From Basics to Brilliance: Learn Three White Soldiers and Three Black Crows in Crypto Price Action Trading

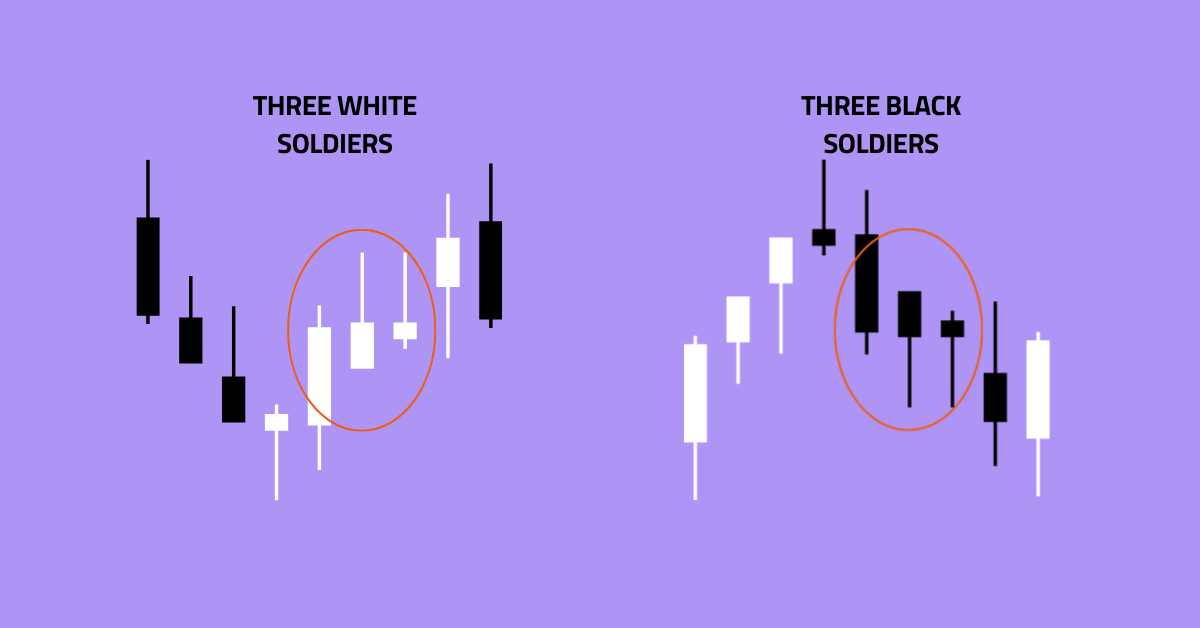

Crypto trading is risky, and success relies on the right tools. Chart patterns are crucial for traders. There exist numerous powerful chart patterns capable of giving accurate insights. Among the most popular are Three White Soldiers and Three Black Crows. Definitely, these patterns hold significant power in analysing market trends. Let’s delve into understanding these patterns deeply for successful trading.

1. Three White Soldiers Pattern: What You Should Know

Let’s explain three white soldiers pattern in a simple way. The Three White Soldiers pattern is a bullish candlestick formation that indicates a likely trend reversal. It emerges near the end of a downtrend. This pattern suggests an upcoming shift to a bull market, making it a key indicator for traders looking for potential upward price movements.

1.1. How to Identify Three White Soldiers Pattern

Identifying the Three White Soldiers pattern involves:

- Recognising three consecutive green candles with increasing size, minimal wicks, and bottoms above the previous mid-price

- Each candle opens below the prior maximum but closes higher

- Substantial increase in accompanying volume

In order to develop an effective three white soldiers pattern crypto strategy, it is important to identify the pattern accurately.

2. Three Black Crows Pattern: What’s It

Time to explain three black crows pattern in an in depth way. The Three Black Crows pattern is a bearish chart pattern indicating a shift in market sentiment. It emerges when bears dominate for three consecutive trading sessions, overpowering bullish momentum. Each session features a black candlestick, signifying lower closing prices. This pattern suggests a potential downtrend, warning traders of substantial bearish pressure.

