Following the recent crypto market sell-off, Bitcoin slipped below $95K, its lowest in a month, sparking a wave of online rumors that Michael Saylor’s MicroStrategy sold over $1 billion in BTC to cut losses. But how accurate are those claims?

Here is an in-depth fact-check to clarify the situation.

Where Did This Claim Come From?

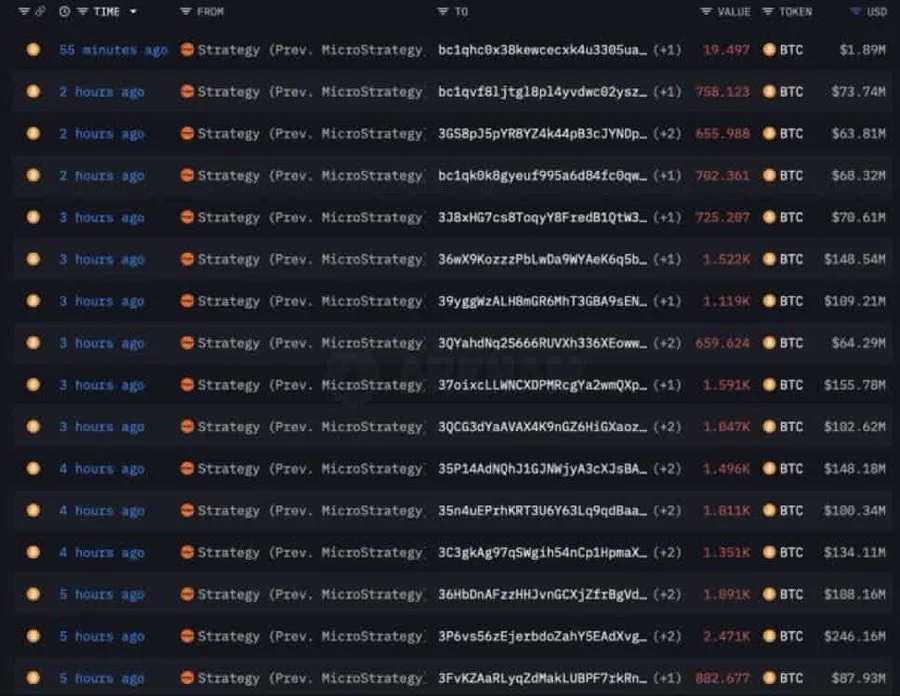

The claim was first magnified by crypto influencers and on-chain trackers highlighting wallet activity attributed to “Strategy (Prev. MicroStrategy).” The attached chart shows over a dozen large Bitcoin transactions in recent hours, some worth tens or hundreds of millions of dollars.

This data led to speculation that Strategy and Michael Saylor himself were selling off their Bitcoin position. But are these claims supported by facts?

So what’s really happening?

Coinpedia Review: What’s Actually True?

1. Strategy Is Still Accumulating—Not Selling

According to verified financial media and Strategy’s own disclosures, there have been no reports, SEC filings, or company statements confirming any BTC sale in 2025. On the contrary, Strategy has recently continued buying Bitcoin, adding 487 BTC on November 10, and 397 BTC the week before.

Their total holdings now approach 641,692 BTC worth over $65 billion as of mid-November 2025.

2. Large Transfers Aren’t Proof of Sales

Bitcoin’s on-chain data shows wallet activity linked to Strategy, but these movements don’t confirm any selling. Arkham Intelligence platform noted that Strategy has been moving billions of dollars of BTC as part of what appears to be a change in custodians for some of their Bitcoin.

So far, no on-chain or exchange evidence shows that these transfers resulted in actual Bitcoin sales.

3. Michael Saylor Has Publicly Denied the Rumor

Michael Saylor directly addressed the viral claims, stating clearly in a recent post that there is no truth to the rumor that Strategy sold any Bitcoin.His public stance remains unwaveringly bullish.

In a Friday CNBC interview, Saylor reinforced his long-term conviction:

“I think the volatility comes with the territory,” Saylor said. “If you’re going to be a Bitcoin investor, you need a four-year time horizon and you need to be prepared to handle the volatility in this market.”

This aligns with his long-standing “never sell” philosophy.

Summary Table: Coinpedia’s Evidence Against the Theory

| Claim Made by Theory | Coinpedia’s Counter-Evidence |

| Strategy has sold over $4B of its Bitcoin holdings | ❌ Arkham confirms transfers are custodian changes, not sales; Coinpedia finds continued accumulation. |

| Michael Saylor is selling Bitcoin | ❌ No evidence, Saylor remains bullish, and the company shows no sales activity |

| On-chain large BTC transfers are confirmed sales | ❌ Transfers alone do not prove sales, may be for internal reasons. |

Conclusion

| Claim | Michael Saylor’s Strategy Sold Over $1B of Bitcoin |

| Verdict | ❌ False |

| Fact-Check by Coinpedia | As per Coinpedia research and a review of official sources, there is no credible or verifiable evidence linking the Strategy to having sold any significant amount of Bitcoin in 2025. The rumors are based mainly on misinterpretation of on-chain movements that lack confirmation of actual sales. |

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author's own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.