Gensler emphasizes the need for applying federal security laws and regulations to cryptocurrencies and related entities.

There are similarities between the current market and the U.S. financial markets before regulations in the 1920s.

Gensler calls for stricter supervision and oversight of cryptocurrency markets.

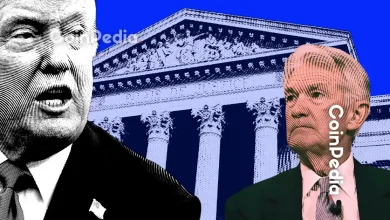

In a recent development, Gary Gensler, the Chair of the U.S. Securities and Exchange Commission (SEC), pointed out, once again, his stance on the necessity of applying federal security laws and regulations to cryptocurrencies and related entities.

This comes ahead of an upcoming hearing scheduled for Wednesday.

Long Standing Rules in Focus

As per his testimony, Gary Gensler said these securities regulations have “been on the books for decades” and are scheduled to appear before the House Financial Services Committee. Gensler emphasized that the SEC’s role is to protect investors and ensure fair markets, which includes enforcing these existing securities laws. He also expressed the need for additional regulatory clarity in the crypto markets to address potential risks and promote innovation.

Given the extensive noncompliance of this business with the securities rules, Gensler stated, “It’s not surprising that we’ve seen many problems in these markets.”

History Tells Us…

The SEC Chair emphasized the importance of learning from historical events and applying those lessons to the present scenario. He pointed out the striking resemblance between the current cryptocurrency situation and the state of the U.S. financial markets prior to the establishment of federal securities regulations in the 1920s.

By pointing this out, Gensler implied the necessity of creating a comprehensive regulatory framework to protect investors and maintain market integrity, much like the reforms that were implemented following the 1929 stock market crash.

In his testimony, Gensler referred to the agency’s rulemaking, citing a release from April that claimed DeFi platforms and other crypto platforms already fall under the definition of an exchange.

Security and Transparency Are Key

By addressing these concerns, Gensler believes we can foster a safer and more transparent environment for cryptocurrency markets to thrive. Gensler also stressed the urgency for regulators to keep pace with the rapid growth and change. He proposed implementing stricter supervision and oversight mechanisms to prevent fraud and manipulation and safeguard against potential systemic risks.

Calling for unity

Additionally, Gensler called for enhanced cooperation between global regulators to create a consistent and harmonized approach to cryptocurrency regulations, promoting investor confidence and encouraging greater participation in these markets. Overall, Gensler’s vision aims to balance innovation and investor protection in the crypto space.