Trump’s Iran threat shook markets, causing panic-driven sell-offs across major altcoins and Bitcoin.

Ether, Solana, XRP tumbled while Cardano, Dogecoin, and SUI suffered double-digit weekly losses.

Meanwhile, Federal Reserve warns inflation remains sticky, delaying interest rate cuts.

Rising geopolitical tensions are once again shaking up the crypto market. U.S. President Donald Trump targeting Iran’s supreme leader has sparked investor fear, leading to a sell-off in altcoins like Ether, Solana, and XRP have recorded a drop of nearly 5% to 9% in a week.

If Bitcoin plunges, Altcoin will follow, thus investors are in fear of a further market crash.

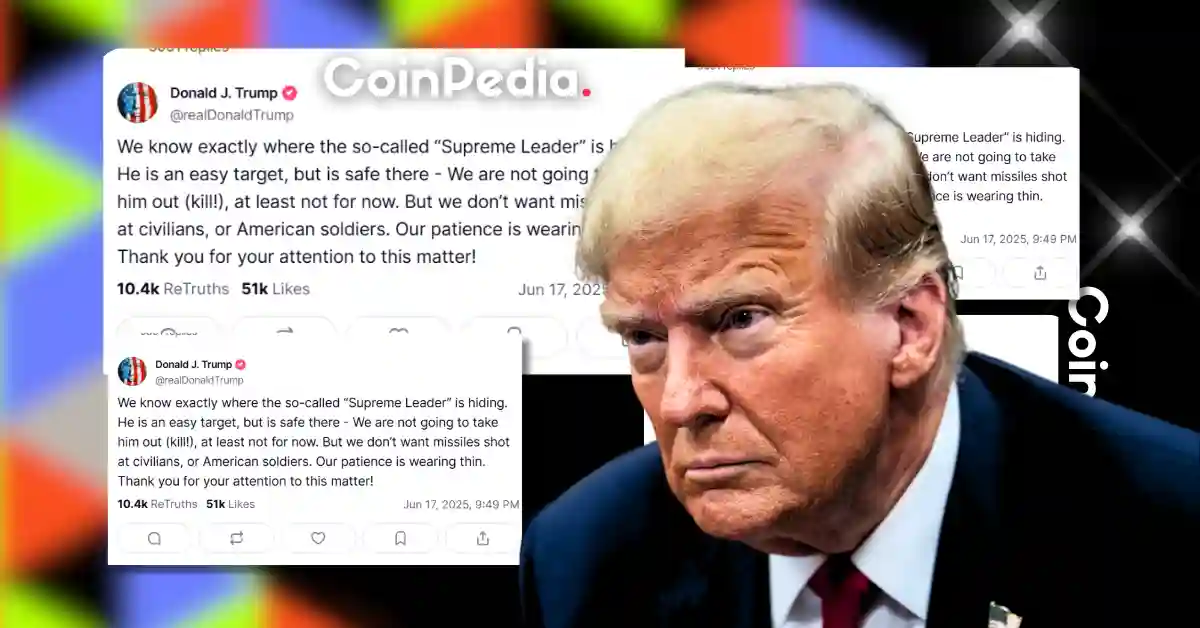

Trump’s Threat Triggered Crypto Sell-Off

On Tuesday, Trump posted a warning on his social media, saying the U.S. knows the location of Iran’s Supreme Leader and could strike — but “not for now.” These words were enough to shake investor’s confidence worldwide.

Soon after this post, Bitcoin dropped quickly from $108,952 to $103,371 before bouncing back slightly to $104,950.

Other major coins, including Ether, Solana, and XRP, also fell. Ether lost 1.5%, dropping from $2,618 to $2,462 before recovering to $2,526. Meanwhile, Solana and XRP dropped over 2% in 24 hours.

However, Cardano, SUI, and Dogecoin saw even bigger losses of over 10% to 12% for the week.

Fed’s Warning Adds More Caution

On top of geopolitical worries, the U.S. Federal Reserve added more concerns. Fed Chair Jerome Powell warned that global conflict and new tariffs could make inflation worse.

Although interest rates stayed the same, Powell made it clear that the Fed isn’t ready to lower them yet.

Bitcoin Stuck Between Roles

As tensions rose, many investors shifted their funds into stablecoins or held on to Bitcoin, viewing them as safer compared to altcoins. Despite this, BTC hasn’t acted fully like a safe-haven asset like gold, nor has it rallied like risk assets.

While Bitcoin is up 60% in the last 1 year, analysts say it’s still unclear which direction it’ll take next. Crypto expert Doctor Profit warns that BTC could dip below $100,000 soon, possibly even to $93,000, as markets brace for more macro shocks.