Solana (SOL) could propel SOL by 10% to reach the $265 mark.

82.17% of top Solana (SOL) traders on Binance hold long positions, while 17.83% hold short positions.

SOL has broken out of a two-week descending trendline and is currently heading toward its all-time high.

Solana (SOL), the world’s fifth-largest cryptocurrency by market cap is poised for upside momentum, as it has formed a bullish price action pattern in its four-hour time frame. Earlier, SOL breached a bearish head and shoulders pattern, trapping bears as the price reversed after the breakout.

Solana (SOL) Technical Analysis and Upcoming Level

Today, December 5, 2024, SOL has broken out of a two-week descending trendline and is currently heading toward its all-time high. With a strong bullish breakout and the four-hour candle closing above the resistance level of $240, CoinPedia’s expert suggests that this breakout could propel SOL by 10%, reaching the $265 mark in the coming day.

On the positive side, the altcoin is trading above the 200 Exponential Moving Average (EMA) on the four-hour time frame, indicating an uptrend. Meanwhile, SOL’s Relative Strength Index (RSI) currently stands at 55, below the overbought area, suggesting that the asset has enough room to soar.

RSI is a technical indicator that traders and investors use to determine whether an asset is in oversold or overbought territory, and based on that, they make informed decisions.

Bullish On-Chain Metrics

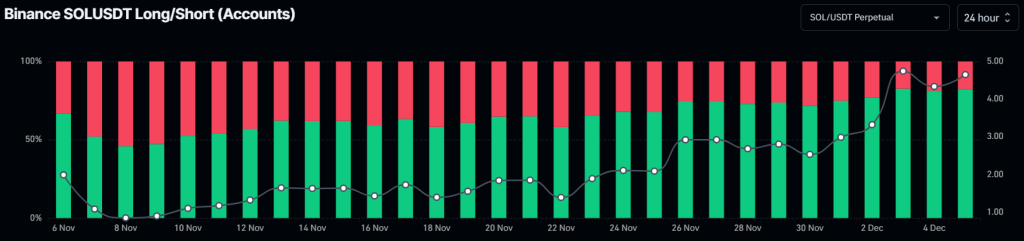

With positive technical analysis, the on-chain metrics further support SOL’s bullish outlook. According to the on-chain analytics firm Coinglass, Binance SOLUSDT’s Long/Short ratio currently stands at 4.61, indicating strong bullish sentiment among traders.

As of writing, 82.17% of top traders on Binance hold long positions, while 17.83% hold short positions.

Besides notable long positions on Binance in the past 24 hours, traders’ interest and confidence in SOL have remained stable, as reported by Coinglass’s Open Interest data.

In the past 24 hours, SOL’s OI has registered a modest gain of over 1.2%, indicating slight interest from traders amid a potential breakout. Given the recent price action, there is a strong possibility that this OI value could rise in the coming hours.

Solana’s (SOL) Price Analysis

Currently, SOL is trading near $240 and has registered a price gain of over 3.5% in the past 24 hours. During the same period, its trading volume increased by 8.5%, indicating modest interest from traders and investors amid the recent breakout.