Cryptocurrency exchange Binance is facing fresh legal trouble after being hit with a class action lawsuit alleging the firm deliberately sparked the implosion of now-bankrupt rival FTX.

Filed in California, the lawsuit spearheaded by plaintiff Nir Lahav claims Binance violated securities law and engaged in unfair competition to undermine FTX’s business.

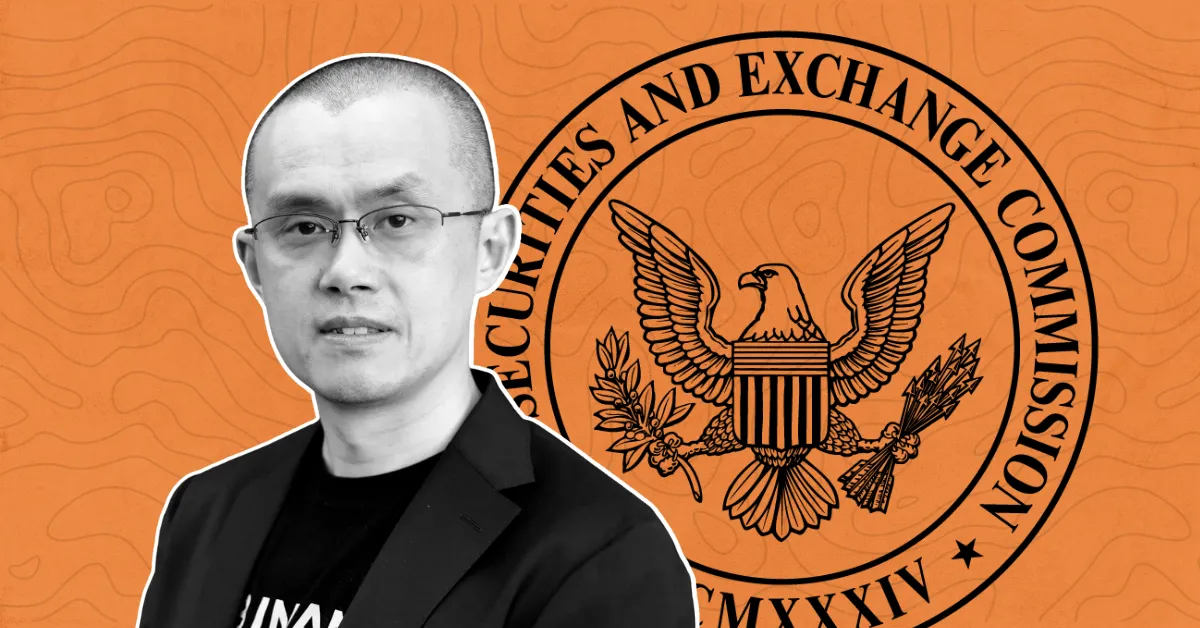

Specifically, it points to Binance CEO Changpeng Zhao’s November 2022 tweet announcing the firm’s intent to sell its FTX Token (FTT) holdings as a premeditated move to sow distrust and trigger mass FTT sell-offs.

Allegations claim CZ knowingly triggered rival exchange’s collapse

According to the suit, Binance had already offloaded 23 million FTT worth $530 million the previous day, indicating Zhao knowingly sought to manipulate the market and profit from FTX’s demise.

The ensuing FTT crash and loss of user confidence ultimately caused the catastrophic bank run that led to FTX’s abrupt unraveling. Binance then offered to acquire its crippled rival before promptly withdrawing the proposal.

While Binance maintains it acted responsibly in withdrawing from FTX, the lawsuit alleges its public statements and actions were intentionally designed to destabilize and acquire FTX at a cut-rate price.

Binance has yet to comment on the specifics of the litigation. The class action underscores lingering suspicions around behind-the-scenes motivations in FTX’s spectacular collapse. However, proving market manipulation in crypto remains an uphill legal battle.

The coming proceedings promise to further unravel the FTX debacle while testing novel legal boundaries. Regardless of the outcome, the scandal will likely spur tighter industry self-regulation to prevent similar episodes of crypto contagion.