2.1. Easy Way to Identify Three Black Crows Pattern

Identifying the Three Black Crows pattern is very simple.

- Look for three successive long candlesticks

- Each opens within the prior candle’s body but closes lower

- This pattern visually represents bears dominating for three consecutive sessions, with descending closing prices

If you want to create an efficient three black crows pattern crypto strategy, it is crucial to identify the pattern without any scope of confusion.

Also Read: How to Trade Cryptocurrencies? A Step-by-Step Guide to Buying and Selling Crypto

3. Three White Soldiers vs. Three Black Crows: The Key Differences

Here is the comparison between the Three White Soldiers pattern and Three Black Crows pattern. The comparison is made based on six important aspects: pattern type, candle colour, candle size, wick size, price relationships, volume confirmation and visual representation.

| Aspects | Three White Soldiers | Three Black Crows |

| Pattern Type | Bullish reversal | Bearish reversal |

| Candle Colour | Three white or green candles | Three black or red candles |

| Candle Size | Above the same size, often vast | Long and descending |

| Wick Size | Small wicks or shadows | May have small wicks |

| Price Relationships | Bottoms above the previous mid-price | Opens within the previous candle’s body, close lower |

| Volume Confirmation | Significantly increasing volume | Typically associated with increased volume |

| Visual Representation | Visually appears as three consecutive, long green candles | Visually appears as three consecutive, long red candles |

4. How to Use Three White Soldiers & Three Black Crows in Crypto Trading

Unlocking crypto trading potential with these patterns involves considering key conditions and following specific rules.

4.1. Conditions Where Three White Soldiers & Three Black Crows Work Better

To apply Three White Soldiers and Three Black Crows successfully in crypto trading,

- prioritise higher time frames for a comprehensive market outlook

- Recognise the relevance of suitable crypto pairs

- Embrace the pure price action nature of the strategy, as it relies solely on candlestick patterns without the need for additional indicators

4.2. Rules While Using Three White Soldiers & Three Black Crows

- Executing these patterns demands precision. Place Buy Stop orders 3-5 pips above the 3rd candle’s high for Three White Soldiers and Sell Stop orders below the 3rd candle’s low for Three Black Crows.

- Strategically manage Stop Loss, positioning it above the 3rd candle’s high for Sell orders, and below the 3rd candle’s low for buy orders.

- Target swing highs/lows for profit taking.

- Enhance your strategy with thorough analysis of support/resistance, pivot and Fibonacci levels.

- Stay alert to potential consolidation.

5. Limitations of Using Three White Soldiers & Three Black Crows

While Three White Soldiers and Three Black Crows offers valuable insights, relying solely on these candlestick patterns can be risky.

Here are the three prime limitations:

- False Signals

False signals may lead to significant losses if not considered in the broader market context.

- Potential Stopouts

Be cautious of large distance between patterns, as implementing a feasible Stop Loss may be challenging.

- Temporary reversal

Always consider the possibility of temporary reversals, preventing unexpected losses.

Trending Topic These Days: Bitcoin Halving 2024: Why It Matters & What To Expect

Endnote

In the dynamic realm of crypto trading, mastering patterns like Three White Soldiers and Three Black Crows is essential. These candlestick formations, with their bullish and bearish implications, provide valuable insights for crypto traders. However, caution is paramount. While these patterns offer powerful signals, the complexities of the market demand a holistic approach. Always supplement pattern analysis with broader market fundamentals, use additional indicators for confirmation, and be mindful of potential limitations like false signals. By combining pattern recognition with a comprehensive strategy, traders can navigate the crypto market with increased precision and resilience.

Well Done! You have now completed the Lesson.

Complete the Quiz and Get Certified! All The Best!

We'd Love to Hear Your Thoughts on This Article!

Was this writing helpful?

Yes

Yes  No

No

Disclaimer and Risk Warning

The information provided in this content by Coinpedia Academy is for general knowledge and educational purpose only. It is not financial, professional or legal advice, and does not endorse any specific product or service. The organization is not responsible for any losses you may experience. And, Creators own the copyright for images and videos used. If you find any of the contents published inappropriate, please feel free to inform us.