November 27, 2025 12:54:00 UTC

Tether’s Massive Gold Bet Outshines Global Central Banks

Tether shocked markets in Q3 2025 by buying nearly 26 tonnes of gold—more than any central bank that quarter, including Kazakhstan and Brazil. The purchase reflects Tether’s growing role as a crypto-native “mini central bank,” using gold to hedge against inflation, geopolitical risk, and overreliance on the dollar. The move also strengthens backing for its gold-pegged token, XAUt, showing how stablecoin issuers are increasingly adopting traditional reserve strategies.

November 27, 2025 12:33:26 UTC

Bhutan Begins Staking Ethereum Through Figment

Bhutan’s Royal Government has officially begun staking Ethereum, sending 320 ETH—worth roughly $920,000—to an ETH 2.0 staking validator operated by Figment. The move signals Bhutan’s deeper entry into digital asset infrastructure, following earlier reports of the nation’s growing crypto mining and investment activity. By staking ETH, Bhutan aims to earn consistent validator rewards while strengthening its long-term position in the Ethereum ecosystem.

November 27, 2025 12:06:44 UTC

Dormant Whale Returns: 200 BTC Sold for $18M After 223% Gain

A long-dormant Bitcoin whale, address 1CA98y, has resurfaced after nearly three years, selling 200 BTC worth $18.35 million. The whale originally withdrew 400 BTC from OKX on April 1, 2023, when Bitcoin traded at $28,432, totaling $11.37 million. With BTC now significantly higher, the holder’s realized profit exceeds $25 million, marking a 223% gain. The move highlights renewed whale activity during the current market cycle, raising questions about potential profit-taking and short-term price volatility.

November 27, 2025 11:40:16 UTC

Bitcoin Eyes $100K as Liquidity Builds Above Current Price

Most of Bitcoin’s liquidity remains stacked to the upside, signaling that higher prices are still the path of least resistance. Some liquidity is forming around the $85,000–$86,000 zone, but the key trigger lies higher. If BTC can reclaim the $93,000–$94,000 range, momentum could accelerate quickly, opening the door for a $100,000 Bitcoin before any meaningful downside. With liquidity pockets and market structure favoring upward continuation, bulls may get another major breakout if price regains that critical zone.

November 27, 2025 11:38:26 UTC

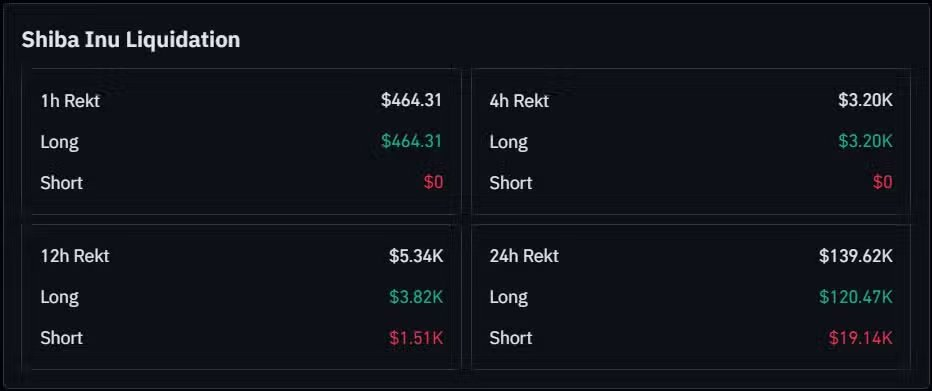

Shiba Inu Longs Take the Hit as Liquidations Cool, Hinting at Market Stabilization

Shiba Inu’s latest liquidation data shows that over-leveraged longs absorbed most of the damage, with $139.6K liquidated in 24 hours—about $120.5K from longs and only $19.1K from shorts. Short-term windows show fading pressure, with minimal liquidations in the past 12, 4, and 1 hours, all hitting long traders. After such long-heavy flushes, markets often transition into consolidation or a relief bounce. With liquidation spikes cooling and shorts barely

November 27, 2025 11:30:18 UTC

Binance Dominates Market Flows as Exchange Shows Strength in Correction

Binance is displaying exceptional strength during the latest market correction, supported by fresh data from CryptoQuant. The exchange leads all CEXs with $25B in spot volume and $62B in futures, far surpassing competitors. Around one-third of all BTC and ETH flows $15B of $40B moved through Binance, outpacing Coinbase’s $11B. Stablecoin reserves reached a massive $51.1B, boosted by $60B in October inflows and $29B in November. With an $8.9B stablecoin surge in 30 days, Binance continues to strengthen its market dominance.

November 27, 2025 11:14:34 UTC

Bitcoin News Today, BTC Price Eyes $98K Target

Bitcoin has officially filled the fair value gap (FVG) and tapped the bearish order block, exactly as earlier mapped out, triggering a clean long move from the $81–$85K zone. The next major FVG sits at $96,800–$98,000, a high-level imbalance that could offer a low-risk short setup. Macro expectations still point to Bitcoin tagging $98K before any meaningful correction. The bearish outlook becomes invalid if BTC records a higher-timeframe close above $107,550, which would signal a new ATH-driven bullish phase.

November 27, 2025 07:22:28 UTC

World Liberty Financial Buys $7.7M in WLFI Tokens Amid Buyback Program

World Liberty Financial continued its buyback strategy by purchasing $7.7 million worth of WLFI tokens at an average price of $0.16 per token. The program uses 100% of treasury liquidity fees for token repurchases, reinforcing value for holders and supporting the token’s market price. This latest acquisition underscores the company’s commitment to strengthening WLFI liquidity and signals confidence in the token’s long-term potential, as buybacks remain a key tool for sustaining market stability and investor trust.

