A new controversy is spreading across crypto media and X, claiming the U.S. Department of Justice (DOJ) violated President Donald Trump’s Strategic Bitcoin Reserve executive order by selling forfeited Bitcoin instead of holding it.

According to multiple crypto publications and industry experts, the DOJ, through the U.S. Marshals Service (USMS), allegedly sold 57.55 BTC (worth around $6M) in November 2025 via Coinbase Prime. The Bitcoin was forfeited by Samourai Wallet co-founders Keonne Rodriguez and William Lonergan Hill.

The rumor gained huge attention, so Coinpedia stepped in to review the facts to verify whether this claim holds up.

Who Made This Claim?

The allegation originated from multiple posts on X and was intensified by several crypto-focused publications and high-profile commentators.

These posts cited court documents related to the Samourai Wallet case and claimed the BTC sale directly conflicts with Executive Order 14233, which reportedly mandates that forfeited Bitcoin be held in the U.S. Strategic Bitcoin Reserve.

But is this claim true? Let’s break it down.

Coinpedia’s Key Findings: What’s Actually True?

The BTC Sale Was Backed by a Court-Approved Agreement

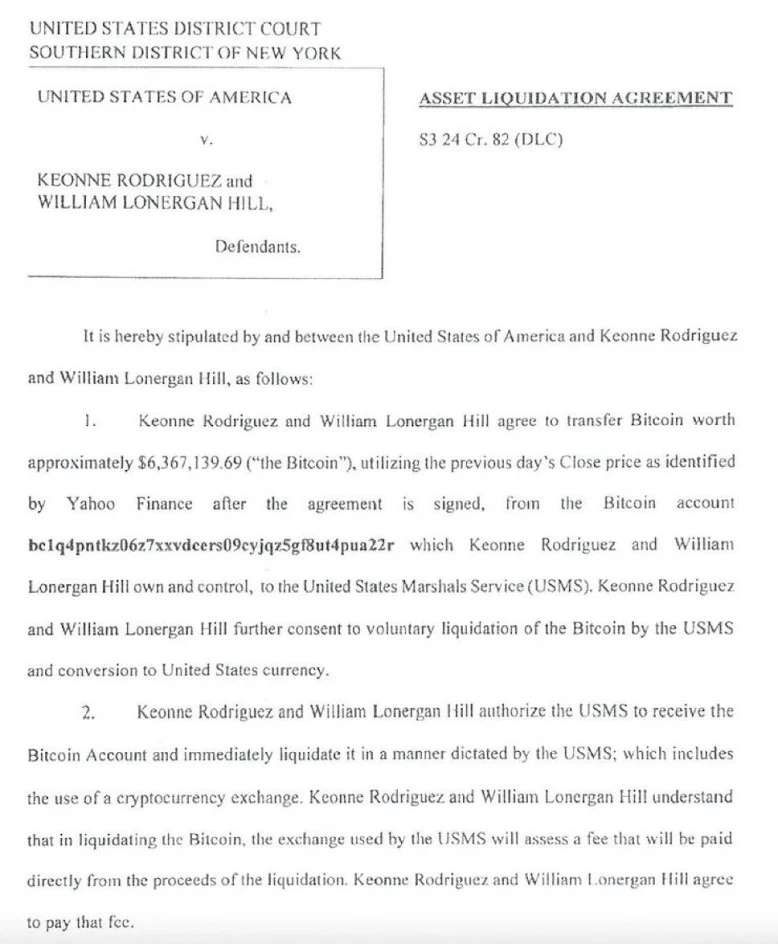

Court documents show that Rodriguez and Hill entered into an Asset Liquidation Agreement with the U.S. government. Under this agreement, they voluntarily consented to the liquidation of approximately $6.36 million worth of Bitcoin by the USMS.

The agreement explicitly authorizes the USMS to:

- Transfer custody of the Bitcoin

- Liquidate it immediately

- Convert the proceeds into U.S. dollars

This process is standard in federal forfeiture cases and was legally approved before any sale occurred.

- No On-chain Proof that the Sale Happened After the Order Took Effect

While reports claim the BTC was sold in November 2025, Coinpedia’s findings reveal that there is no public confirmation of a sell-off.

