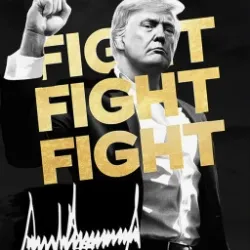

$TRUMP Coin Listed in Record Time – Did Crypto Exchanges Put Investors at Risk?

-

TRUMP $ 7.54 (-4.02%)

TRUMP $ 7.54 (-4.02%)

Top crypto exchanges listed Trump’s $TRUMP coin within days, bypassing their usual review timelines.

Despite 80% of the supply being controlled by insiders, exchanges moved fast amid massive demand.

The token’s crash caused $4.3B in retail losses, while a few wallets and exchanges made millions.

When Donald Trump launched his own meme coin, crypto exchanges didn’t wait. They listed it within hours – something that rarely happens, especially for high-risk tokens.

The coin, simply called $TRUMP, was listed by eight of the top ten crypto exchanges within 48 hours of launch. Coinbase, which normally takes weeks or even months to approve tokens, moved in just one day.

For comparison, it took these same exchanges an average of 129 days to list other popular meme coins like Pepe, Bonk, and dogwifhat.

Why Did Trump’s Memecoin Get Listed So Fast?

Exchanges like Bitget, OKX, MEXC, and Coinbase said they didn’t skip any steps. They claimed the listings were fast because of strong user demand.

“The crypto space was buzzing with the hype,” said Bitget CEO Gracy Chen, adding that since Trump himself announced the token, “that should kind of solve the compliance issue.”

Coinbase’s legal head Paul Grewal said teams worked through the weekend to complete the listing, but “no steps were skipped.”

But there were clear warning signs that are usually taken seriously starting with who controls the coin.

80% of the Coin Was in Trump’s Hands

At launch, Trump and his partners controlled 80% of the total supply. In crypto, this level of control is a red flag. It means a small group can dump large amounts of tokens, crashing the price while retail investors are still buying in.

That’s exactly what happened.

The coin hit $75.35 just two days after launch. Then it collapsed to around $9.55, leaving most holders with losses.

According to data analyzed by Bubblemaps:

- 45 wallets made $1.2 billion in profits

- 712,777 wallets lost a combined $4.3 billion

- Around half a million wallets made small gains

Yet the coin stayed live, and the exchanges made millions in trading fees.

Trump’s Influence Changed the Rules

After Trump won the 2024 election, the crypto environment shifted fast. The SEC dropped or paused major cases, including one tied to a Trump family project. Soon after, meme coins were no longer treated as securities.

That gave exchanges more room to move and they did.

“You don’t say no to hosting the president’s new meme coin,” said Corey Frayer, a former senior SEC advisor.

Trump’s coin reportedly brought in $320 million for his entities. The 10 exchanges made over $172 million in trading fees.

The Bigger Concern: Investor Safety

Coinbase restricted New York users from trading the token, likely to avoid stricter local rules. But most platforms moved ahead, despite public warnings.

A day before the coin’s launch, New York regulators warned that meme coins often involve price manipulation and insider profits especially when supply is controlled by a few wallets.

Bitget’s CEO admitted the concentration was “very risky,” but said strong demand outweighed that concern.

What This Means for Crypto

This meme coin listing showed how fast the rules can bend when political power and profit align.

As Seoyoung Kim, a crypto finance professor, put it: fast listings may look efficient, but don’t always protect investors. And in this case, they didn’t.

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

FAQs

Crypto exchanges, including Coinbase, listed $TRUMP within hours, citing “strong user demand” and claiming no steps were skipped. The direct announcement by Trump himself was also seen as alleviating some compliance concerns.

After Trump won the 2024 election, the crypto regulatory environment shifted, with the SEC pausing or dropping major cases and meme coins no longer being treated as securities. This gave exchanges more leeway, with one former SEC advisor noting, “You don’t say no to hosting the president’s new meme coin.”

The rapid listing of $TRUMP, despite clear risks like concentrated supply and potential manipulation, highlights how rules can bend when political power aligns with profit. Critics, including New York regulators and crypto professors, emphasize that this does not always protect investors.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author's own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.