Bitcoin reclaiming $90K, strong whale accumulation, and long-term holder buying are reducing sell pressure and rebuilding confidence across the crypto market.

Altcoins surge as market cap breaks key resistance, Ethereum activity rises, and institutional demand grows, signaling improving fundamentals for 2026.

The crypto market has started 2026 on a strong note, with Bitcoin climbing back above the $90,000 mark and triggering a broad rally across altcoins. While Bitcoin’s move itself drew moderate attention, the real momentum is coming from strong buying activity, rising whale accumulation, and improving on-chain signals across the market.

At the time of writing, the total crypto market cap has crossed $3.07 trillion, with nearly all major assets trading in the green.

Bitcoin Price Reclaims $90K, Sets Positive Market Tone

Bitcoin is currently trading around $90,290, recovering from recent lows and regaining a key psychological level. Although BTC remains nearly 30% below its 2025 high, the rebound has restored confidence among investors who view this zone as a long-term accumulation area.

Historically, Bitcoin reclaiming major levels has often led to renewed activity in the broader market, and this time has been no exception.

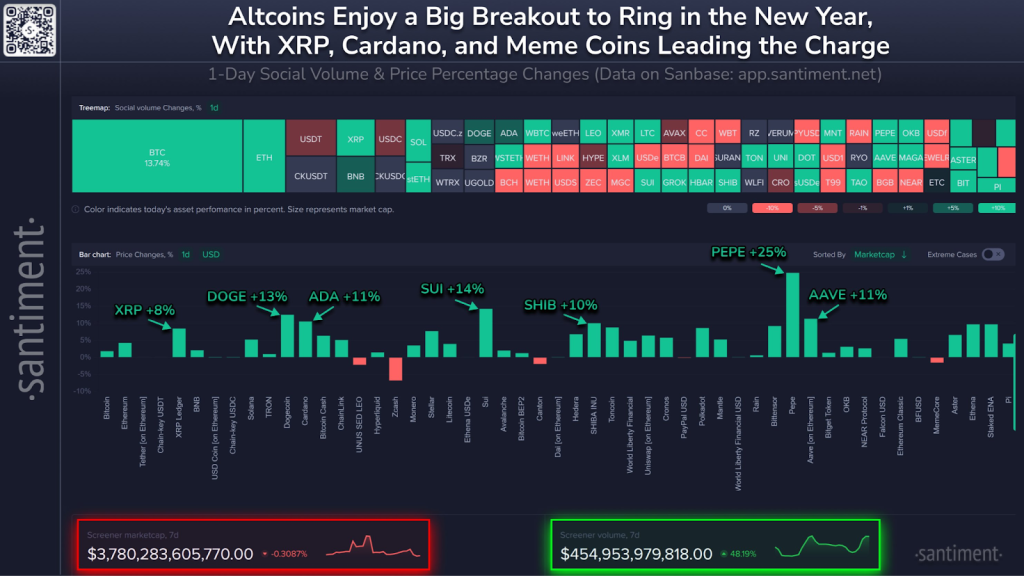

Altcoins Rally as Market Turns Green

Altcoins have taken the spotlight heading into the weekend, with strong gains across the board. In the past 24 hours, PEPE jumped 25%, while SUI rose 14% and DOGE climbed 13%. ADA and AAVE each gained 11%, SHIB moved up 10%, and XRP added around 8%, showing renewed buying interest across major tokens.

Ethereum has also strengthened, trading near $3,124, while the altcoin market cap has surged to $214.86 billion.

XRP Flips BNB to Become Third-Largest Crypto

One of the most notable developments today is XRP overtaking BNB to claim the third spot by market capitalization. This shift reflects rising interest driven by whale accumulation and XRP’s growing role as a hedge narrative amid global uncertainty.

The move has added fuel to broader altcoin sentiment, encouraging traders to rotate capital beyond Bitcoin.

Why Crypto Market is Surging Today?

