SARB focuses on improving traditional payments, non-bank access, and cross-border CBDC solutions.

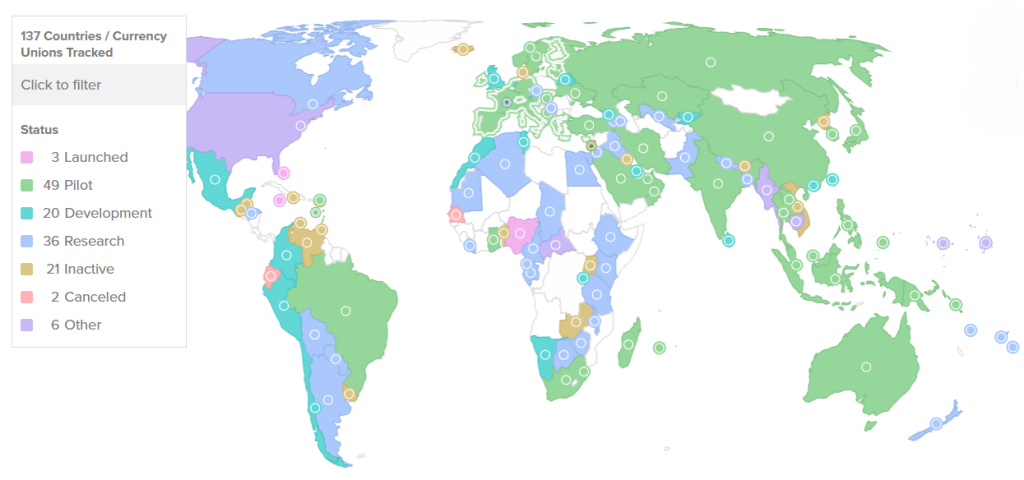

Globally, 3 countries launched CBDCs, 49 testing, 20 developing, 36 still researching digital currencies.

SARB says South Africa has no urgent need for a retail CBDC yet, digital currency won’t solve this.

While dozens of countries rush to launch their own CBDCs, the South African Reserve Bank (SARB) says the nation doesn’t need one right now. The central bank argues that a digital currency won’t fix the country’s biggest financial struggles, especially when many people still lack bank access.

This unexpected move now raises a big question: Is South Africa being smart or falling behind?

South Africa Rejects CBDC for Now

According to a position paper released by the South African Reserve Bank (SARB) on November 27, 2025, the country sees “no strong immediate need” for a retail central bank digital currency (CBDC).

The bank said the idea is technically possible, but it does not solve the country’s most urgent financial needs.

Instead of launching a digital rand for everyday users, SARB wants to focus on modernizing the traditional payments system, improving access for non-banks, and exploring wholesale CBDC and cross-border payment upgrades.

SARB made it clear that it will continue monitoring global CBDC progress and stay prepared if the country eventually needs one.

Why South Africa Is Holding Back on Retail CBDCs?

SARB’s research found that a retail CBDC would not instantly fix existing problems. Nearly 16% of adults don’t have a bank account, and a digital token alone cannot solve this gap unless it offers:

- Cash-like offline access

- Low transaction fees

- Simple and universal usability

- Strong privacy protections

Meanwhile, SARB also warned that crypto assets and stablecoins are becoming a growing risk, saying issues like cyber threats and financial stability concerns outweigh their benefits for now.

The report said crypto can help bypass Exchange Control Regulations, raising concerns about capital flows in and out of South Africa.

Global CBDC Race Continues Without SA

While South Africa steps back from launching a Central Bank Digital Currency (CBDC), many other countries continue to move forward rapidly.

- 3 countries have already launched their own CBDCs.

- 49 countries are testing CBDCs in real-world pilot programs.

- 20 more countries are busy developing their CBDC systems.

- 36 countries are still researching.

Even the United States has paused its own CBDC plans for now, especially after the Trump administration decided to move away from the idea.

In the meantime, by slowing down and observing, South Africa is placing itself among nations that want to wait and learn first, rather than jump in too early.

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

FAQs

A CBDC, or Central Bank Digital Currency, is a digital form of a country’s official currency, directly issued and backed by its central bank, unlike cryptocurrencies.

The central bank found a digital Rand wouldn’t immediately solve key issues like financial inclusion for the unbanked, and it wants to prioritize more urgent financial system upgrades.

Three countries have fully launched a CBDC, while many others are in advanced pilot or development stages, according to global tracking. South Africa is currently observing their progress.

The South African Reserve Bank warns that crypto assets pose risks like enabling capital to bypass exchange controls, along with cyber threats and potential financial instability.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author's own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.