Global crypto market sheds 1.68%, with traders reacting to macroeconomic and political events

Over $327M in liquidations in 24 hours as volatility spikes across major tokens

Bitcoin and Ethereum lead the downturn, altcoins see heavier losses

The global cryptocurrency market witnessed a broad downturn today, with total market capitalization falling by 1.68% to $3.39 trillion. Daily trading volume also dipped 5.27% to $133.81 billion, signaling cautious investor sentiment. The Fear & Greed Index currently sits at 61, still in the “Greed” zone, though edging downward as uncertainty clouds the outlook.

The decline follows a sequence of macroeconomic and political events that have rattled both crypto and traditional markets. Talking about Wall Street, the S&P 500 is down 0.27% at 6,022.24, DJT fell 1.87% to 20.52, NASDAQ dropped 0.50% to 19,615.88, and the Dow Jones slipped marginally by 0.0026% to 42,865.77.

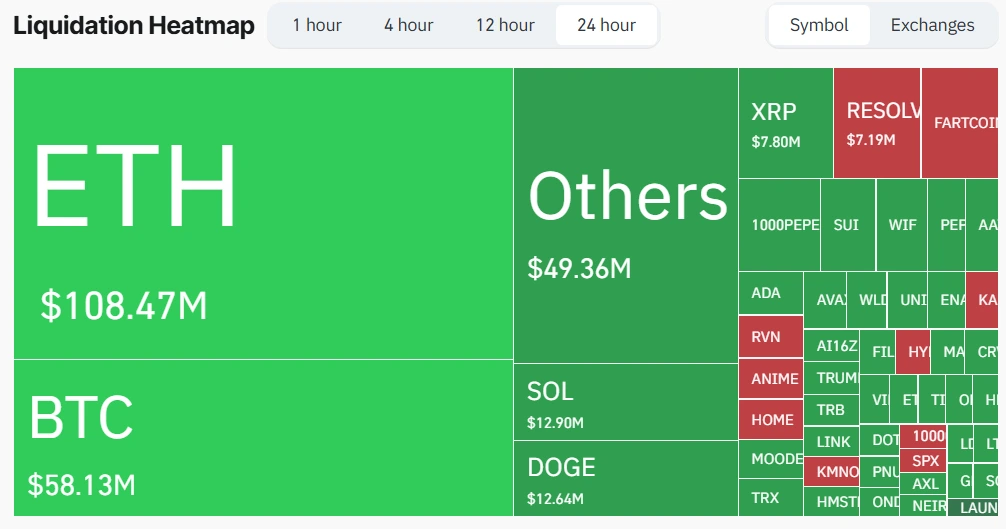

Liquidations Surge as Traders Get Caught Off Guard?

As price action turned against the bulls, liquidations began to mount. In the past 24 hours, 112,143 traders were liquidated, amounting to a total of $327.94 million wiped out across exchanges. The single-largest liquidation occurred on Binance’s BTCUSD perpetual pair, totaling $2.15 million.

The scale of the liquidations suggests that many traders were caught off guard by the rapid reversal in sentiment, especially those betting on a bullish continuation after the CPI dip. With leveraged positions wiped out across both long and short sides, volatility is expected to be present in the short term.

BTC & ETH in Red, Altcoins Hit Harder?

Bitcoin price is down 1.68% in the last 24 hours, now trading at $107,740.76. Its market cap stands at $2.14 trillion, with $53.99 billion in daily trading volume. Ethereum followed suit, dipping 1.11% to $2,760.10. Among the top altcoins, XRP dropped 1.87%, while Solana took a heavier bash with a 3.97% decline.

Top Gainers

- SPX6900: $1.68 (+6.63%)

- KAIA: $0.1695 (+3.14%)

- AB: $0.01167 (+2.64%)

Top Losers

- CRV: $0.6394 (-9.98%)

- JUP: $0.4553 (-9.39%)

- RAY: $2.26 (-9.38%)

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

FAQs

Bitcoin fell 1.68% to around $107,740, while Ethereum dipped 1.11% to about $2,760

The sudden market reversal caught many leveraged traders off guard, resulting in over 112,000 liquidations and $327.94 million lost across exchanges.

The S&P 500 is a stock market index tracking the performance of 500 of the largest publicly traded U.S. companies. It’s widely considered a benchmark for overall U.S. stock market health.

DJT fell 1.87% and is trading at 20.52 amid broader market declines.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author's own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.