US government shutdown creates data blackout, boosting Bitcoin and altcoins as traders seek safe havens.

Justin Wu sees regulatory pauses, liquidity boosts, and safe-haven demand favoring crypto rallies.

Crypto analyst CryptoJelle predicts market peak around October 27, 2025, if history repeats itself.

The U.S. government has entered its first shutdown in almost seven years, raising worries for thousands of workers without pay, weaker spending, and leaving investors uncertain about what comes next.

But according to a leading DeFi marketer and community strategist, Justin Wu, this latest crisis may not be as bearish as it looks, but actually setting the stage for one of the strongest rallies in Bitcoin and altcoins in the months ahead.

Data Blackout Boosts Crypto Demand

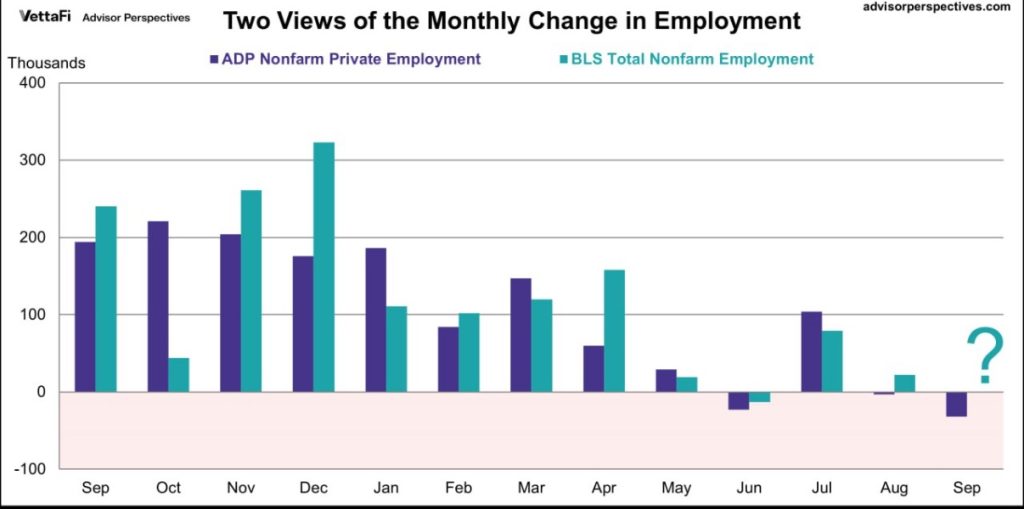

One key impact of the shutdown is the sudden “data blackout.” When Washington shuts down, crucial economic indicators like jobs data, payroll numbers, and inflation updates stop rolling out.

With no fresh numbers, traders must rely on what’s already known, cooling inflation, the labor market is showing weakness, and the chances of a Federal Reserve rate cut are 100% sure.

This backdrop is pushing Bitcoin higher as a safe hedge, with prices above $120,000. Meanwhile, altcoins like Ethereum, XRP, and Solana are also gaining, while the total crypto market cap rose 1.14% in just 24 hours.

- Also Read :

- U.S. Government Shutdown Could Last Beyond October 15

- ,

Why Crypto Could Rally – Wu’s Take

Justin Wu sees several reasons why the shutdown may boost crypto:

- Regulatory Pause: SEC and CFTC delays on crypto rules and ETF approvals create a favorable window for decentralized assets.

- Liquidity Boost: With key economic data stalled, the Fed may keep cutting rates, lowering yields, and weakening the dollar.

- Safe-Haven Demand: Fiscal gridlock and inflation push investors toward Bitcoin and gold.

Wu notes that when the “old playbook breaks,” digital assets often perform well. In past shutdowns, equities faltered, but Bitcoin gained as investors for protection and profit.

History Supports a Bullish Case

Wu says shutdowns cause short-term noise, but markets often rally once data returns. With Bitcoin trading strongly, PCE inflation at 2.7%, and the Fed likely to ease, conditions favor a breakout.

Early ETF inflows and robust October seasonality also support Wu’s thesis, with Q4 regularly delivering double-digit returns in nearly every Bitcoin bull cycle since 2011.

Coinpedia recently reported that crypto analyst CryptoJelle expects the crypto market to peak on October 27. He said that in the past two cycles, Bitcoin took exactly 1,064 days to go from the bottom to the top.

If history repeats, the current cycle could also reach its peak around October 27, 2025.

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

FAQs

A shutdown can boost crypto by creating a “data blackout,” pausing harsh regulations, and pushing the Fed to cut rates, which increases liquidity and safe-haven demand for assets like Bitcoin.

Yes, historically, fiscal gridlock and economic uncertainty have been catalysts for crypto. Paused regulations and potential Fed rate cuts can create a perfect storm for a significant market uptrend.

It’s when federal agencies halt the release of key economic data like inflation and jobs reports. This leaves traders in the dark, often increasing market volatility and demand for alternative assets.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author's own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.