Roundhill filed an XRP Covered Call ETF amendment, signaling growing institutional acceptance of XRP-based products.

The amendment only delays the ETF launch date, showing approval exists but timing remains undecided.

The SEC filing confirms XRP is approved as an underlying asset for regulated ETF strategies.

Roundhill Investments, a U.S.-based firm known for launching new ETF products, has filed an updated XRP-related ETF document with the U.S. SEC.

While some view it as a significant step forward for Ripple’s XRP, the filing also comes with limitations that investors need to be aware of.

Here’s what the Roundhill updated filing actually means.

Roundhill Field Post-Effective Amendment for XRP Covered ETF

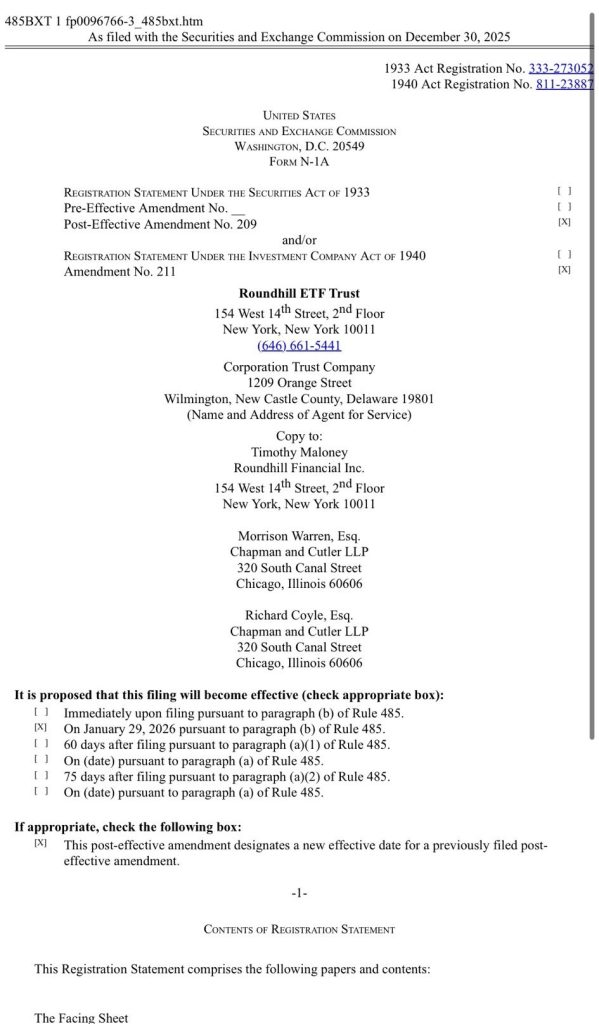

According to a filing submitted to the U.S. Securities and Exchange Commission on December 30, 2025, Roundhill ETF Trust filed a Rule 485 amendment for its XRP Covered Call Strategy ETF.

This filing shows that XRP is now accepted as a base asset for regulated ETF strategies, marking an important step for XRP in traditional finance.

However, this filing does not create a spot XRP ETF, and it does not mean the fund will directly hold XRP tokens.

Instead, Roundhill’s ETF is designed to earn income by using options premiums linked to other XRP-based ETFs. In simple words, it focuses on making steady returns from XRP price movement rather than owning XRP itself.

Why does the Update Filing Say?

The filing clearly states that the update was made solely to delay the ETF’s launch date, not to modify its operational structure. This means the ETF structure is already ready, and approval is not the issue, the only missing piece is the timing of when it will go live.

Even though this is not a spot ETF, the filing still sends a strong message. It confirms that XRP is accepted as a base asset for regulated ETF products.

Moves like this usually happen after an asset passes key regulatory and structural checks, making it an important step forward for XRP.

Will Roundhill Go For the Actual XRP ETF in the Future

For now, Roundhill’s strategy is focused on earning a steady income from XRP volatility, not betting on price growth. Still, this move adds credibility to XRP’s role in regulated financial products.

While many in the XRP community hoped this amendment might lead to a spot XRP ETF, that is not currently the case.

Following this news, the XRP token price has seen a slight jump, currently trading around $1.87.

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

FAQs

Roundhill filed an amendment for its XRP Covered Call Strategy ETF, delaying its launch but confirming XRP as a base asset for regulated ETFs.

It signals XRP is recognized as a base asset for regulated ETFs, adding credibility to its role in traditional financial products.

The filing delays the launch date, but the ETF’s structure is ready. Approval isn’t the issue—timing is the only missing piece.

Currently, the focus is on income from XRP volatility. A spot XRP ETF isn’t planned yet, but future products may be considered.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author's own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.

![Why Is the Crypto Market Going up Today [Live] Updates on March 3, 2026](https://image.coinpedia.org/wp-content/uploads/2026/03/03170220/Why-Is-the-Crypto-Market-Going-up-Today-Live-Updates-on-March-3-2026-2-390x220.webp)