LIT jumped 13% after Lighter confirmed protocol fees would be used for token buybacks.

On-chain data shows treasury spent USDC buying 180,700 LIT, proving buybacks are already active.

LIT broke key resistance near $2.60, forming bullish structure with targets toward $3.60 next.

Lighter, a decentralized perpetual exchange built as a zero-knowledge rollup on Ethereum, has seen its native token LIT price jump nearly 13% today.

This sudden rally came right after the Lighter team announced that all fees generated by its core DEX product and future services would be used for LIT tokens.

LIT Protocol Buybacks Plan Drive Price Up

The biggest trigger behind today’s LIT rally is Lighter’s protocol fee buyback program. On January 6, on-chain data showed Lighter’s treasury using protocol fees to buy back LIT tokens directly from the market. Community members tracked transactions where the treasury spent over $10,000 in USDC to purchase roughly 180,700 LIT tokens.

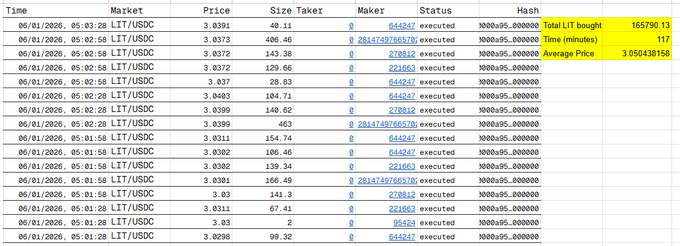

In addition, the Lighter Assistance Fund also bought 165,790 LIT tokens over a short period, at an average price close to $3.05.

These purchases are fully transparent and visible on-chain through a dedicated treasury account, confirming that buybacks are already active, not just a plan.

Trading Volume and Whale Activity Spark Rally

In addition to this, trading activity surged alongside the buybacks. LIT’s 24-hour trading volume jumped nearly 89%, reaching around $36 million. This spike suggests renewed interest from both retail and large traders.

Interestingly, on-chain data also shows whale involvement. One large transaction involved the sale of 52.1 wrapped Bitcoin worth around $4.86 million, followed by a $3.36 million USDC deposit into Lighter.

Those funds were later used to buy over 1.119 million LIT tokens, adding strong upward pressure to the price.

Lighter LIT Token Price Outlook

Looking at the 1-hour price chart, LIT has shifted into a strong short-term uptrend after breaking out from a consolidation phase near the $2.50–$2.60 zone. The price is currently trading around $3.09, holding above key short-term support.

LIT price has broken above a descending corrective trendline, confirming trend reversal.

So, as long as the price holds above $2.95, the bullish structure remains intact. A sustained move above would open the door for upside targets near $3.60.

Meanwhile, RSI remains healthy around 66 and below extreme overbought levels, leaving room for further upside.

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

FAQs

LIT surged after Lighter confirmed it is actively using protocol fees to buy back LIT tokens, reducing supply and boosting market confidence.

Lighter uses fees from its DEX and future products to repurchase LIT tokens on the open market through a transparent on-chain treasury.

Yes, buybacks are live. On-chain data shows the treasury has already purchased hundreds of thousands of LIT tokens using protocol fees.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author's own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.