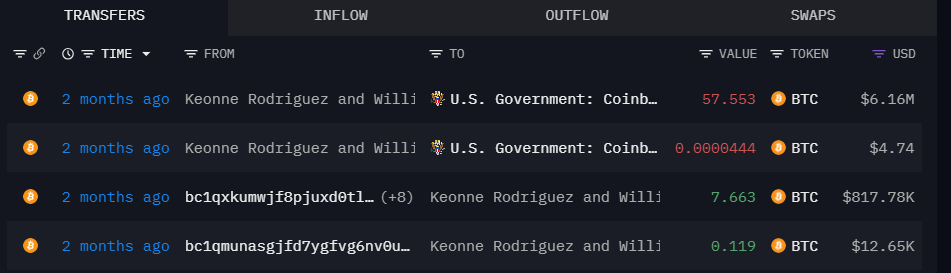

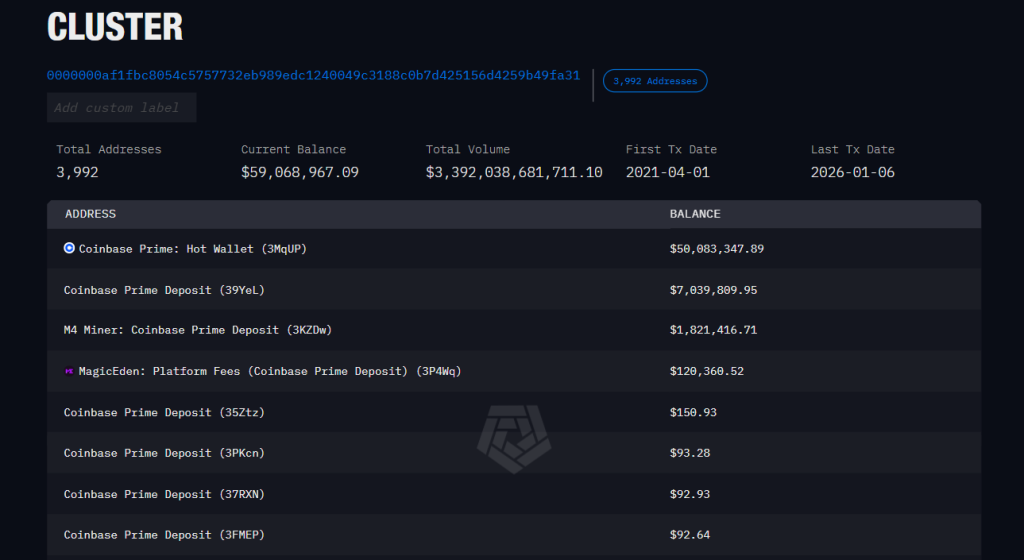

On November 3, 2025, approximately 57.55 BTC was transferred from a Samourai-linked address (bc1q4….a22r) to a Coinbase Prime deposit wallet. The funds were then swept into other Coinbase Prime wallets, which is a normal custodial activity.

At no point did the Bitcoin leave Coinbase-controlled infrastructure. The data blockchain displays internal transfers only, not actual sales. A zero balance at the deposit address simply means the funds were consolidated, not liquidated.

As a result, on-chain data alone cannot confirm whether the BTC was sold or retained in custody.

- Executive Order 14233 Does Override Court-Ordered Forfeiture

Even if Executive Order 14233 exists and says “forfeited bitcoin should be held

- Criminal forfeiture is governed by courts, not agencies

- Judges can order liquidation as part of sentencing, restitution, or settlement

- The U.S. Marshals Service executes court orders, not policy preferences

Despite this, there is also no official DOJ filing, court objection, or government statement indicating that the Bitcoin sale happened or violated any executive directive.

Summary Table: Coinpedia’s Evidence vs the Claim

| Claim Circulating Online | Coinpedia’s Findings |

| DOJ violated the Bitcoin reserve order | No proof of retroactive applicability |

| USMS sold BTC illegally | The sale is authorized by a court-approved agreement |

| The executive order blocked the liquidation | No such restriction was stated publicly |

| Coinbase Prime sale confirms breach | No on-chain data shows the confirmation of sales |

Conclusion

| Claim | DOJ violated President Trump’s Strategic Bitcoin Reserve executive order by selling forfeited Bitcoin. |

| Verdict | ❌ False |

| Fact-Check by Coinpedia | Coinpedia’s review shows that the Bitcoin sale linked to the Samourai Wallet case was conducted under a court-approved asset liquidation agreement. There is no verified evidence that Executive Order 14233 applies retroactively or that the DOJ breached any legal directive. As of now, claims of a violation are misleading and unproven. |

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author's own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.