aggressive whale accumulation. On-chain data shows that a newly created wallet spent approximately $2.75 million USDC to purchase over 21 million WLFI tokens in a single transaction.

However, wallets linked to the World Liberty Financial team have also increased their holdings. One team-linked wallet reportedly received $10 million from Coinbase, signaling strong internal confidence in the project’s future.

WLFI Trading Volume Jumped 120%,

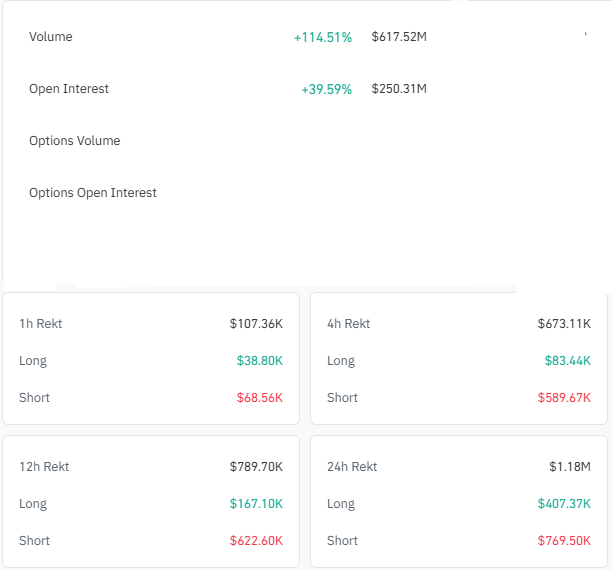

This increase in whale buying has pushed WLFI trading volume up nearly 120% in the past 24 hours, reaching around $242 million. Rising volume often signals that investors are showing stronger interest in the asset.

At the same time, open interest rose about 40% to roughly $250 million, while funding rates stayed negative. This suggests many traders were betting against the token.

Liquidation Add More Pressue On Short seller

As the WLFI price started rising, short sellers closed their positions, creating additional buying pressure.

Over the past 24 hours, WLFI recorded approximately $1.18 million in total liquidations, with $770,000 coming from short positions alone.

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

FAQs

WLFI rose nearly 20% due to a high-profile Mar-a-Lago event, strong whale buying, rising trading volume, and short liquidations boosting demand.

It’s a high-profile summit at Donald Trump’s resort hosting CEOs from Coinbase and Goldman Sachs, where experts expect World Liberty Financial to make major announcements.

The sharp increase in volume, up 120% to $242 million, signals strong investor interest and confirms that the price move is backed by real market activity.

WLFI’s rally reflects positive sentiment, but crypto investing carries risk—research fundamentals, news, and your own goals before deciding.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author's own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.