A new crypto bill led by Senator Cynthia Lummis brings game-changing updates for tokens, NFTs, and DeFi.

The draft limits SEC power and introduces new protections, but there are more lawmakers aren’t openly saying yet.

With votes coming soon, the big question is whether this bill will finally reshape crypto rules before year-end.

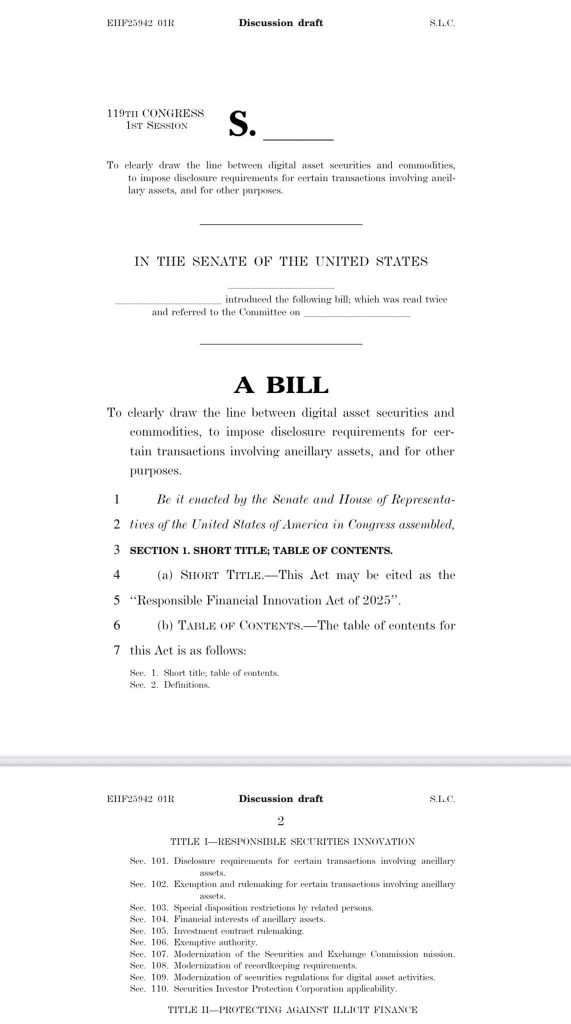

U.S. Senators introduced an updated draft of the market structure bill on Friday, aiming to bring more clarity to digital assets and cryptocurrencies.

One of the most notable changes is that stocks and securities will not be treated as commodities if they are tokenized. The bill also excludes certain crypto activities, such as DePIN, staking, and airdrops, from securities law.

Under Section 101, the bill blocks the SEC and private firms from bringing lawsuits against existing tokens unless fraud is involved. This provision is designed to stop regulators from overreaching into the crypto market.

It also clearly states that NFT transactions will not be treated as securities, meaning buying, selling, or transferring an NFT is not the same as trading stocks. This approach was missing in the earlier House version.

SEC and CFTC Coordination

Crypto journalist Eleanor Terrett reported that the bill creates a joint advisory committee under Section 701, requiring the SEC and CFTC to coordinate on crypto oversight.

In addition, Section 702 directs the agencies to resolve disputes together, preventing regulatory turf wars.

Protection for Developers and DeFi

The updated draft includes strong protections for software developers and DeFi platforms.

- Section 505, the “Blockchain Regulatory Certainty Act,” makes sure developers are not treated as money transmitters simply for writing or publishing code.

- DeFi platforms get exemptions so they are not forced to follow the same rules as centralized companies.

- The bill also protects self-custody wallets, ensuring users can safely hold their own crypto.

As one senator put it, the goal is to make sure “developers and innovators aren’t punished for building.”

When Will the Bill Pass?

The House passed its version in July, but the Senate is still reviewing its draft. The two versions must eventually be combined before reaching President Trump’s desk.

Senator Cynthia Lummis told CNBC:

“We want this on the president’s desk before the end of the year.”

She expects the Senate Banking Committee to vote this month on the SEC provisions, while the Senate Agriculture Committee will review the CFTC sections in October. A full Senate floor vote could happen as early as November.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author's own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.