Tom Lee Says “Investors Are Still Early” as Bitcoin and Ethereum Enter Super-Cycle

-

BTC $ 68,931.18 (3.61%)

BTC $ 68,931.18 (3.61%) -

ETH $ 2,029.32 (3.43%)

ETH $ 2,029.32 (3.43%)

Bitcoin nears key resistance as supply on exchanges hits multi-year lows, setting the stage for explosive moves amid rising institutional demand.

Ethereum approaches a pivotal breakout while Tom Lee predicts a crypto super-cycle fueled by soaring adoption, liquidity, and long-term investor accumulation.

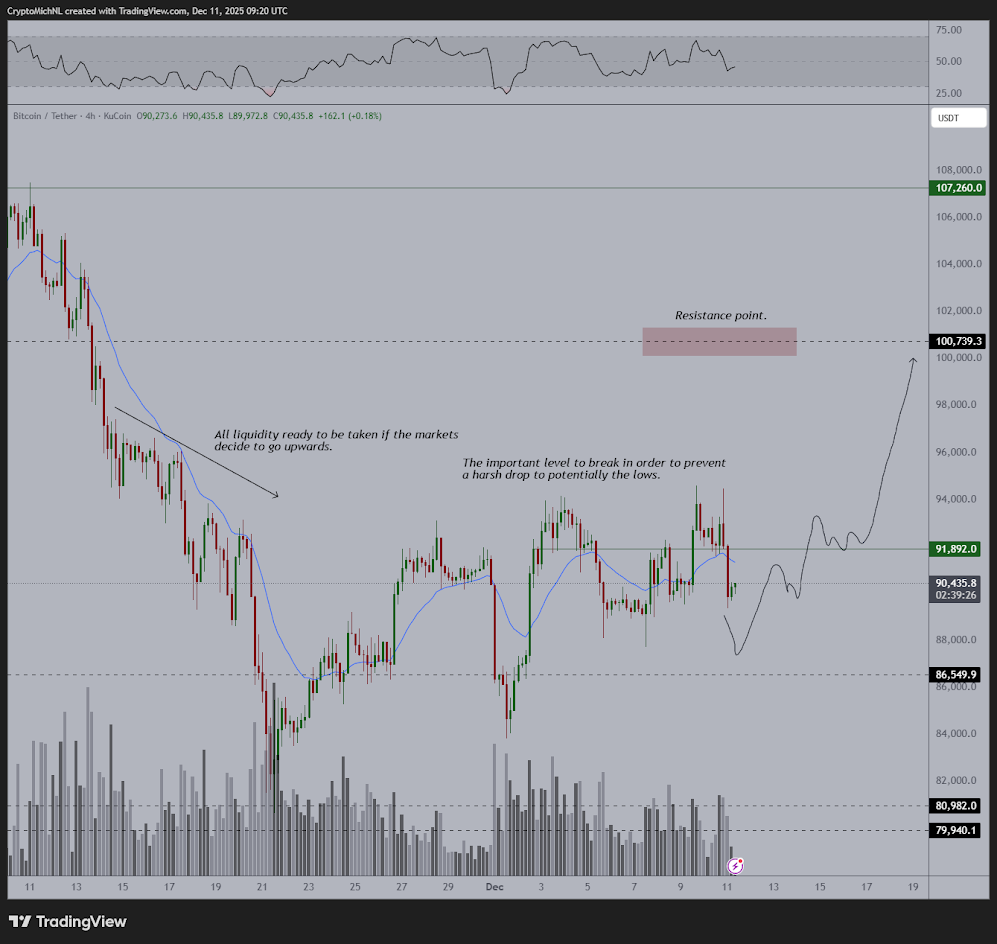

Bitcoin price today is moving toward a critical retest of the $91.8K resistance level, a level it lost after the recent FOMC meeting that triggered a broad market correction. Despite growing concern, the market structure still shows higher lows across lower timeframes, indicating that the broader upward trend remains intact.

A successful reclaim of $91.8K could shift momentum sharply to the upside. However, if Bitcoin fails to break this zone or loses $89.5K support, the market could slide further, potentially retesting the $80K region where a double-bottom pattern might emerge.

Bitcoin Supply Squeeze Intensifies

Exchange reserves have dropped to some of the lowest levels in years. Deposits that were 88,000 BTC in 2021 and 126,000 BTC at the previous all-time high have now fallen sharply, even with Bitcoin near $80K.

With fewer coins on exchanges, sell pressure is fading as more Bitcoin moves into cold storage, ETFs, and long-term custodians. This shrinking exchange inventory means any rise in demand could hit a thin order book, making sharp upward price moves far more likely.

