December 3, 2025 07:44:42 UTC

South Korea Moves Forward With Stricter Stablecoin Rules

South Korea’s government and National Assembly are advancing the second phase of digital asset legislation, known as the “Digital Asset Basic Act.” A major proposal limits stablecoin issuance to consortiums where banks hold at least 51% of shares. The Digital Asset Special Task Force within the Democratic Party has largely confirmed this plan. The move aims to strengthen oversight and stability in the crypto market, ensuring that stablecoins are backed and managed by regulated financial institutions.

December 3, 2025 07:40:15 UTC

Bitcoin’s 2025 Quarterly Pattern Echoes 2018, Could Spark Early 2026 Rally

Bitcoin’s 2025 quarterly chart is showing similarities to 2018, when a red Q4 ended the year and set the stage for a strong Q1–Q2 surge in 2019. That rally flipped market sentiment and kicked off the next major cycle. If history repeats, early 2026 could see Bitcoin gaining momentum quickly, potentially pushing toward a new all-time high faster than many expect. Analysts are watching for a similar reset-and-rally pattern.

December 3, 2025 06:21:38 UTC

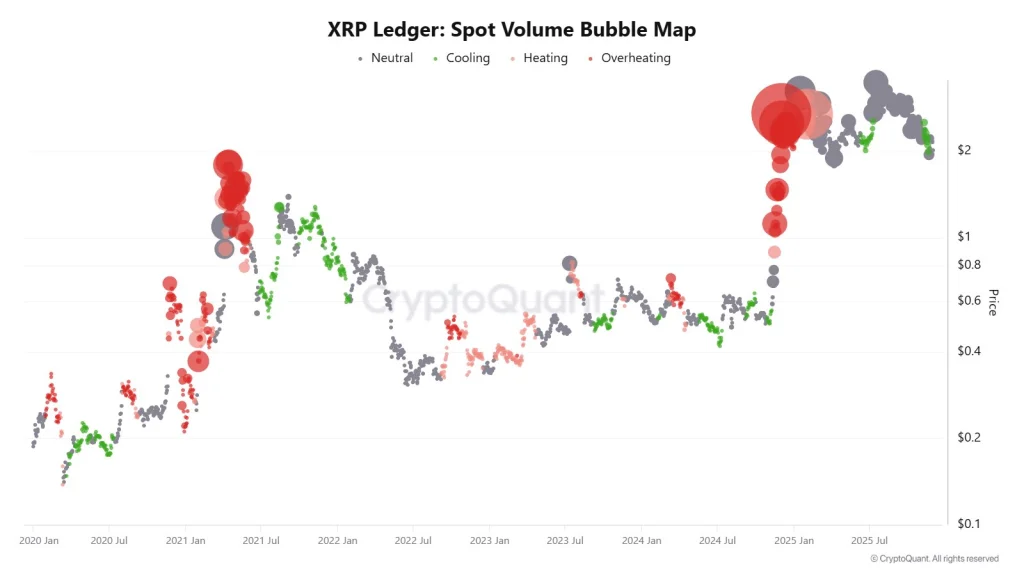

XRP Shows Cooling Phase, Setting Up Potential Fund Inflows

The latest XRP spot volume bubble map indicates a cooling phase, often seen when an asset is oversold and near bottom levels. Despite the temporary slowdown, XRP ETFs are being continuously listed, boosting global liquidity. With more ETFs coming online, new institutional and retail fund inflows are expected. Analysts suggest this cooling phase may be short-lived, positioning XRP for a potential upswing as demand picks up and the market absorbs fresh capital.

December 3, 2025 06:19:58 UTC

Bitcoin Price Prediction Ahead of FOMC Event

Markets are shaping a bullish narrative heading into December 10th, with the next key pivot on the 4th. Analysts note two scenarios: if prices rise into the 4th, a short-term reversal downward may follow; if prices drop, upward momentum could continue. Historically, after FOMC rate cut announcements, markets have fallen 5–8% in the following days, often followed by a rally. Traders are watching closely, as the pattern could repeat—or shift depending on market moves into the FOMC.