Whale Buying Surges Across Major Exchanges

A major driver behind today’s rally is heavy Bitcoin buying from large players. On-chain data shows coordinated accumulation over the last 10 hours:

- A single whale bought 7,194 BTC

- Binance acquired 4,928 BTC

- Coinbase added 8,176 BTC

- Kraken bought 2,267 BTC

- Wintermute accumulated 1,613 BTC

In total, more than $2.5 billion worth of Bitcoin was purchased in a short period. Such large-scale buying typically reduces available supply and pushes prices higher, especially during low-liquidity periods.

Crypto Market Cap Breaks Key Trendline

The total crypto market cap has now broken above a long-standing descending trendline. The last time this technical breakout occurred, the market rallied nearly 60% in the months that followed.

While past performance does not guarantee future results, this breakout is widely seen as a positive structural shift for the market.

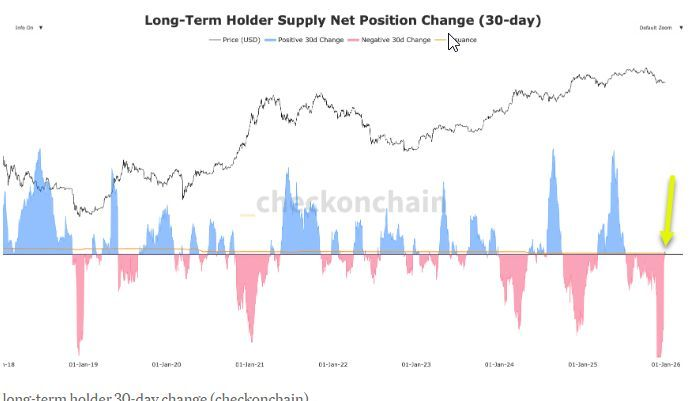

Another important factor supporting prices is the behavior of long-term Bitcoin holders. After months of heavy selling, the largest distribution phase since 2019, long-term holders have flipped back to net accumulation.

When long-term holders stop selling, downward pressure typically fades. Prices may not surge instantly, but strong support levels often begin to form.

At the same time, Bitcoin ETFs continue to absorb available supply while corporate treasuries are quietly buying on dips. Retail participation remains limited, and overall market sentiment is still driven by caution rather than hype.

Historically, this mix of strong institutional demand, low retail involvement, and elevated fear has tended to appear closer to market bottoms rather than market tops, often laying the groundwork for a more sustained recovery.

Ethereum Activity Hits New Highs

Ethereum’s on-chain activity has also strengthened. Daily transaction counts have surpassed levels last seen during the 2021 NFT boom, suggesting renewed network usage and demand.

Rising activity often signals improving market conditions, especially when paired with price stability.

- Also Read :

- Top Crypto Market Trends and Predictions for 2026

- ,

Rising Open Interest Signals Renewed Risk Appetite

Futures open interest has climbed 2.16% in the last 24 hours, reaching nearly $130 billion. This increase suggests traders are deploying fresh capital and leverage, a sign of growing confidence in short-term market direction.

Buying the Dip Supports Market Recovery

Many investors are also buying the dip after steep declines in 2025. Ethereum is still down about 40% from last year’s high, while several major tokens remain well below previous peaks. Historically, such pullbacks often attract long-term buyers looking for value.

Regulatory Clarity and Institutions Boost 2026 Outlook

With clearer crypto regulations expected in the US and increased institutional onboarding, many market participants believe 2026 could mark a turning point for crypto adoption.

While volatility remains part of the market, today’s rally reflects improving fundamentals rather than short-term hype.

In short, the crypto market is moving higher because sellers are stepping back, whales are accumulating, and confidence is slowly returning.

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

FAQs

The market is rising due to strong whale buying, long-term holder accumulation, ETF demand, and a breakout in total crypto market cap, reducing sell pressure.

Altcoins are gaining as investors rotate capital from Bitcoin, sentiment improves, and major tokens benefit from rising liquidity and risk appetite.

Whale accumulation reduces available supply on exchanges, often leading to price increases, stronger support levels, and improved market confidence.

The rally appears structurally supported by institutional demand, long-term holder accumulation, and low retail hype, conditions often seen near market recoveries.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author's own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.