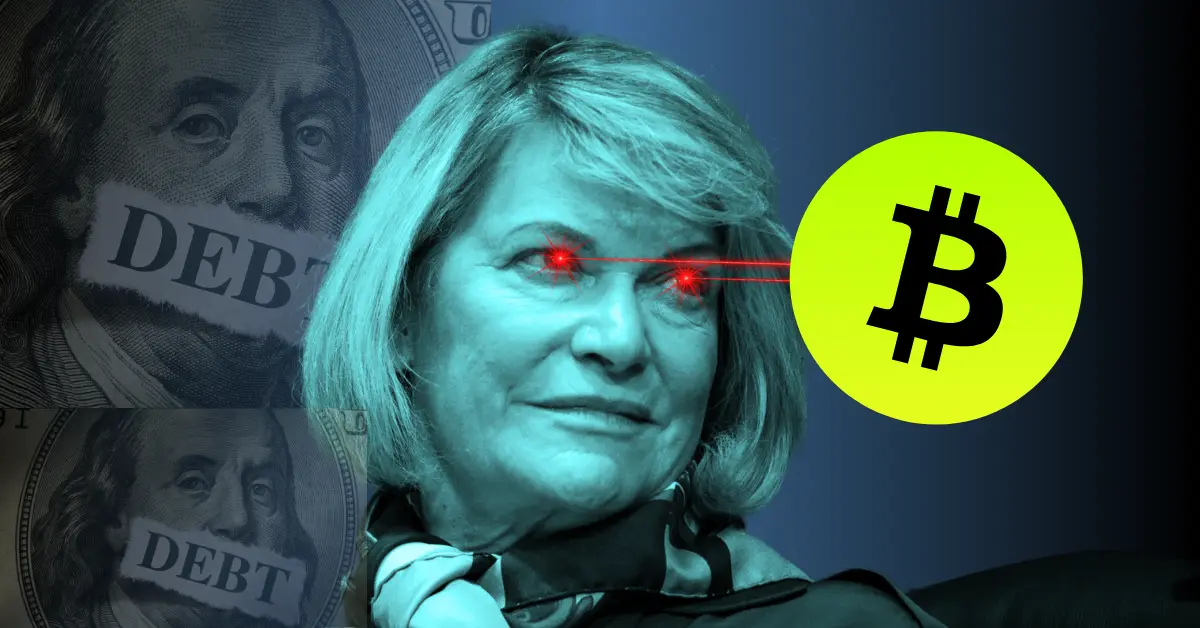

Senator Lummis proposes a U.S. Bitcoin reserve to cut national debt by half over 20 years.

The reserve would start with crypto held by the U.S. Marshals Service.

Lummis positions Bitcoin as a strategic asset in economic competition with China.

Can Bitcoin help reduce America’s $33 trillion debt? Senator Cynthia Lummis believes it can and she’s outlined a bold plan to make it happen.

In a recent Bloomberg interview, Lummis revealed her proposal to create a U.S. Bitcoin reserve, aiming to secure one million BTC, around 5% of the total supply, over the next 20 years.

Her vision goes beyond investing. It’s about turning Bitcoin into a strategic asset that could reshape the country’s financial future.

Using Govt. Crypto to Kickstart the Reserve

Lummis suggested starting the reserve with digital assets already held by the U.S. Marshals Service, specifically from asset forfeiture funds. These funds, some of which are in crypto, could lay the foundation for the first year, without needing new legislation right away.

Still, she acknowledged that clear legal protections would be necessary later on to keep the reserve safe from political shifts.

Why Only Bitcoin? Lummis Makes Her Case

Lummis stressed that this reserve should focus only on Bitcoin. Why? Because of its proof-of-work mining model, which makes it more secure and reliable compared to other cryptocurrencies.

In her view, Bitcoin stands out as the best choice for a long-term national reserve. The core of Lummis’ plan is to acquire and hold one million Bitcoin over 20 years. She believes that if Bitcoin’s value rises as expected, the U.S. could use the reserve to cut the national debt in half.

Lummis also tied the idea to global strategy, saying a U.S. Bitcoin reserve could be just as important as oil reserves, especially in the ongoing economic rivalry with China.

She mentioned that top U.S. military officials in Southeast Asia back the idea and see Bitcoin as a valuable strategic asset.

A Nod to Trump

Lummis went on to praise President Donald Trump for his early investments in Bitcoin. She called him a forward-thinker when it comes to digital assets and encouraged more Americans to see the value in early crypto adoption.

As the digital economy grows, she believes this mindset will become increasingly important.

If this plan takes off, it could mark a major shift in how the U.S. manages its economy and how Bitcoin is seen as a tool for national strength.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author's own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.