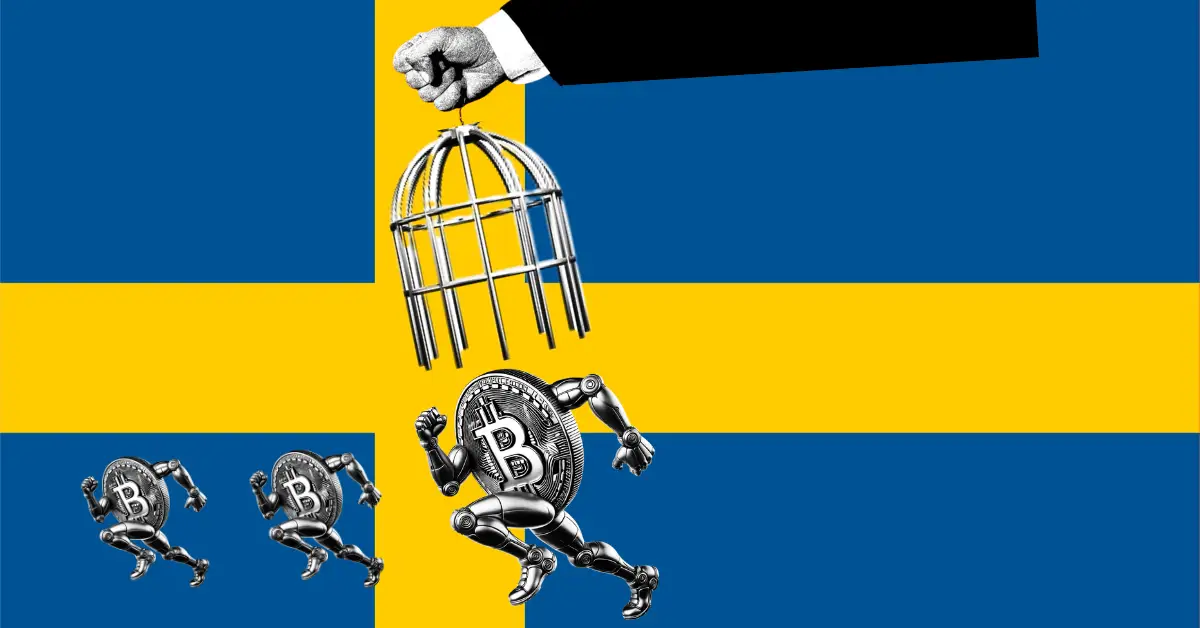

Swedish authorities have identified cryptocurrency exchanges facilitating money laundering for organized crime.

These exchanges have been categorized into four distinct profiles, each involved in systematic money laundering.

Sweden has also targeted Bitcoin mining operations for tax evasion and irregular reporting.

The Swedish Police Authority and the Financial Intelligence Unit (FIU) have identified some cryptocurrency exchanges as “professional money launderers” (PMLs) based on the support they have given to organized crime. This conclusion was reached after comparing an assessment of unrecorded and unlawful crypto service suppliers.

The FIU has identified four main types of PMLs operating in Sweden: the node exchange provider, the hawala exchange provider, the asset exchange provider, and the platform exchange provider. These groups are involved in systematic money laundering for criminals and organized crime groups.

A Growing Concern for Swedish Authorities

These cross-border activities present serious challenges for Swedish authorities. The FIU noted that such transactions are key components of organized criminal activities.

They stressed the need for law enforcement agencies to closely monitor these trading platforms to curb illicit actions. Enhanced oversight is essential to reduce the growth of criminal markets in Sweden.

Previously, genuine and licensed cryptocurrency exchanges received recognition for their efforts to combat money laundering. These exchanges were encouraged to stay alert and report any suspicious trading activity, taking necessary action against illicit trades when appropriate.

Tax Evasion – Uncovered!

Sweden’s crackdown also includes Bitcoin mining. The Stockholm-based Swedish Tax Agency recently investigated 21 firms, finding that all 18 of them reported irregular or incomplete tax information from 2020 to 2023.

This investigation revealed significant cases of tax evasion, with around 90 million SEK found to be unpaid.

While many mining companies are challenging these tax claims, the actions of Swedish authorities reflect growing concerns about the operations of blockchain companies, especially in the areas of mining and cryptocurrency trading.

This report sends a strong message: any unauthorized operations within the crypto market will face serious legal and regulatory consequences. Sweden is committed to ensuring that all participants in the cryptocurrency landscape operate within the law.