December 3, 2025 06:16:47 UTC

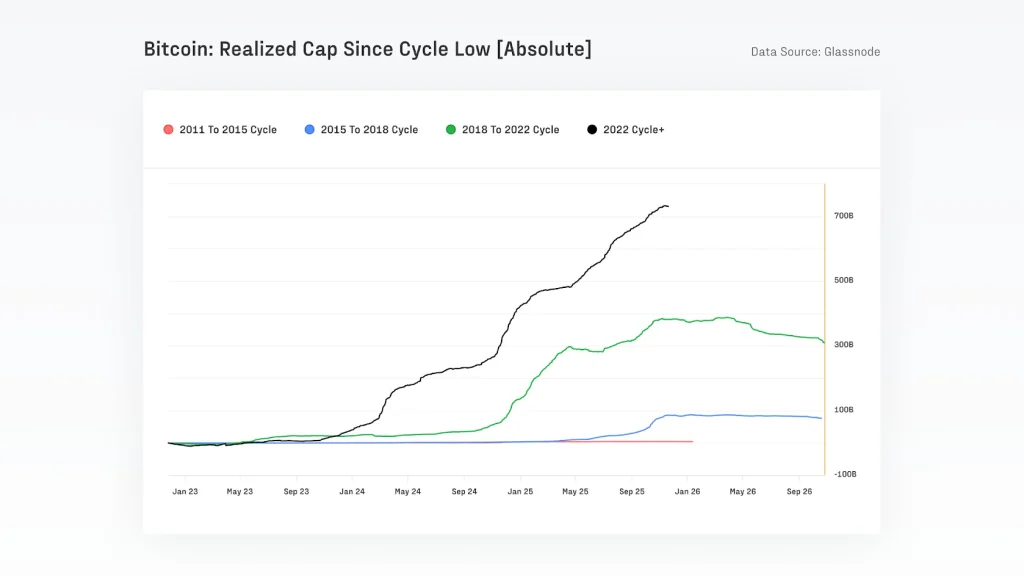

Bitcoin Gains $732B as Market Turns Calmer and More Institutional

Bitcoin has attracted $732 billion in new capital this cycle, while its one-year realized volatility has nearly halved. The market is now trading in a calmer, larger, and more institutionalized environment. Fasanara Digital’s Q4 Digital Assets Report highlights these structural shifts, showing how Bitcoin’s evolution is changing market dynamics. The data suggests that as volatility declines, institutional participation increases, pointing to a more mature crypto ecosystem shaping the next phase of digital asset growth.

December 3, 2025 06:15:36 UTC

Crypto Interest Drops, But Bears Can Be an Opportunity for Speculators

Google search data shows declining interest in the crypto market, including exchanges and trackers like CoinMarketCap and CoinGecko. Historically, low social engagement has aligned with bear markets, reflecting cautious sentiment. Yet, ironically, these quieter periods have often offered the best chances for speculation, as fewer participants mean opportunities for those willing to take calculated risks. For savvy traders, market lull can be a time to position ahead of the next potential rally.

December 3, 2025 06:12:15 UTC

Zcash Price Faces Pullback After Peak Hype

Analyst Van de Poppe notes that ZEC hasn’t delivered upward returns lately. During its peak, hype around ZEC drove prices up, but long liquidity was taken out, causing a sharp drop. According to him, this phase of liquidation is now complete, creating the potential for a bounce from current levels. However, he cautions that this doesn’t signal a full trend reversal yet—investors should view it as a short-term recovery opportunity rather than a sustained uptrend.

December 3, 2025 06:12:15 UTC

Why is Bitcoin Price Surging Today?

