UAE mined over $453 million Bitcoin through Citadel Mining operations in Abu Dhabi facilities.

Arkham tracked 37 wallets showing UAE holding Bitcoin without major outflows recently for months.

UAE earned estimated $344 million profit from Bitcoin mining excluding operational and energy costs.

The United Arab Emirates has quietly built a massive Bitcoin reserve worth over $453 million through its Royal family mining operation. The holdings, linked to Citadel Mining, highlight the country’s growing long-term commitment to Bitcoin as a strategic digital asset.

UAE Quietly Built $453M Bitcoin Stack

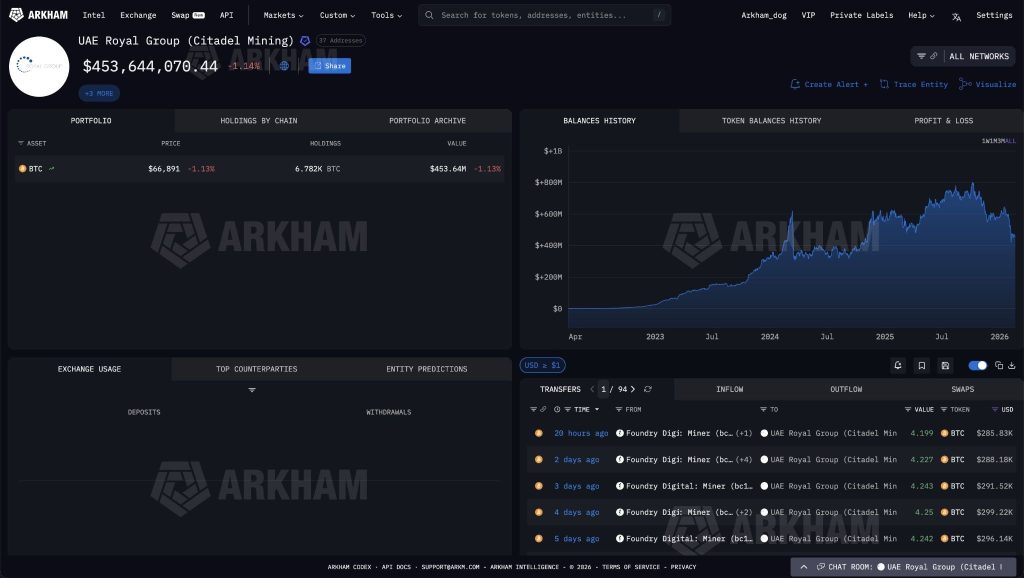

Blockchain analytics firm Arkham Intelligence tracked 37 crypto wallets connected to Citadel Mining, an operation tied to Abu Dhabi’s Royal Group through its investment arm.

These wallets currently hold around 6,782 BTC, valued at approximately $453.6 million. The data shows that most of this BTC was generated through bitcoin mining rather than buying from exchanges.

Arkham estimates that the UAE is already sitting on profits of around $344 million from its Bitcoin mining operations, excluding energy and operational costs.

More importantly, the UAE has not made any major Bitcoin outflows in the past four months, signaling a clear long-term holding strategy.

UAE Expands Bitcoin Mining With Large Industrial Infrastructure

The UAE’s Bitcoin mining expansion began in 2022, when Citadel Mining launched large-scale operations in Abu Dhabi.

The country strengthened its position further in 2023 through a major partnership between Marathon Digital and Zero Two, an Abu Dhabi-based company.

This partnership focused on developing large immersion-cooled mining facilities with a total capacity of 250 megawatts. These advanced facilities allow efficient Bitcoin mining while reducing operational costs.

By producing Bitcoin domestically, the UAE avoids relying on external markets and gains direct exposure to Bitcoin’s long-term value growth. This move highlights a bigger global shift. Governments are no longer ignoring Bitcoin.

UAE Emerges as One of the Largest State Bitcoin Holders

Based on current data, the UAE now ranks 6th among the top sovereign-linked Bitcoin holders globally. Its holdings are larger than El Salvador’s national Bitcoin reserves and place it among countries actively building strategic crypto positions.

Unlike traders who sell quickly, the UAE is showing a clear long-term strategy. By mining and holding Bitcoin, the country is treating it more like digital gold rather than a short-term trade.

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

FAQs

No, the UAE hasn’t made major Bitcoin outflows in months, signaling a long-term holding strategy.

Most of the UAE’s Bitcoin comes from domestic mining rather than buying on exchanges, boosting long-term strategic reserves.

Large-scale mining lets the UAE produce Bitcoin efficiently, cut costs, and gain direct exposure to its long-term value.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author's own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.