Ripple’s David Schwartz stresses institutional adoption as key to crypto’s mainstream success at ONDO Finance Summit 2025.

XRP thrives despite SEC lawsuit, with Schwartz highlighting global regulatory shifts boosting blockchain innovation.

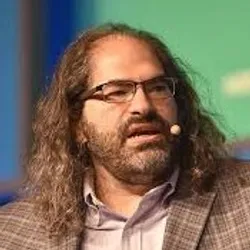

At the ONDO Finance Summit 2025, Ripple’s Chief Technology Officer (CTO), David Schwartz

Schwartz began by reflecting on Ripple’s journey, noting the ups and downs the company has faced over the years. He said that while many in the industry once believed retail adoption would be the driving force behind blockchain’s widespread use, it is now clear that institutional adoption is a prerequisite for achieving mainstream success.

- Also Read :

- Crypto News Today: Trump Jr. Declares Crypto the New Weapon for U.S. Economic Hegemony

- ,

Ripple’s Resilience and Recent Wins

Schwartz acknowledged the challenges Ripple has faced, especially in the wake of the SEC’s lawsuit.

“Four years ago, we had what I called the worst Christmas ever when I found out that the SEC was suing us and a lot of people thought that would be the end of business,” he said.

Despite the setback, Schwartz pointed to Ripple’s resilience and the company’s recent successes, particularly with XRP, which has been one of the top-performing cryptocurrencies in recent months. He explained how the changing regulatory landscape in the U.S. has helped unlock new business opportunities both domestically and internationally.

He further said that the change in the regulatory environment in the United States has had a ripple effect globally. Countries that typically take regulatory cues from the U.S. are now more open to fostering innovation, creating a more competitive international landscape for blockchain technology and cryptocurrency.

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.