Standard Chartered forecasts tokenized real-world assets to surge from $35 billion to $2 trillion by 2028.

Ethereum is expected to dominate the $2 trillion tokenization market due to its proven reliability.

Upcoming U.S. laws may bring clarity, boosting institutional adoption and fueling massive tokenization growth.

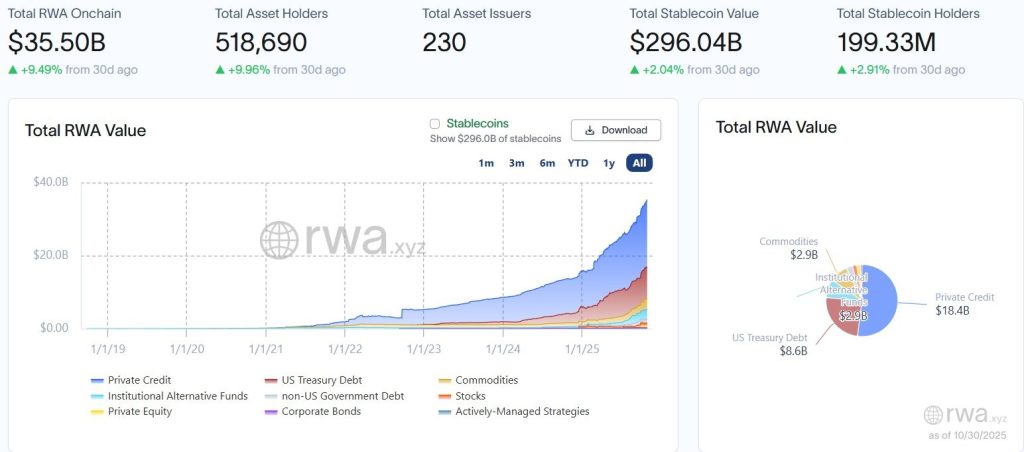

Global banking giant Standard Chartered has shared a bold forecast that the market value of tokenized real-world assets (RWAs) could surge from around $35 billion today to nearly $2 trillion by the end of 2028, with Ethereum expected to host the majority of this activity.

Here’s how it possible?

What’s Driving the Tokenization Boom

Geoff Kendrick, the bank’s head of digital assets, predicts tokenized real-world assets will soar from $35 billion to $2 trillion by 2028, a massive 57x jump in just three years.

According to Kendrick, the rise of stablecoins is the key driver behind this growth. In early October 2025, Stablecoins have increased nearly 47% just this year, hitting $300 billion.

This has created deep on-chain liquidity, providing the foundation for expanding DeFi products and tokenizing real-world assets.

Standard Chartered highlights three key factors supporting this trend:

- Growing awareness and acceptance among major institutions

- Strong on-chain liquidity to handle large transactions

- Expanding blockchain-based lending and borrowing systems

Kendrick said the rise in stablecoins and DeFi is creating a “self-sustaining system” driving tokenized assets into mainstream finance.

Ethereum to Lead the Tokenization Wave

Geoffrey Kendrick said Ethereum’s strength lies in its proven reliability, with ten years of smooth operation and unmatched network trust.

- $750 billion in tokenized money market funds

- $750 billion in tokenized U.S. equities

- $250 billion in tokenized U.S. funds

- $250 billion in less liquid assets such as private equity, commodities, corporate debt, and real estate

Most of these assets will likely run on Ethereum, strengthening its position as the top blockchain for tokenization and DeFi.

DeFi’s Next Frontier: Real-World Assets

For years, DeFi platforms mainly catered to crypto-native users. Now, Kendrick believes the integration of RWAs marks the start of DeFi’s true disruption of traditional markets. If these assets trade on decentralized exchanges, they may rival traditional stock markets

On top of it, recent U.S. legislation, including the GENIUS Act and Digital Asset Market Clarity Act, aims to bring the clarity needed for wider adoption. Kendrick believes clear rules will attract institutions, driving a cycle of growth for both DeFi and tokenization.

If this plays out, Ethereum could soon become the backbone of global finance.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author's own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.