Corporates Embrace XRP: Firms like Flora Growth, Hyperscale Data, and Webus International are adding XRP to their treasury holdings.

Institutional Access Expands: XRP listings on BDACS and major Korean exchanges boost adoption; legal clarity could further accelerate demand.

XRP is no longer just for traders. It is quietly becoming a go-to asset for corporate treasuries. Recent SEC filings reveal that more companies are adding XRP to their balance sheets, not for speculation but as a strategic financial move.

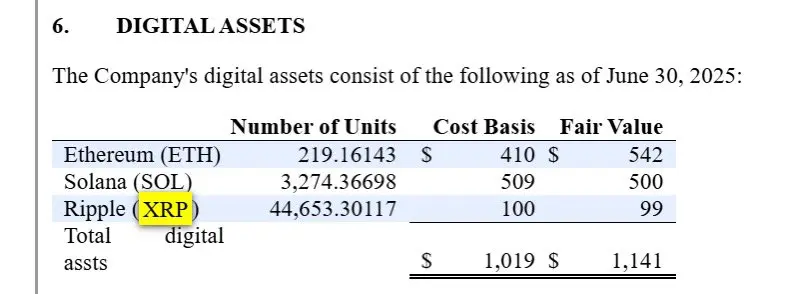

Crypto legal expert Bill Morgan pointed out this growing shift. Flora Growth, a US company, disclosed in its Form 10-Q that it holds XRP along with Ethereum and Solana. The company says these assets were acquired to strengthen its financial foundation.

Similarly, Hyperscale Data has committed to publishing monthly updates on its digital holdings starting with XRP. Its subsidiary Ault Capital Group has already invested 10 million dollars into the token.

This trend is not limited to the United States. China-based Webus International announced a 300 million dollar XRP-focused treasury strategy in its Form 6 K. London-based VivoPower and pharmaceutical distributor Wellgistics have also disclosed XRP holdings, showing that the adoption is spreading across industries and borders.

Institutions Are Gaining Easier Access

XRP is becoming more accessible to large investors. The token is now listed on BDACS, a platform that offers secure custody solutions for institutions. This strengthens Ripple’s connection to the Korean market, where exchanges like Upbi,t Coinone, and Korbit already offer deep liquidity. With BDACS in the picture, institutions can now deploy XRP more efficiently.

- Also Read :

- Ripple Responds to U.S. Senate Crypto Bill, Says XRP, ETH, and SOL Could Face Unfair Regulation

- ,

Meanwhile, a recent transfer of 20 million XRP, worth about 60 million dollars, from Upbit to an unknown wallet has sparked speculation among traders. Big moves like this often hint at growing interest and long-term positioning.

What Lies Ahead

The Ripple versus SEC case still hangs in the balance. A status update is expected by August 15 and could bring much-needed clarity. That anticipation recently fueled an 8 to 10 percent rally in the XRP price.

At the time of writing, XRP is trading at 2.97 dollars. While market pressure remains, the bigger story is unfolding quietly. Companies are holding XRP Institutions are joining in Legal clarity is approaching

XRP is no longer just a crypto asset It is steadily gaining ground as a legitimate corporate treasury tool with long-term potential.

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

FAQs

Corporations like Flora Growth and Hyperscale Data hold XRP as a strategic financial asset, not for speculation, citing balance sheet strength.

BDACS now offers institutional custody for XRP, complementing Korean exchanges (Upbit, Coinone) and enabling large-scale deployments.

Pending August 15 case update may bring regulatory clarity, recently boosting XRP 8-10%. Corporate adoption grows despite legal overhang.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author's own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.