Asia lights the first spark for Bitcoin, but U.S. institutions decide lasting direction.

Korea Premium Index shows Asian demand patterns, with spikes signaling short-term overheating and caution.

Coinbase Prime outflows reveal strong U.S. institutional accumulation, shaping Bitcoin’s long-term upward momentum.

Despite regional battles, Bitcoin remains dominant hedge against inflation, with $200K target by 2025.

Bitcoin’s recent price moves are not just about supply and demand, it’s about where the real buying power is coming from. On-chain data shared by CryptoQuant shows Asia often sparks the first push, while U.S. institutions decide whether that momentum lasts.

Add to this the growing influence of spot ETFs in America and Hong Kong, and the stage is set for a decisive shift in Bitcoin’s direction.

Asia Sparks the First Moves

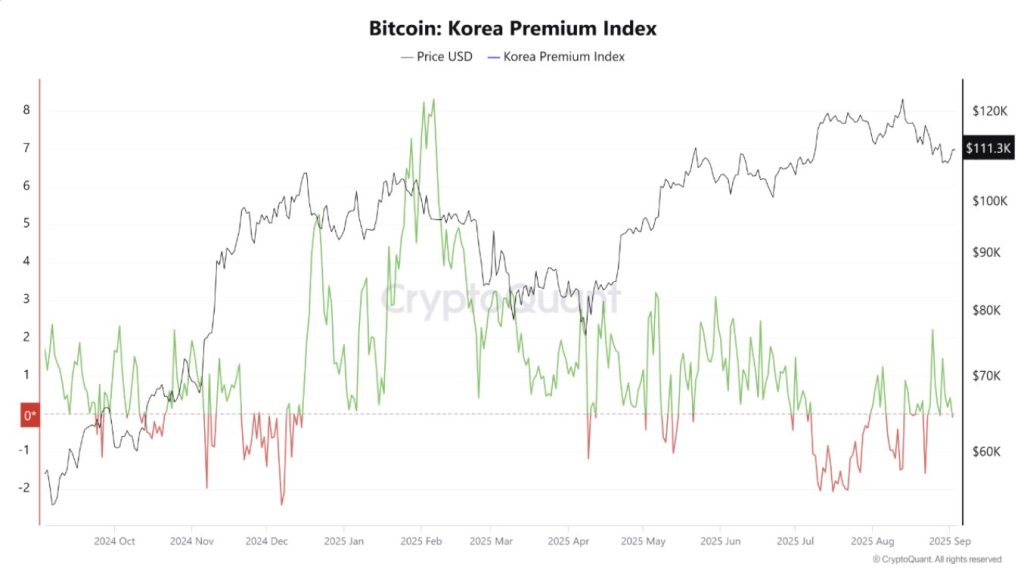

According to CryptoQuant, Asian traders continue to play a critical role in Bitcoin’s short-term swings. However, the Korea Premium Index, often called the “Kimchi Premium,” highlights how local buyers sometimes pay higher prices than the global average.

When this index sits between +1% and +3%, demand looks solid, considering healthy levels. But when it spikes above +5%, it often suggests overheating and short-term tops.

Recent trends show that Korean traders still drive early surges, proving that Asia plays the role of lighting the spark.

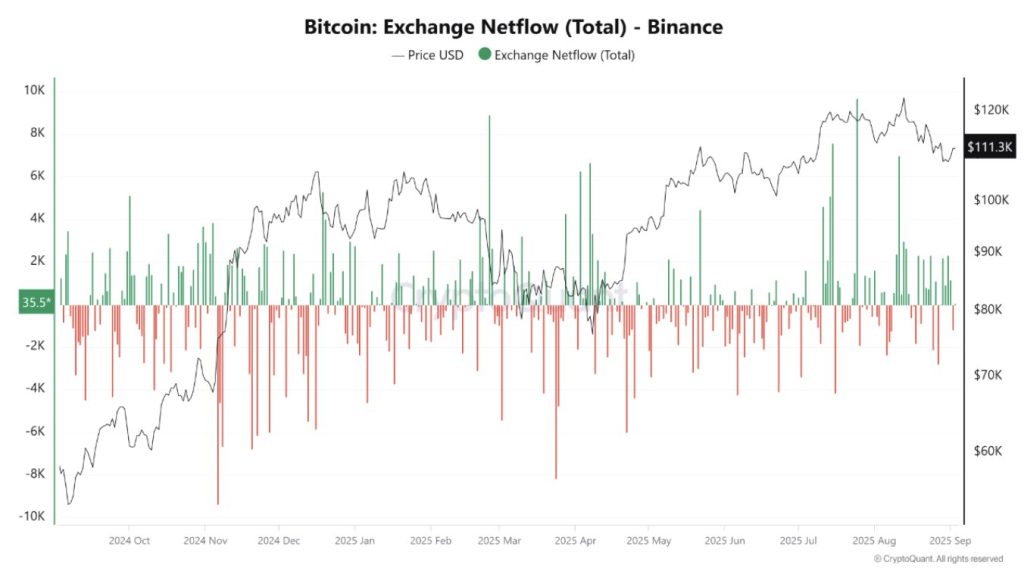

Meanwhile, Binance netflows show retail sentiment across Asia. Inflows often mean selling, while outflows suggest dip-buying. Asian traders frequently set the pace for Bitcoin’s daily moves.

U.S. Institutions Shape the Trend

On the other side of the world, U.S. institutions remain the real decision-makers. Outflows from Coinbase Prime typically signal large investors moving Bitcoin into custody, a sign of long-term accumulation.

The Coinbase Premium Index, which compares Coinbase and Binance prices, further shows when U.S. demand dominates. When this index is positive, Bitcoin rallies tend to hold.

Meanwhile, Binance netflows reflect broader Asian retail activity. Heavy inflows here usually hint at upcoming sell pressure, while strong outflows show dip-buying appetite. The latest data reveals sharp swings, reminding us that retail traders add volatility to the mix.

U.S. Bitcoin ETF Influence

Beyond exchange data, the spotlight is firmly on spot Bitcoin ETFs in the U.S. In Q3 2025 alone, they’ve attracted a staggering $118 billion in inflows, with BlackRock’s IBIT dominating about 89% of the market.

These ETFs now hold roughly 1.29 million BTC, or about 7% of the total Bitcoin supply, giving them serious influence. Daily ETF trading volumes even rival, and sometimes beat, major exchanges

Hong Kong Enters the ETF Race

Hong Kong isn’t staying on the sidelines. It launched its first spot Bitcoin ETFs through asset managers like Bosera, Harvest, and ChinaAMC. While initial trading volume was modest, around $12.7 million on debut, it highlights growing Asian interest in regulated crypto investment tools

Bitcoin’s Unstoppable Journey

No matter who takes the driver’s seat, Asia or the U.S, it’s Bitcoin that keeps proving its dominance. Seen as a hedge against inflation and backed by major players, experts predict Bitcoin could climb to $200,000 by the end of 2025.

As of now, it trades around $110,871, reflecting a slight drop in the last 24 hours, but the long-term story remains firmly bullish.

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

FAQs

U.S. institutions provide sustained momentum; positive Coinbase Premium Index signals and ETF inflows show long-term accumulation that validates rallies.

It’s a metric showing when Korean traders pay a premium over the global Bitcoin price. A reading above +5% can signal overheating and a local top.

Extremely significant. U.S. spot Bitcoin ETFs hold ~7% of total supply, with massive inflows giving them major influence over Bitcoin’s price direction.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author's own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.