Veteran trader Wealthmanagerrr warns of a looming market correction, selling most holdings for safety.

U.S. margin debt hits record $1.1 trillion, surpassing levels seen before previous crashes.

Trader holds only Bitcoin and Ethereum long term, shifting rest into stablecoins amid fear.

The recent surge in both stock and crypto markets has left many traders optimistic. But not everyone shares that confidence. A veteran trader, Wealthmanagerrr, has sparked debate on X after revealing he has sold most of his positions, warning markets could face a sharp correction in the coming months.

And his concern isn’t just a gut feeling, the data backs his claim.

Rising Margin Debt Raises Red Flags

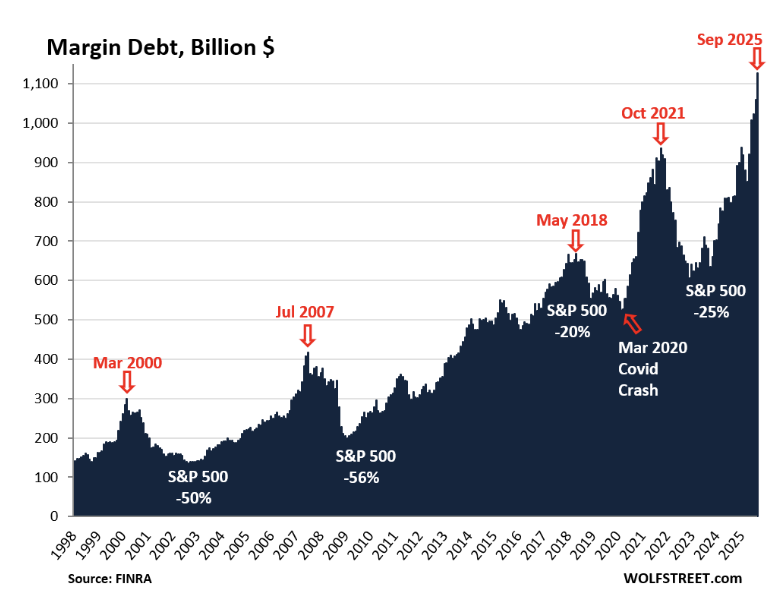

According to new data from FINRA, U.S. margin debt has jumped above $1.1 trillion, the highest ever recorded. This even beats the levels seen before the big market crashes in 2000, 2008, and 2021.

This means many investors are borrowing large amounts of money to buy more stocks and crypto, hoping for bigger profits. But history shows that such excitement often ends badly. When prices start falling, those same investors are forced to sell to cover their loans, which causes prices to drop even faster.

The trader warned that this heavy use of debt could set off a “chain reaction” if market confidence suddenly disappears.

Past Crashes Hint at a 25% Market Fall

However, the warning isn’t without reason. In 2000, when margin debt hit its previous peak, the S&P 500 fell by nearly 50%. In 2008, it dropped 56%. Even in 2021, high leverage led to a 25% correction.

Each time, over-leverage played a major role.

Now, with margin debt higher than ever and inflation creeping up again, the setup feels almost familiar.

On top of it, Fed Chair Jerome Powell’s recent comment that another rate cut in December isn’t “a foregone conclusion” only added pressure, strengthening the dollar and cooling investor sentiment just as markets appear stretched once more.

Stocks and Crypto Could Be Next

While many retail investors continue to “buy the dip,” the trader has taken the opposite route. He’s exited most of his positions, holding only Bitcoin and Ethereum for the long term, and moving the rest into stablecoins.

He expects a major correction within the next 3–9 months, affecting both the stock and crypto markets.

With the cost of living climbing again and borrowing costs still high, he believes markets are “highly overextended” and due for a major.

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

FAQs

Margin debt is money investors borrow to buy stocks/crypto. It just hit a record $1.1 trillion—higher than 2000, 2008, or 2021 peaks. History says crashes follow.

Past peaks saw the S&P 500 fall 25–56%. With today’s record leverage, a 25% correction in the next 3–9 months is realistic if sentiment flips.

No need to panic-sell, but trim leveraged positions, keep 3–6 months cash, and hold only core Bitcoin/Ether if you’re long-term bullish.

Watch margin debt shrink two months in a row—that’s when forced selling snowballs. Set a Google alert for “FINRA margin debt” and act fast.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author's own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.