Ethereum whale transferred 30,000 ETH worth $138M into Bitfinex within just two days.

Whale deposits raise concerns of possible selling pressure, signaling upcoming price swings in Ethereum markets.

Alongside exchange deposits, whale moved $109M ETH into two new secure storage wallets.

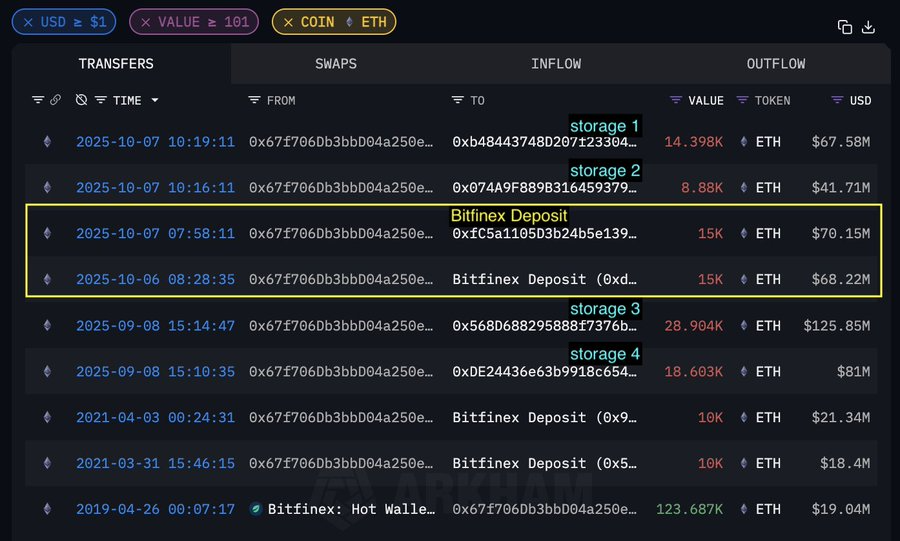

A massive Ethereum whale is back in the spotlight after moving a huge chunk of ETH. On-chain data from SpotOnChain shows the wallet sent 15,000 ETH, worth about $70 million, to Bitfinex just three hours ago.

This isn’t the whale’s first big transfer this week, and it’s fueling speculation about possible price swings or a shift in Ethereum trading strategy.

Two Days, Two Huge Transfers

In the past two days alone, this whale has offloaded a total of 30,000 ETH, worth around $138.4 million, into Bitfinex. The average transfer price sits around $4,612 per ETH, suggesting the whale might be taking profits as Ethereum hovers near key resistance levels.

Large deposits like this often create concerns about possible selling pressure. When whales send coins to exchanges, it can sometimes indicate plans to sell, especially during uncertain market phases.

Interestingly, the whale hasn’t only been sending ETH to Bitfinex.

Alongside these deposits, it has also moved 23,278 ETH worth about $109.3 million into two new wallets.

Analysts believe these could be new “storage” or “cold” wallets — used to hold crypto securely for the long term. Perhaps this mix of exchange deposits and storage transfers suggests a balanced approach, possibly partial profit-taking while still holding a large position for the future.

- Also Read :

- Bitcoin Price Prediction 2025, What Next For BTC Price?

- ,

Current Holdings and Market Impact

Even after these massive transfers, the whale still holds a total of 70,785 ETH, valued at nearly $332.4 million, spread across four wallets.

While some traders view the Bitfinex deposits as a warning sign of potential sell-offs, others see it as a simple portfolio reorganization. Either way, whale movements of this size never go unnoticed.

Ethereum Price Update

Ethereum is currently trading around $4,704, showing resilience with modest gains of 2.58% seen in the last 24 hour.

Technical analysts highlight a crucial resistance zone between $4,700–$4,800, as the coin is inching closer to its 2025 high near $4,956, supported by growing institutional interest and fresh influxes of liquidity into the ecosystem.

A decisive break above this level, especially if sustained by high volume, could propel ETH to targets around $5,000 in the near term and possibly beyond $6,650 in the coming months, further fueled by upcoming network upgrades and scaling initiatives.

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

FAQs

A major whale moved $70 million in ETH to an exchange, which can signal profit-taking. However, they also moved a larger portion to cold storage, suggesting a long-term strategy.

While whale sales can cause volatility, Ethereum is currently holding key support levels. A break above the $4,800 resistance could instead propel it toward $5,000.

Analysts see a path to $5,000 if Ethereum breaks above the $4,700-$4,800 resistance zone, with some long-term targets extending toward $6,650 based on market structure.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author's own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.