Bitcoin collapses below $94K as Fear Index hits extreme levels, confirming 10x Research warnings.

10x Research predict breaking the $92K–$96K zone could trigger Bitcoin’s next severe decline, analysts strongly caution.

Traders ignoring 10x signals risk heavy losses as Bitcoin continues sliding within widening downtrend.

Bitcoin has officially slipped below $94,000, triggering one of the sharpest drops in months as the Fear & Greed Index plunges to 10, “Extreme Fear”. But here’s the twist most people didn’t see coming, 10x Research warned about this exact breakdown weeks before it happened.

And now, as the price falls 10x Research again say there are charts that could decide Bitcoin’s next big move.

10x’s Warning That Everyone Ignored

For the last month, 10x Research repeatedly highlighted the $110,000–$112,000 zone as the line that could flip the market from bullish to bloody. Once Bitcoin slipped below that range, momentum cracked, support vanished, and the downtrend activated, exactly as the chart now shows.

And during this decline, major financial outlets including Bloomberg repeatedly cited their early warnings as the market crashed.

Many traders missed the early warnings, and they paid the price. Some watched their portfolios drop double digits in days. Others were forced into panic selling when volatility spiked.

Now, with emotions high and fear spreading quickly, these six charts have become the survival guide that every profitable trader refuses to ignore.

Downtrend Is Now Fully Active

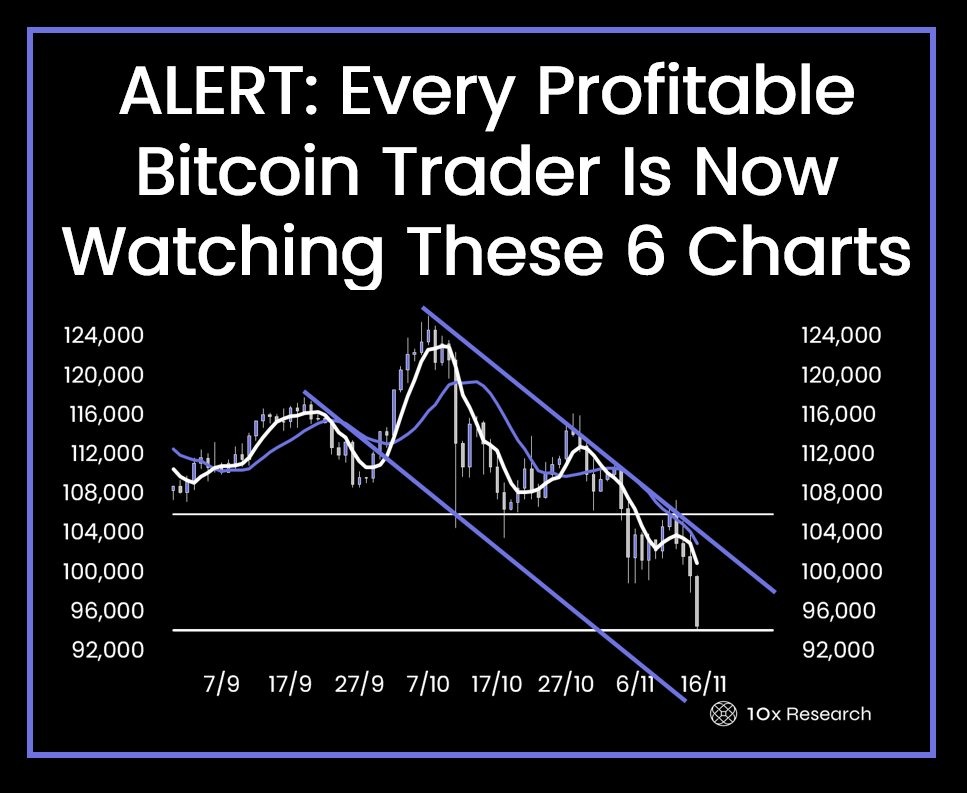

Just look at the chart from 10x Research reveals a clean fall inside a widening downward channel, with Bitcoin losing support after multiple failed attempts to reclaim momentum.

Today, Bitcoin hovers around $95,000, but the real battleground sits just below, $92,000–$96,000. If this zone breaks, analysts believe the next leg down could accelerate.

For traders, this is not just a price drop, it’s a signal that market structure has shifted. However, the latest 10x Research report warns that ignoring these signals could leave traders vulnerable to the next major downturn.

As of now, bitcoin is trading around $95,985 reflecting a drop of 1.11%, with a market cap hitting $1.91 trillion.

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

FAQs

As per Coinpedia’s BTC price prediction, the Bitcoin price could peak at $168k this year if the bullish sentiment sustains.

With increased adoption, the price of Bitcoin could reach a height of $901,383.47 in 2030.

As per our latest BTC price analysis, Bitcoin could reach a maximum price of $13,532,059.98

By 2050, a single BTC price could go as high as $377,949,106.84

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author's own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.

![Why Is Crypto Crashing Today [Live] Updates](https://image.coinpedia.org/wp-content/uploads/2026/02/23165659/Why-Is-Crypto-Crashing-Today-Live-Updates-1-1-390x220.webp)