Today, March 20, 2025, Bitcoin (BTC), the world’s largest cryptocurrency, appears to be shifting from its prolonged consolidation to massive upside momentum. The Fed’s decision to hold interest rates steady during the March FOMC meeting has pushed BTC above a crucial level.

Bitcoin (BTC) Technical Analysis and Upcoming Levels

According to expert technical analysis, after the March FOMC, BTC breached its prolonged consolidation and the resistance it faced from the 200 Exponential Moving Average (EMA) on the daily timeframe.

Despite the breakout, it is not yet fully confirmed whether BTC will rally or continue its prolonged consolidation. Based on recent price action and historical patterns, if BTC closes a daily candle above the $85,800 mark, there is a strong possibility it could soar by 8% to reach $92,600 in the coming days.

This bullish thesis will remain valid only if BTC holds above the $85,600 mark; otherwise, it may fail.

Current Price Momentum

At press time, Bitcoin is trading near $85,500, having surged over 4.50% in the past 24 hours. Meanwhile, its trading volume has jumped by 40% during the same period, indicating heightened participation from traders and investors compared to the previous day following bullish price action.

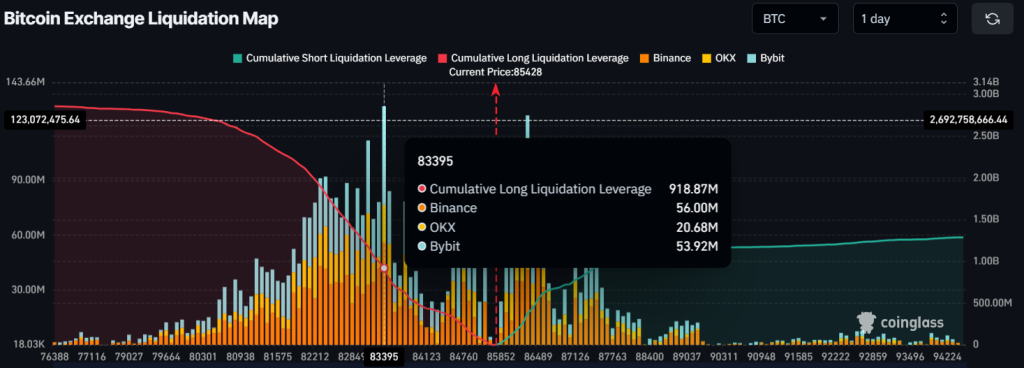

Major Liquidation Areas

After bullish price action and impressive upside momentum, traders seem optimistic about the asset, as reported by the on-chain analytics firm CoinGlass.

Data revealed that traders are currently over-leveraged at $83,400, a level where they hold nearly $920 million worth of long positions. On the other hand, $86,300 is another over-leveraged level where traders betting on the short side have held $375 million worth of short positions.

When combining these on-chain metrics with technical analysis, it appears that bulls dominate and push BTC toward reclaiming the $90,000 mark.