WLFI made significant cryptocurrency purchases (ETH, LINK, AAVE), significantly impacting their prices.

Justin Sun invested $30 million in WLFI and joined as an advisor, boosting the project's credibility.

WLFI holds a substantial cryptocurrency portfolio and is considered a major player in the DeFi space.

World Liberty Finance (WLFI), a DeFi project publicly supported by U.S. President-elect Donald Trump, is making waves once again. Known for its bold strategies and market-shaking moves, WLFI has grabbed headlines with massive purchases of Ethereum (ETH), Chainlink (LINK), and AAVE. These strategic buys triggered price surges across the crypto market, leaving analysts and traders buzzing.

Let’s dive into WLFI’s latest actions to uncover the bigger picture.

Ethereum’s Big Day

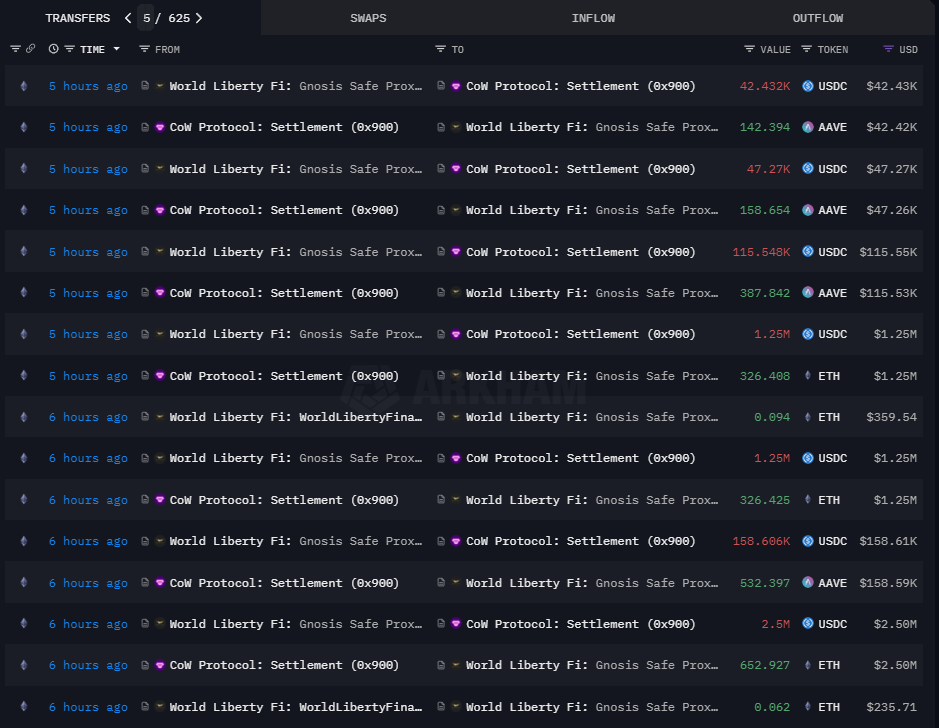

WLFI spent $10 million in USD Coin (USDC) to acquire 2,631 ETH tokens, with Ethereum trading at an average price of $3,801 per token at the time. This large purchase had an immediate impact, causing ETH’s price to jump by 2.36%. By the end of the day, the token’s value had surged 6.86%, showcasing how a single major transaction can shake up the market.

But that wasn’t all. WLFI’s move boosted investor confidence, proving how much influence this DeFi project has on the crypto scene.

Chainlink Rockets 20% After WLFI Purchase

WLFI’s buying spree didn’t stop with Ethereum. The project invested $1 million USDC to purchase 41,335 Chainlink (LINK) tokens at an average price of $24.20 each. The effect was dramatic: within 24 hours, LINK’s price surged 20.56%, climbing to $26.72. Such a significant rise highlights the volatility and responsiveness of the crypto market.

AAVE didn’t miss out either. WLFI spent $1 million on 3,357 AAVE tokens at $297 each. While the market impact wasn’t as dramatic as with LINK, it still cemented WLFI’s role as a heavy hitter in the DeFi space.

Justin Sun Joins the Party

Adding to the excitement, Justin Sun, founder of Tron, announced a $30 million investment in WLFI. This makes him the project’s largest investor. He’s also taken on an advisory role, bringing his years of blockchain experience to the table.

WLFI’s Expanding Crypto Reserves

WLFI’s wallet now holds $74.36 million in cryptocurrencies, including 14,570 ETH and nearly 103 wrapped Bitcoin (wBTC). These substantial reserves highlight the project’s long-term commitment to growth and its increasing influence in the DeFi market.

Justin Sun’s involvement and Trump’s backing give the project significant momentum. However, as with any crypto venture, the market remains unpredictable. Investors and enthusiasts will be watching closely to see what WLFI does next.