The global crypto market looks weak again as the total market cap slips to $3.23 trillion, down 0.94%, showing a slow and shaky trend across major coins. The mood in the market is very negative, with the Fear and Greed Index at just 18, which signals extreme fear, and the average crypto RSI near 41, showing that many coins are still leaning toward oversold levels.

Even leaders like Bitcoin at $95,381 and Ethereum at $3,154 are struggling to find strong momentum, while most top assets are showing small daily moves and no clear recovery signs.

Altcoins are struggling to hold steady as prices show more weakness across the market. XRP is at $2.21, BNB is at $933, and Solana is near $139, but none of them are showing strong upward movement and the gains from last week are slowly fading.

Other popular coins like Tron, Dogecoin, Cardano, Chainlink, Hyperliquid, and Zcash are also under light selling pressure, with very small daily price changes and no clear signs of strong buying interest.

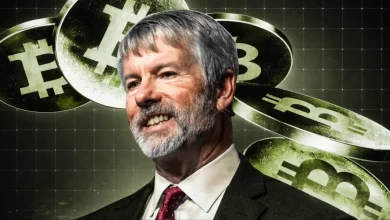

BitMine Chairman Tom Lee says the latest crypto market weakness may be linked to one or more large market makers facing a serious financial gap in their balance sheets. He said the current price drop looks like a situation where bigger players are trying to trigger liquidations and push Bitcoin lower on purpose.

According to him, this kind of pressure often happens when large trading firms are in trouble, and it can create sharp price moves that look worse than they really are.

Lee also said this downturn is short-term pain and does not change the bigger, long-term growth plan for Ethereum and blockchain adoption by Wall Street. He warned that this is not a safe time to use leverage, as the risk of forced liquidations is high. Despite the negative sentiment, he expects that stability and recovery could return within six to eight weeks, likely sometime after Thanksgiving.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author's own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.