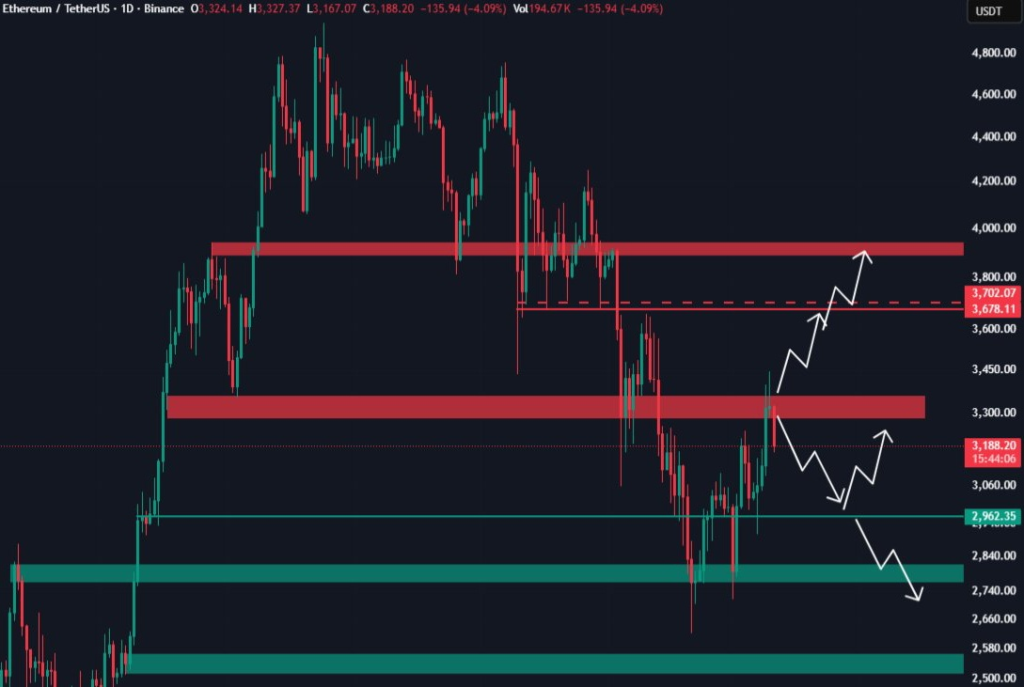

Ethereum Approaches a Pivotal Breakout Zone

Ethereum is nearing a critical moment after getting rejected at $3,400 and slipping toward the $3,000–$3,100 support zone. A rebound from this area could trigger another strong upside move, while a breakdown may open the path toward $2,800.

Despite the short-term weakness, ETH Price remain bullish. Ethereum is increasingly outperforming major assets and recently crossed $4,000 with notable resilience. Ethereum now mirrors Bitcoin’s 2017 setup, right before its explosive mainstream breakout.

Institutional interest is rising rapidly as asset managers and hedge funds recognize Ethereum’s expanding role in DeFi, stablecoins, and blockchain infrastructure. Combined with record on-chain activity, rapid developer growth, and improving regulatory sentiment, Ethereum is widely expected to reach and eventually surpass $5,000.

Tom Lee Sees a Crypto Super-Cycle Forming

Fundstrat’s Tom Lee remains firmly bullish on both Bitcoin and Ethereum, arguing that markets are still underestimating the power of liquidity, institutional adoption, and monetary policy heading into 2026.

“Investors are still early,” Lee said, calling crypto the “best-performing asset of them all.”

Lee expects 1.1 billion active crypto wallets by the end of 2025, describing it as the fastest wealth expansion the world has seen.

“This will be the fastest wealth accumulation cycle in history,” he added, highlighting how rapidly adoption is scaling.

He also stressed that crypto is highly sensitive to the business cycle. With the ISM index set to move above 50 after more than three years, Lee says history shows this shift often triggers super-cycle rallies in Bitcoin and Ethereum.

Reiterating his long-term view, Lee noted that the market may already be entering a Bitcoin “super cycle,” fueled by structural liquidity changes and institutional demand. He added that long-term investors typically avoid selling during these phases, instead treating volatility as an opportunity to accumulate.

For Ethereum, Lee said dips toward $3,000 offer compelling long-term value, comparing them to temporary pullbacks in high-conviction stocks like Nvidia. With liquidity conditions expected to improve significantly in 2026, Lee believes major crypto assets with strong fundamentals are positioned for substantial upside

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

FAQs

Crypto reacts fast to Fed news because rate changes affect liquidity, investor risk appetite, and dollar strength.

Rate cuts can help long term by adding liquidity, but short-term reactions may be negative if the Fed signals caution.

Liquidity affects how easily large orders move markets. Low liquidity makes crypto prices swing harder during news events.

Many institutions buy gradually during downtrends, focusing on long-term positioning rather than short-term moves.

Definitely. As crypto becomes mainstream, prices react more to interest rates, inflation data, and liquidity trends.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author's own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.