Hedera (HBAR) soars 15% to $0.20, becoming one of today’s top crypto gainers.

The launch of the first-ever Canary HBAR ETF on Nasdaq sparks massive investor interest.

Hedera expands stablecoin use as USDC goes live on Bybit, boosting ecosystem liquidity.

Traders predict another 50–60% surge as network upgrades and partnerships fuel bullish momentum.

Hedera (HBAR), the native cryptocurrency of the Hedera Hashgraph network, has stunned the crypto world with a sharp 15% jump in just 24 hours, hitting the $0.20 mark. The sudden surge has reignited investor excitement and placed one of today’s top gainers.

With growing institutional interests, traders believe more 50% to 60% gain is coming for HBAR’s token?

Here’ Why HBAR’s Price Jumping

Here’s the key reason why HBAR token price is jumping today, while other cryptocurrency struggling to surge.

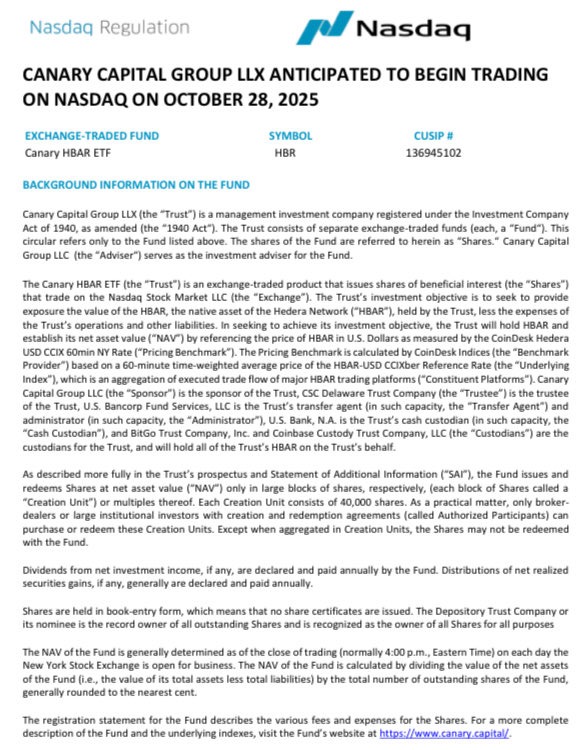

Launch of the First HBAR ETF

The main driver behind HBAR’s rally is the launch of the Canary HBAR ETF on Nasdaq. This marks the first-ever exchange-traded fund offering direct exposure to HBAR, allowing large investors to buy the token in a regulated and secure way.

The fund holds real HBAR tokens in custody with BitGo and Coinbase Custody, providing assurance for institutions concerned with compliance and security.

Expansion in Stablecoin Utility

Adding more momentum, the Hedera Foundation announced that USDC, one of the largest stablecoins, is now available on Bybit. This expansion enhances liquidity and trading opportunities within the Hedera ecosystem, solidifying HBAR’s position in stablecoin-powered payments and DeFi activities.

Major Network Upgrades and Partnerships

Hedera has recently rolled out key network upgrades aimed at improving speed, scalability, and transaction efficiency. Alongside this, several new DeFi and NFT integrations have expanded its ecosystem.

Strategic partnerships and ongoing developer initiatives have also increased attention toward HBAR’s real-world applications, further boosting investor sentiment.

HBAR Price Outlook

The HBAR ETF listing opens a new era for Hedera, as greater Wall Street interest could further boost price and profile while validating the project’s long-term potential.

At the same time, several pseudonymous crypto traders believe HBAR is on the edge of a major price breakout. Based on current chart patterns, they predict a 50–60% price surge could soon follow.

The accompanying chart shows a clear bullish setup, suggesting that HBAR may be preparing for a sharp upward move as momentum continues to build.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author's own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.