November 27, 2025 07:09:10 UTC

Grayscale and Franklin Templeton’s XRP ETFs See $130M Inflows on Debut

Grayscale and Franklin Templeton’s XRP ETFs made a strong debut on NYSE Arca, collectively attracting over $130 million in net inflows. Grayscale’s GXRP raised $67.4 million, while Franklin Templeton’s XRPZ pulled in $62.6 million, according to SoSoValue. The strong initial demand highlights growing investor interest in XRP exposure through regulated products, outperforming other crypto ETFs on their first trading day. Analysts see this as a positive signal for XRP adoption and institutional participation in the crypto market.

November 27, 2025 06:35:46 UTC

Ripple USD (RLUSD) Gets Regulatory Green Light in Abu Dhabi

Ripple announced that its USD-backed stablecoin, Ripple USD (RLUSD) has been recognized as an Accepted Fiat-Referenced Token by Abu Dhabi’s Financial Services Regulatory Authority (FSRA). This approval allows RLUSD to be used within the Abu Dhabi Global Market (ADGM), the UAE’s international financial center. The move marks a significant step for Ripple, expanding its stablecoin’s regulatory compliance and usability in a major global financial hub, supporting adoption among businesses and investors in the UAE and beyond.

November 27, 2025 06:27:25 UTC

Ethereum ETFs Lead Inflows as Crypto Spot Funds Show Mixed Trends

On November 26, Ethereum spot ETFs recorded a net inflow of $60.82 million, extending a four-day streak of gains. Bitcoin spot ETFs saw $21.12 million in inflows, though Fidelity’s FBTC posted a slight outflow. XRP spot ETFs attracted $21.81 million, signaling growing investor interest, while Solana ETFs faced a net outflow of $8.1 million. The data reflects continued appetite for Ethereum and XRP exposure, even as other crypto ETFs experience selective profit-taking and cautious market positioning.

November 27, 2025 06:22:38 UTC

Tether Exits Uruguay, Lays Off 30 Employees Amid Rising Costs

Tether is halting operations in Uruguay and laying off 30 employees, citing high energy costs and an uncompetitive tariff framework, according to El Observador. The stablecoin company had initially planned a $500 million investment in the country but completed just over $100 million before deciding to fully exit. Tether’s withdrawal highlights challenges crypto firms face in regions with high operational costs and regulatory hurdles, marking a significant retreat from its planned expansion in Latin America.

November 27, 2025 06:08:22 UTC

SpaceX Moves Another 1,163 BTC — $105M Transfer Sparks Market Buzz

SpaceX has transferred 1,163 BTC worth roughly $105.23 million, with on-chain data suggesting the funds were moved to Coinbase Prime, likely for custody. This follows a series of large Bitcoin transactions linked to SpaceX, adding to speculation about the company’s treasury management and long-term BTC strategy. While the move doesn’t confirm selling pressure, any major transfer to an exchange-linked custodian naturally draws attention in a sensitive market.

November 27, 2025 05:44:32 UTC

Kaspa Soars 37% as Whale Adds 10M KAS, Supply Tightens

Kaspa surged 37% to $0.058, marking a strong return to the top 50 as whale accumulation intensified. The largest wallet added over 10 million KAS in a single day, pushing its holdings above 1.2 billion tokens, roughly 4–5% of the circulating supply. With low sell-side liquidity on exchanges and nearly half the supply idle for six months, even moderate buying fueled the sharp rally. While optimism grows around tight supply and heavy accumulation, Kaspa’s history, including a 70% crash from its 2024 peak, shows volatility remains a key risk.

November 27, 2025 05:42:23 UTC

SPX6900 Explodes 18.88% as Memecoin Mania Fuels Breakout Above $0.60

SPX Price surged 18.88% in the last 24 hours, defying a broader market pullback as strong inflows into the $42B memecoin sector pushed price decisively above the $0.60 resistance. Bullish MACD and RSI indicators support the breakout, while rising holder activity across Base and other chains strengthens momentum. However, thin liquidity below $0.52–$0.48 signals elevated pullback risk if volume cools. The key test now is whether SPX can hold above $0.60, or if traders begin locking in profits.

November 27, 2025 05:37:59 UTC

Bitcoin Price Eyes $90K but Momentum Still Missing in High-Risk Market

Bitcoin is pushing toward the $90K level, but the market still sits in a high-risk environment with momentum yet to ignite. For a true bullish shift, BTC needs its first close inside the $89K–$90K zone, followed by consolidation and an extension toward $91.5K, eventually breaking through the $93.5K–$95K compression band. During this climb, the Risk-Off Signal must drop into a low-risk regime to show real buyer strength. Without rising momentum, every move higher remains tactical rather than a structural market recovery.

November 27, 2025 05:31:32 UTC

Bitcoin Price Today Sees Recovery Signals

The crypto market is finally stabilizing as Bitcoin defends a key support zone following a clean liquidity sweep. BTC has moved back into the mid-range of its rising channel, hinting at early recovery across market structure, dominance, and momentum. Sentiment has shifted from extreme fear to a more constructive tone, but true confirmation depends on Bitcoin forming a higher low in the coming days. The setup is improving, yet the next reaction at resistance will determine whether this bounce turns into a real trend reversal.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author's own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.

![Why Is the Crypto Market Up Today [Live Updates] March 5, 2026](https://image.coinpedia.org/wp-content/uploads/2026/03/05131243/Why-Is-the-Crypto-Market-Up-Today-Live-Updates-March-5-2026-2-390x220.webp)