Eric Balchunas highlights the “Vanguard Effect” as Bitcoin jumped 6% right around the U.S. market open, the first day after Vanguard lifted its Bitcoin ETF ban. The move sparked $1 billion in BlackRock’s IBIT ETF volume in just 30 minutes. Even traditionally conservative Vanguard investors are now adding crypto exposure, showing that demand for regulated ETFs is strong. The shift marks a major catalyst for institutional and retail participation in Bitcoin.

December 3, 2025 05:42:49 UTC

Why Vanguard’s Crypto Move Is a Major Market Catalyst

Vanguard’s decision to allow spot crypto ETF trading could reshape the market. Even a tiny share of its $11 trillion assets flowing into Bitcoin and crypto ETFs would exceed inflows from the entire 2024 ETF cycle. Crypto ETFs are now proven, with BlackRock’s IBIT hitting $80B+, Ethereum ETFs growing fast, and new XRP and SOL ETFs launching. With improved regulation and wider access across banks and brokers, Vanguard’s entry signals deeper institutional adoption and a powerful new demand wave.

December 3, 2025 05:41:52 UTC

Vanguard Opens $11 Trillion Platform to Crypto ETFs

Vanguard, which manages $11 trillion for over 50 million investors, has officially reversed its anti-crypto stance. Starting today, clients can trade Bitcoin, Ethereum, XRP, and Solana spot ETFs from BlackRock, Fidelity, Grayscale, VanEck, and Bitwise. The shift follows the arrival of new CEO Salim Ramji, who helped launch BlackRock’s IBIT ETF. With even a small 0.5% portfolio allocation, Vanguard could send over $55 billion into crypto ETFs—creating one of the biggest institutional catalysts yet.

December 3, 2025 05:39:01 UTC

Ripple Teams Up With OpenEden to Tap Into Tokenized Treasuries

Ripple has entered the tokenized U.S. Treasury market through a new partnership with OpenEden, marking a big step toward bringing real-world assets on-chain. The move connects XRP’s ecosystem to one of the fastest-growing areas in crypto, giving users access to yield-backed Treasury products. With real-world assets expected to grow into a multi-trillion-dollar market, Ripple’s push positions XRP for deeper institutional use and stronger long-term demand.

December 3, 2025 05:38:00 UTC

BTC Break Above $93K Could Trigger Major Short Squeeze

Glassnode reports that if Bitcoin climbs past the $93,000 level, it could set off significant liquidations of short positions. Such a short squeeze may give BTC strong upward momentum, potentially pushing the price higher in a fast move. The $93K mark is now seen as a key resistance level for the market.

December 3, 2025 05:36:33 UTC

Bitcoin Price Today Rebounds to $92K

Bitcoin is recovering strongly after its brief dip on the 1st of this month, showing renewed bullish momentum. Traders are watching the $92,000 level closely — a breakout above this zone could trigger a push toward a new all-time high and potentially a test of $100K. With BTC climbing again and market sentiment improving, it’s shaping up to be a strong day across the crypto market.

December 3, 2025 05:35:05 UTC

Bitcoin Price Eyes $93K Again as Short Liquidations Build Up

Bitcoin was rejected at the $93,000 level last week, but as it makes another attempt to break through today, large clusters of short liquidations are forming. These liquidations can act as fuel for an upside move, as forced buying adds extra momentum to the rally. If BTC clears $93K this time, the squeeze could push the price sharply higher.

December 3, 2025 05:15:46 UTC

Bitcoin Jumps 6% as Vanguard Opens Doors to BTC ETFs

Bitcoin surged nearly 6% right after the U.S. market opened, and the reason is clear. Vanguard lifted its ban on Bitcoin ETFs, allowing its clients to access them again. This triggered fresh institutional inflows, mainly through BlackRock’s IBIT ETF. Within just two hours, IBIT recorded over $1.8 billion in trading volume. The move shows strong renewed demand from big investors, helping push BTC higher.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author's own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.