Analysts say derivatives are now setting the Bitcoin price.

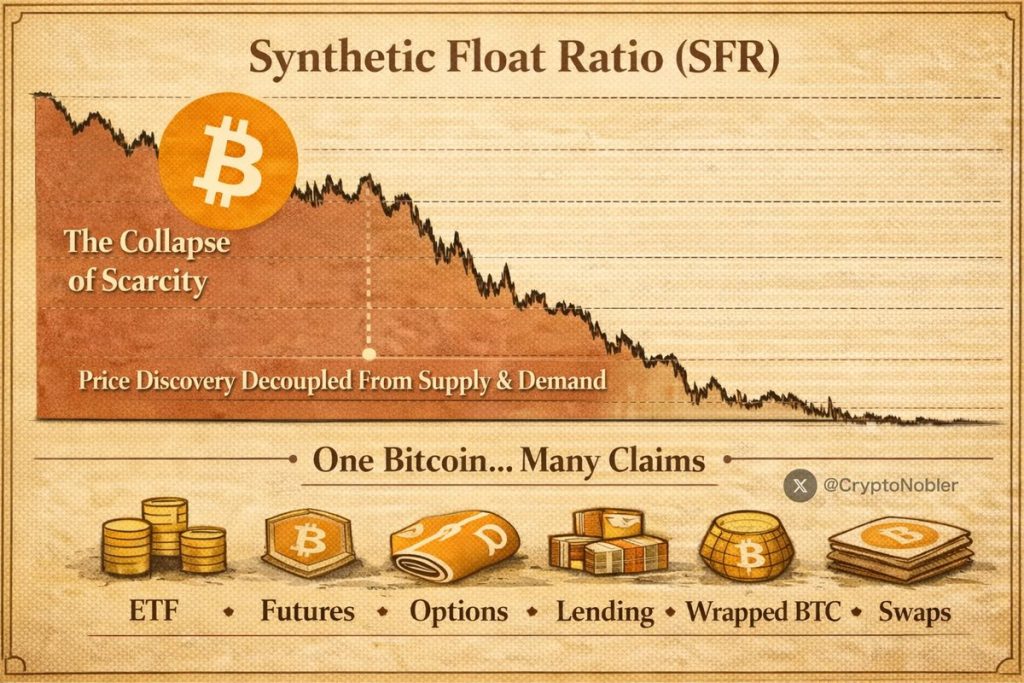

Synthetic BTC exposure may be diluting Bitcoin’s scarcity, shifting price discovery away from the spot market.

As liquidations pile up, questions are growing over how much control Wall Street now has over Bitcoin’s moves.

Bitcoin briefly crashed toward $60,000 on February 6, wiping out over $2.6 billion in leveraged positions in 24 hours. That makes it the worst single-day drop since the FTX collapse in November 2022. Most outlets are blaming macro pressure and weak sentiment.

But DeFi researcher CryptoNobler says the real issue is structural, and it has been building for months.

According to CryptoNobler, Bitcoin no longer trades like a supply-and-demand asset. Derivatives have taken over price discovery entirely.

“The moment supply can be synthetically created, scarcity is gone. And when scarcity is gone, price stops being discovered on-chain and starts being set in derivatives,” he stated.

What Happened to Bitcoin’s 21 Million Hard Cap?

The hard cap still exists on-chain. But Bitcoin’s original value proposition relied on two things: fixed supply and no rehypothecation.

That framework broke the moment Wall Street layered cash-settled futures, perpetual swaps, options, ETFs, prime broker lending, wrapped BTC, and total return swaps on top of the chain.

Bob Kendall, creator of PortfolioXpert and a technical analyst, backed the same argument.

“Once you can synthetically manufacture the supply, the asset is no longer scarce, and once scarcity is gone, price becomes a derivatives game, not a supply-and-demand market,” he said.

The Six-Layer BTC Problem

CryptoNobler pointed to what he calls the Synthetic Float Ratio (SFR). The idea is simple: one real BTC can now simultaneously back an ETF share, a futures contract, a perpetual swap, an options delta, a broker loan, and a structured note. All at the same time.

“That’s six claims on one coin. That is not a free market. That is a fractional-reserve price system wearing a Bitcoin mask,” he warned.

He added that this is the same structural break that already happened to gold, silver, oil, and equities once derivatives took over those markets.

Wall Street’s Playbook

Both researchers described a cycle that keeps repeating: create unlimited paper BTC, short into rallies, force liquidations, cover at lower prices, and do it again. CryptoNobler called it “inventory manufacturing.”

Today’s crash fits that pattern. Of the $2.6 billion in liquidations, over $2.1 billion came from long positions being force-closed. Derivatives markets led the selloff while spot activity stayed relatively calm.

What Does This Mean for Bitcoin Holders?

Bitcoin is trading around $66,000 after bouncing from the $60,000 floor.

The question now is how long this cycle continues before the market catches up.

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

FAQs

Bitcoin is down today due to heavy leverage liquidations in derivatives markets, where forced selling amplified losses despite relatively stable spot demand.

Bitcoin often tests major liquidity zones after crashes; downside risk depends on leverage unwinding, but strong spot buying can limit deeper drops.

Recovery usually begins once leverage is flushed out and derivatives open interest resets, allowing spot demand to regain control of price movement.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author's own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.