The SEC permanently dismissed its lawsuit against Gemini after Earn users were fully repaid, closing a major regulatory chapter for the exchange.

Full crypto repayment through the Genesis bankruptcy process was the decisive factor in reducing investor harm and ending the case.

The dismissal removes legal uncertainty for Gemini but does not signal looser oversight for future crypto lending or yield products.

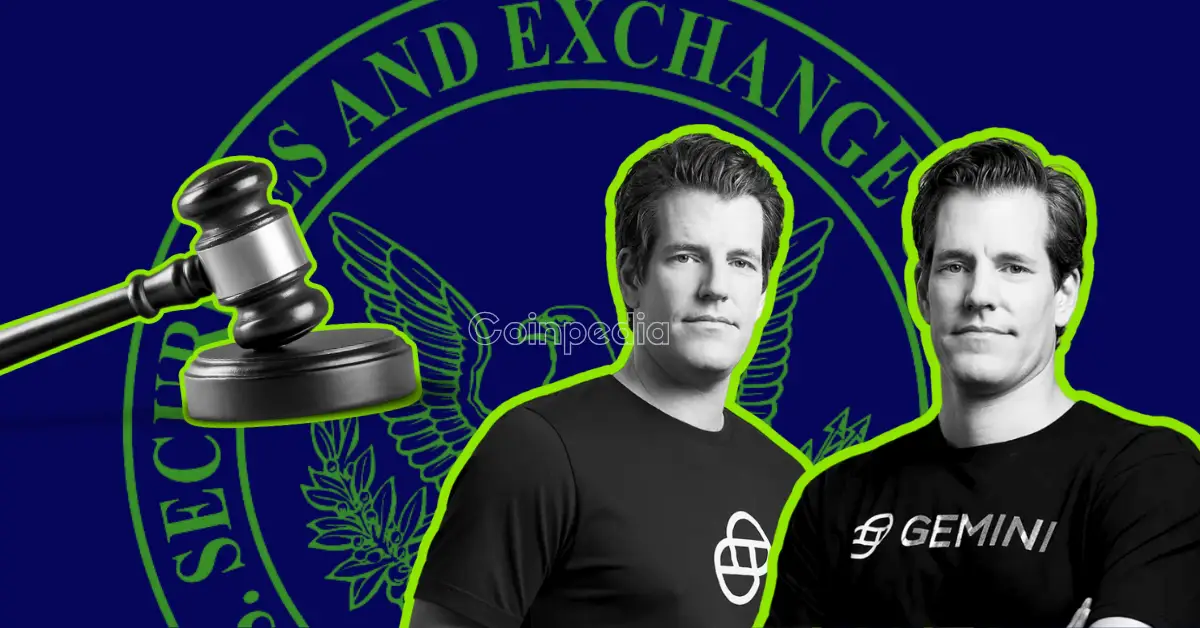

The U.S Securities and Exchange Commission has officially dropped its civil lawsuit against Gemini Trust Company, a major relief for the crypto exchange founders Tyler and Cameron Winklevoss.

The decision comes after Gemini Earn users received all their crypto back, bringing an end to a long legal case that started in 2023.

SEC Drops Gemini Earn Lawsuits

According to the 23rd January 2026 filing, the SEC and Gemini Trust Company jointly agreed to dismiss the case with prejudice, meaning it cannot be reopened. The SEC said the decision was made using its own judgment, with investor repayment playing a major role.

All affected Gemini Earn users received a 100% return of their crypto assets, not cash. These repayments were completed through the Genesis Global Capital bankruptcy process between May and June 2024.

By returning users’ crypto in full, the SEC noted that investor harm was significantly reduced.

The regulator also pointed out that Gemini had already settled related issues with several state regulators. Taken together, these steps supported the decision to fully dismiss the lawsuit.

Background of Gemini Earn Case

The case traces back to December 2020, when Gemini partnered with Genesis, a crypto lending firm linked to Digital Currency Group. Through this arrangement, Gemini users could lend their crypto to Genesis in return for interest payments.

Problems began when Genesis collapsed during the broader crypto market downturn. Withdrawals were frozen, leaving around $900 million in crypto assets belonging to nearly 340,000 users locked and inaccessible.

To help resolve the situation, Gemini later contributed about $40 million in Bitcoin and $10 million in other assets, and also paid a $37 million penalty as part of a separate settlement with New York regulators.

Over time, Gemini worked through multiple legal and regulatory processes at both the state and federal levels, with the full repayment of users emerging as the key turning point in closing the case.

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

FAQs

The dismissal removes a major legal overhang but does not grant approval for new yield products. Any future offerings would still need to comply with evolving U.S. securities and crypto regulations.

The case highlights a more pragmatic enforcement approach where investor remediation can influence outcomes. It does not signal a rollback of oversight, but it may shape how remedies factor into future cases.

Non-Earn users are not directly impacted, but the resolution reduces overall platform risk and uncertainty. This can improve confidence in Gemini’s operations and regulatory standing.

While this case is closed, Gemini remains subject to ongoing compliance obligations and future rulemaking. Broader crypto legislation and SEC guidance could still reshape how exchanges operate in the U.S.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author's own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.