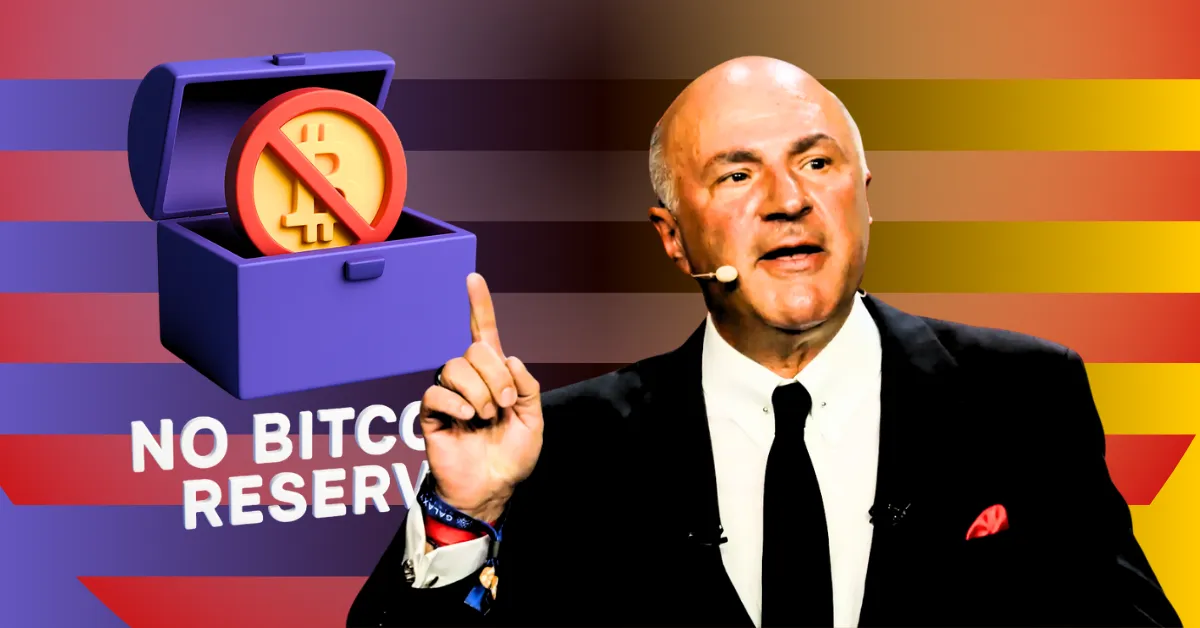

Kevin O’Leary Slams U.S. Bitcoin Reserve Push: “It Will Never Happen”

-

BTC $ 115,160.14 (-2.70%)

Kevin O’Leary rejects the idea of a U.S. Strategic Bitcoin Reserve, calling it politically unviable and self-serving.

While O’Leary stays skeptical, advocates like Michael Saylor and Anthony Scaramucci continue pushing Bitcoin’s national potential.

As global crypto adoption accelerates, the United States remains hesitant. Despite rising interest in digital assets worldwide, U.S. institutions are still dancing around the idea of making Bitcoin part of a national reserve strategy.

And according to investor Kevin O’Leary, that dance won’t be ending any time soon.

“It Will Never Happen,” Says Kevin O’Leary

Shark Tank star and outspoken investor Kevin O’Leary isn’t buying the idea – at all. Speaking candidly, O’Leary dismissed the proposal of a U.S. Strategic Bitcoin Reserve, pointing to the lack of bipartisan support and calling out what he sees as self-interest from advocates like MicroStrategy’s Michael Saylor.

“Strategic Bitcoin Reserve will never happen. Michael Saylor is talking about his book.”

While he shot down the Bitcoin reserve notion, O’Leary did highlight the importance of stablecoin regulation. He predicted that forthcoming legislation would reduce transaction costs globally, potentially paving the way for widespread digital dollar adoption.

U.S. Institutions Continue to Shy Away

The Strategic Bitcoin Reserve Bill, introduced by Senator Cynthia Lummis, has sparked mixed reactions across party lines. While states like North Carolina have backed similar efforts, others – including Oklahoma – have firmly rejected them.

Economists remain divided. A recent University of Chicago survey found no consensus among experts regarding Bitcoin’s viability as a national reserve asset. The main concern? Bitcoin’s volatility and its uncertain role within traditional monetary frameworks.

Saylor and Scaramucci Push Back

Despite O’Leary’s skepticism, not everyone agrees. Anthony Scaramucci, managing partner at SkyBridge Capital, voiced support for the bill, arguing it could boost the U.S. economy.

He also echoed comments from tech entrepreneur David Sacks, who urged a bipartisan approach and warned that a Republican-only push might be reversed if political power shifts.

Michael Saylor shows support through action. His company, Strategy, recently added a jaw-dropping $180.3 million in Bitcoin, raising its total holdings to 555,450 BTC, with plans to accumulate even more. Saylor remains a vocal supporter of the reserve bill and sees Bitcoin as a cornerstone of future financial infrastructure.

Global Outlook

The U.S. isn’t the only country wrestling with Bitcoin’s place in official reserves. The European Central Bank, under President Christine Lagarde, has clearly stated that Bitcoin won’t be part of its reserves anytime soon.

On the flip side, El Salvador has already integrated Bitcoin into its national holdings despite strong pushback from the IMF – highlighting the global split in digital asset policy.

For now, Bitcoin may be winning in the court of public interest, but whether it secures a seat at the national table remains a high-stakes waiting game.

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

FAQs

States like North Carolina support it, while others like Oklahoma have rejected the idea.

El Salvador officially holds Bitcoin as part of its reserves, despite criticism from global financial bodies.