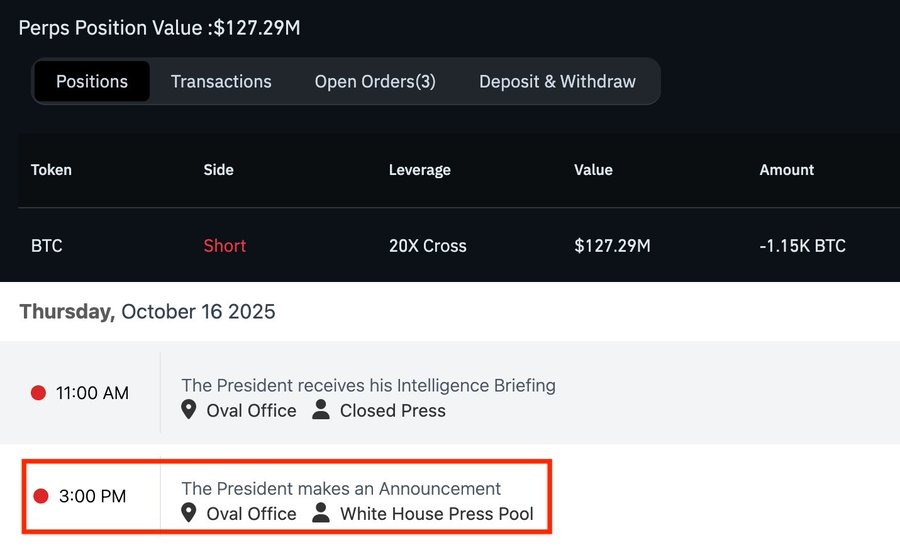

“Mysterious Trump Insider Whale opens $127 million Bitcoin short, fueling fears ahead of announcement.”

“Last week’s Tariff Crash saw Bitcoin drop $18,000, earning insider $192 million profit quickly.”

“Traders brace for volatility as President Trump’s urgent announcement could trigger sudden crypto market swings.”

The crypto market is once again on high alert. A mysterious trader known as the “Trump Insider Whale,” who famously shorted Bitcoin just minutes before President Donald Trump’s tariff announcement caused a crypto market crash, is back.

This time with a massive $127 million short position against Bitcoin, just hours before President Donald Trump’s urgent announcement scheduled for 3:00 PM (ET) today.

Many experts believe the insider might know what’s coming.

Repeat of the “Tariff Crash” Play

Just last week, the crypto market lost over $670 billion in a single day after Trump’s 100% tariffs on Chinese imports triggered panic selling across digital assets and equities.

The event, now called the “Tariff Crash”, saw Bitcoin plunge from $122,000 to nearly $104,000 within hours, perfectly timed with a short position placed by the so-called “Trump Insider Whale.” That trade reportedly gained the trader $192 million in profits within 30 minutes.

Now, blockchain analysts report that the same wallet, tracked by on-chain platforms, gradually built a 20x leveraged position and increased its exposure to $127 million in BTC short positions overnight.

What Could Be Coming?

However, the timing has sparked concern again, as President Trump is set to make an urgent announcement later today, and traders are preparing for sharp market swings.

Social media platforms are already flooded with warnings from analysts and traders predicting volatility. Many believe the insider could have access to non-public information tied to today’s announcement.

Experts say if Trump announces strict trade or financial sanctions, markets could fall fast. But if he announces crypto-friendly measures or liquidity support, a quick rebound may follow.

Will the Market Crash Again?

As of now, Bitcoin price is trading around $111,200, reflecting a drop of 1%, seen in the last 24 hours. Meanwhile, funding rates across derivatives platforms like Binance and Bybit have turned negative, reflecting growing bearish sentiment.

If Trump’s speech introduces new tariffs or confirms stricter capital restrictions, Bitcoin could retest $100,000–$102,000 levels, marking another 10–12% drop.

But if the announcement proves dovish or pro-crypto, short liquidations could trigger a relief rally toward $120,000, reversing losses quickly.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author's own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.